In this article, we will discuss Yatra Online Share Price Target 2024, 2025, 2026, 2028, 2030, 2040 and 2050, along with this we will also cover the company’s fundamentals, financial ratios, strengths, risks and important news. So that it becomes easier for you to forecast the company’s stock and you can earn good profit.

What is Yatra Online

Yatra.com is an Indian travel agency that provides online travel services across the world. It was founded in 2006 by Dhruv Shringi, Manish Amin and Sabina Chopra. Yatra Online provides services like domestic and international air travel, hotel booking, homestay, holiday packages, bus travel, rail travel, visa.

The company has also won many awards from the Ministry of Tourism, Government of India. It is the second Indian e-commerce company to be listed on a global stock exchange.

Yatra Online Fundamental

The market capital of Yatra Online is Rs 2024 crore, this company comes under small-cap. This is a high risk company from investment point of view but the investor can also get good profits in it.

Yatra Online is maintaining its financial risk low with a debt-equity ratio of 0.07. Despite such a challenging past, the company has achieved sales growth of 113.70% in the last two years, although it remains unprofitable with a net loss of ₹18.90 crore and negative EPS of -₹1.20.

The company’s price-to-book (P/B) ratio is 2.89, which suggests that its market value per share is almost three times its book value of ₹44.57, potentially making it an attractive investment. However, the high and negative P/E ratio (-107.16) reflects the company’s challenges.

The company’s Return on Equity (ROE) and Return on Capital Employed (ROCE) are negative, standing at -2.70% and -0.43% respectively, as the company is not able to generate returns on shareholders’ equity and overall capital.

| Company Name | Yatra Online Ltd. |

| Sector | Travel Services |

| Established | 2006 |

| Website | yatra.com |

| Mkt Cap | 2024 Cr |

| Listing At | NSE and BSE |

| BSE Code | 543992 |

| NSE Code | YATRA |

| Debt to Equity | 0.07 |

| 52 Week High | 194.00 |

| 52 Week Low | 120.15 |

| P/E Ratio (TTM) | -107.16 |

| P/B Ratio | 2.89 |

| Face Value | 1 |

| Dividend Yield | 0.00% |

| Book Value Per Share | 44.57 |

| Net Profit | -18.90 |

| Profit Growth | 38.09% |

| EPS (TTM) | -1.20 |

| Net Sales | 319Cr |

| Sales Growth | 113.70% |

| 3 Yr CAGR Sales (%) | -19.56% |

| ROE | -2.70 |

| ROCE | -0.43 |

| 3 Yr CAGR Net Profit (%) | -47.12% |

Yatra Online Ltd. Share Price Target 2024, 2025, 2026, 2028, 2030, 2040 and 2050

Yatra Online Share Price Target 2024

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 150 | 175 |

| February | 170 | 180 |

| March | 158 | 170 |

| April | 145 | 150 |

| May | 132 | 150 |

| June | 130 | 145 |

| July | 125 | 140 |

| August | 122 | 138 |

| September | 125 | 140 |

| October | 130 | 145 |

| November | 129 | 142 |

| December | 135 | 145 |

Yatra Online Share Price Target 2025

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 132 | 145 |

| February | 140 | 150 |

| March | 146 | 155 |

| April | 150 | 160 |

| May | 154 | 159 |

| June | 146 | 162 |

| July | 150 | 160 |

| August | 155 | 164 |

| September | 159 | 169 |

| October | 163 | 172 |

| November | 165 | 174 |

| December | 169 | 180 |

Yatra Online Share Price Target 2026

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 175 | 185 |

| February | 180 | 192 |

| March | 186 | 196 |

| April | 190 | 197 |

| May | 197 | 205 |

| June | 202 | 208 |

| July | 206 | 215 |

| August | 208 | 212 |

| September | 210 | 222 |

| October | 212 | 216 |

| November | 215 | 225 |

| December | 220 | 226 |

Also Read: Venus Pipes stock increased by 525%, became a millionaire in 1 year.

Yatra Online Share Price Target 2028

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 325 | 332 |

| February | 320 | 328 |

| March | 326 | 334 |

| April | 330 | 335 |

| May | 333 | 340 |

| June | 330 | 336 |

| July | 335 | 347 |

| August | 336 | 340 |

| September | 339 | 353 |

| October | 340 | 348 |

| November | 345 | 358 |

| December | 344 | 355 |

Yatra Online Share Price Target 2030

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 415 | 422 |

| February | 416 | 425 |

| March | 414 | 418 |

| April | 417 | 432 |

| May | 430 | 444 |

| June | 432 | 438 |

| July | 435 | 450 |

| August | 434 | 442 |

| September | 440 | 455 |

| October | 450 | 463 |

| November | 460 | 474 |

| December | 458 | 465 |

Yatra Online Share Price Target 2040

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 928 | 940 |

| February | 930 | 935 |

| March | 932 | 942 |

| April | 935 | 952 |

| May | 950 | 965 |

| June | 945 | 955 |

| July | 948 | 958 |

| August | 955 | 972 |

| September | 953 | 962 |

| October | 960 | 975 |

| November | 970 | 982 |

| December | 968 | 976 |

Yatra Online Share Price Target 2050

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 1660 | 1680 |

| February | 1655 | 1672 |

| March | 1670 | 1688 |

| April | 1672 | 1681 |

| May | 1675 | 1684 |

| June | 1674 | 1692 |

| July | 1690 | 1705 |

| August | 1700 | 1712 |

| September | 1702 | 1718 |

| October | 1705 | 1712 |

| November | 1710 | 1725 |

| December | 1715 | 1722 |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Yatra Online Listing date

Yatra Online is a company which is listed on NSE and BSE as well as foreign stock exchange NASDAQ. It was listed on the National Stock Exchange on 28 September 2023, at the time of listing the company’s share price was Rs 136.85.

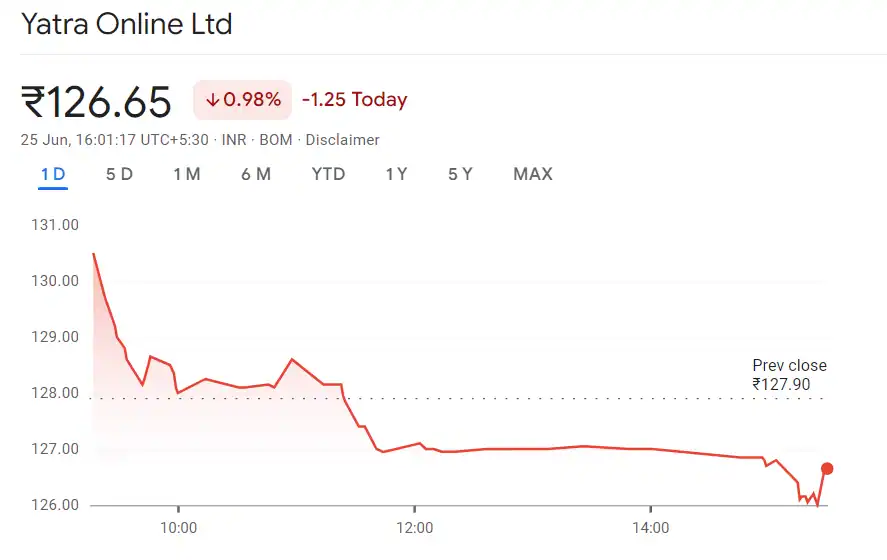

Yatra Online Share Price History

The company was listed on the national stock exchange in 2023 at Rs 136.85 per share and today on June 21, 2024, the company’s share price is Rs 129. Since the listing, the company’s shares had seen a growth of 30%, but its shares have been continuously declining for the last 5 months. As of now the market cap of the company is Rs 2024 crore.

| Time Periods | Performance |

|---|---|

| 1 Week Performance | -1.63% |

| 1 Month Performance | -9.60% |

| 3 Months Performance | -12.74% |

| YTD Performance | -13.80% |

Yatra Online Share Price growth chart

The growth chart of any company helps in understanding the trend of the company and the changes in its shares from time to time can be seen at a glance. The company has been listed for less than a year, its 52 week maximum price is ₹ 193.95 and lowest price is ₹ 120.15.

Yatra Online Profit/Loss – Last 5 Years Report

Yatra Online Income Report

| Description | Mar24 | Mar22 | Mar21 | Mar20 | Mar19 |

|---|---|---|---|---|---|

| 12 months | 12 mths | 12 mths | 12 mths | 12 mths | 12 mths |

| Revenue From Operations [Gross] | 297.12 | 124.91 | 88.88 | 459.24 | 557.00 |

| Revenue From Operations [Net] | 297.12 | 124.91 | 88.88 | 459.24 | 557.00 |

| Other Operating Revenues | 0.00 | 14.94 | 0.00 | 0.00 | 0.00 |

| Total Operating Revenues | 297.12 | 139.85 | 88.88 | 459.24 | 557.00 |

| Other Income | 22.21 | 9.58 | 9.76 | 14.92 | 22.53 |

| Total Revenue | 319.34 | 149.43 | 98.64 | 474.16 | 579.53 |

Expenses Report

| Description | Mar24 | Mar22 | Mar21 | Mar20 | Mar19 |

|---|---|---|---|---|---|

| 12 months | 12 mths | 12 mths | 12 mths | 12 mths | 12 mths |

| Employee Benefit Expenses | 73.67 | 59.35 | 44.03 | 92.64 | 155.62 |

| Finance Costs | 15.65 | 9.13 | 6.11 | 6.40 | 6.41 |

| Depreciation And Amortisation Expenses | 17.25 | 25.14 | 39.67 | 52.82 | 44.11 |

| Other Expenses | 231.67 | 86.34 | 163.62 | 389.88 | 686.91 |

| Total Expenses | 338.23 | 179.96 | 253.43 | 541.74 | 893.05 |

Yatra Online Profit/Loss Report

In the last 4 years, the total revenue of the company has been continuously increasing, along with this the total expenses of the company have also increased due to which the company has not been able to generate any profit in the financial year 2024. The company has suffered a loss of Rs 18.90 crore in FY24. However, in FY23 the company had earned a profit of Rs 7.63 crore.

Also Read: Venus Pipes stock increased by 525%, became a millionaire in 1 year.

| Description | Mar24 | Mar22 | Mar 21 | Mar20 | Mar19 |

|---|---|---|---|---|---|

| 12 months | 12 mths | 12 mths | 12 mths | 12 mths | 12 mths |

| Profit/Loss Before Exceptional, ExtraOrdinary Items And Tax | -18.90 | -30.53 | -154.79 | -67.58 | -313.52 |

| Exceptional Items | 0.00 | -7.27 | 0.00 | 0.00 | 0.00 |

| Profit/Loss Before Tax | -18.90 | -37.80 | -154.79 | -67.58 | -313.52 |

| Profit/Loss After Tax And Before ExtraOrdinary Items | -18.90 | -37.80 | -154.79 | -67.58 | -313.52 |

| Profit/Loss From Continuing Operations | -18.90 | -37.80 | -154.79 | -67.58 | -313.52 |

| Profit/Loss For The Period | -18.90 | -37.80 | -154.79 | -67.58 | -313.52 |

Other Additional Information

| Description | Mar24 | Mar22 | Mar21 | Mar20 | Mar19 |

|---|---|---|---|---|---|

| 12 months | 12 mths | 12 mths | 12 mths | 12 mths | 12 mths |

| Earnings Per Share | |||||

| Basic EPS (Rs.) | -1.39 | -3.39 | -144.00 | -64.00 | -340.00 |

| Diluted EPS (Rs.) | -1.39 | -3.39 | -144.00 | -64.00 | -340.00 |

| Value of Imported and Indigenous Raw Materials | |||||

| Stores, Spares and Loose Tools | – | – | – | – | – |

| Dividend and Dividend Percentage | |||||

| Equity Share Dividend | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Equity Dividend Rate (%) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Yatra Online Balance Sheet – Last 5 Years Report:

Equities and Liabilities

| Description | Mar24 | Mar22 | Mar21 | Mar20 | Mar19 |

|---|---|---|---|---|---|

| 12 months | 12 mths | 12 mths | 12 mths | 12 mths | 12 mths |

| Shareholder’s Funds | |||||

| Equity Share Capital | 15.69 | 11.19 | 11.09 | 10.62 | 10.23 |

| Total Share Capital | 15.69 | 11.19 | 11.09 | 10.62 | 10.23 |

| Reserves and Surplus | 683.72 | 9.14 | 38.71 | 164.24 | 159.91 |

| Total Reserves and Surplus | 683.72 | 9.14 | 38.71 | 164.24 | 159.91 |

| Total Shareholders Funds | 699.42 | 20.33 | 49.80 | 174.86 | 170.14 |

| Non-Current Liabilities | |||||

| Long Term Borrowings | 11.26 | 0.20 | 0.24 | 0.62 | 2.18 |

| Deferred Tax Liabilities [Net] | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Long Term Liabilities | 16.43 | 33.65 | 88.42 | 55.59 | 10.18 |

| Long Term Provisions | 2.43 | 2.53 | 3.64 | 3.98 | 5.84 |

| Total Non-Current Liabilities | 30.11 | 36.38 | 92.30 | 60.19 | 18.20 |

| Current Liabilities | |||||

| Short Term Borrowings | 38.02 | 15.17 | 7.98 | 17.52 | 17.54 |

| Trade Payables | 167.63 | 211.65 | 77.05 | 131.47 | 310.79 |

| Other Current Liabilities | 168.28 | 180.62 | 160.61 | 254.63 | 326.39 |

| Short Term Provisions | 1.91 | 4.02 | 2.93 | 3.48 | 5.31 |

| Total Current Liabilities | 375.83 | 411.46 | 248.57 | 407.10 | 660.03 |

| Total Capital and Liabilities | 1,105.36 | 524.45 | 446.95 | 698.43 | 932.14 |

Assets

| Description | Mar 24 | Mar 22 | Mar 21 | Mar 20 | Mar 19 |

|---|---|---|---|---|---|

| 12 months | 12 mths | 12 mths | 12 mths | 12 mths | 12 mths |

| Non-Current Assets | |||||

| Tangible Assets | 40.79 | 1.34 | 30.19 | 37.09 | 10.88 |

| Intangible Assets | 0.00 | 14.13 | 26.46 | 49.79 | 70.81 |

| Capital Work-In-Progress | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Fixed Assets | 40.79 | 17.78 | 57.76 | 89.33 | 88.36 |

| Non-Current Investments | 140.47 | 140.47 | 140.47 | 253.26 | 320.18 |

| Deferred Tax Assets [Net] | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Long Term Loans And Advances | 0.00 | 0.00 | 3.73 | 0.00 | 0.00 |

| Other Non-Current Assets | 64.01 | 51.79 | 30.42 | 47.43 | 43.32 |

| Total Non-Current Assets | 245.28 | 210.04 | 232.38 | 390.02 | 451.86 |

| Current Assets | |||||

| Current Investments | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Inventories | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Trade Receivables | 384.96 | 182.46 | 68.09 | 121.27 | 210.40 |

| Cash And Cash Equivalents | 356.38 | 59.24 | 81.95 | 82.33 | 110.23 |

| Short Term Loans And Advances | 0.27 | 0.28 | 25.21 | 56.96 | 0.00 |

| Other Current Assets | 118.48 | 72.43 | 39.32 | 47.85 | 159.65 |

| Total Current Assets | 860.08 | 314.41 | 214.57 | 308.41 | 480.28 |

| Total Assets | 1,105.36 | 524.45 | 446.95 | 698.43 | 932.14 |

Other Additional Information

| Description | Mar 24 | Mar 22 | Mar 21 | Mar 20 | Mar 19 |

|---|---|---|---|---|---|

| 12 months | 12 mths | 12 mths | 12 mths | 12 mths | 12 mths |

| Contingent Liabilities, Commitments | |||||

| Contingent Liabilities | 0.00 | 211.71 | 12.98 | 10.30 | 0.00 |

| CIF Value of Imports | |||||

| Raw Materials | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Stores, Spares And Loose Tools | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Trade/Other Goods | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Capital Goods | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Expenditure in Foreign Exchange | |||||

| Expenditure in Foreign Currency | 0.00 | 0.00 | 0.00 | 74.85 | 85.08 |

| Remittances in Foreign Currencies for Dividends | |||||

| Dividend Remittance in Foreign Currency | — | — | — | — | — |

| Earnings in Foreign Exchange | |||||

| FOB Value of Goods | — | — | — | — | — |

| Other Earnings | — | — | — | 103.66 | 163.37 |

| Bonus Details | |||||

| Bonus Equity Share Capital |

Also Read: SW Solar price target, guarantee boom in solar sector.

Yatra Online Quarterly Report

| Mar 24 | Dec 23 | Sep 23 | Jun 23 | |

| Sales + | 1242 | 1078 | 918.52 | 849.25 |

| Expenses + | 1127 | 974.66 | 838.15 | 777.67 |

| EBITDA | 149.49 | 136.44 | 114.73 | 101.40 |

| EBIT | 138.88 | 125.45 | 105.19 | 91.71 |

| Net Profit | 52.79 | 65.61 | 18.58 | 11.96 |

| Profit Before Tax | 115.14 | 103.31 | 80.36 | 71.57 |

| Operating Profit Margin | 12.17% | 12.74% | 12.54% | 11.99% |

| Net Profit Margin | 6.60% | 5.64% | 5.61% | 5.66% |

| Earning Per Share | 51.28 | 38.75 | 34.45 | 32.10 |

| Depreciation | 4.83 | 4.80 | 4.70 | 5.36 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

How to Buy Yatra Online Shares

There are many Indian brokers registered by SEBI for buying and selling the stock of any company, the names of some of which are being mentioned.

- Zerodha

- Groww

- Angel One

- Upstox

Shareholding Pattern

| Promoter | 58.29% |

| Other Domestic Institutions | 2.97% |

| Retail and Others | 14.86% |

| Mutual Funds | 18.60 |

| Foreign Institutions | 5.29% |

| Total | 100.00 |

Latest News

1. Yatra Online has constituted an independent committee to simplify the multi-jurisdictional framework. Its purpose is to streamline operations, reduce costs and support growth.

2. Yatra online returns to profit in fourth quarter with profit of Rs 1 crore. The company’s EBITDA increased by 54.1% from Rs 2.4 crore to Rs 3.7 crore in the same quarter.

3. Yatra Online is acquiring additional 45% stake in Adventure and Nature Network Private Limited (ANN), which will increase its stake in ANN from 50% to 99%.

Strengths

- Low debt levels: The company’s debt-to-equity ratio is very low (.07), indicating limited financial risk from debt.

- Strong Sales Growth: The company has recorded a significant sales growth of 113.70% between March 22 and March 24, indicating growth in operations.

- Improvement in Profitability: Despite the company being in loss, the profit growth rate is 38.09%, giving strong indications of reducing losses and improving profitability.

- Even if the company does not make profit, it has a reserve and surplus of Rs 683.72 crore. Which indicates the financial stability of the company.

- Significant Market Presence: Presence on the foreign stock exchange NASDAQ along with listing on both NSE and BSE indicates a strong market presence.

- Yatra is the largest company in the field of corporate travel in India, many big companies also use the services of this company.

Also Read: Yatra Online shares will make you rich, 100% guarantee.

Risks

- Negative Profitability: The net profit of the company has been negative for the last several years.

- High Volatility in Financial Performance: The above data shows significant fluctuations in the company’s revenue and profits.

- The three-year CAGR for both sales and net profit is highly negative, indicating a weak position for the company.

- High P/E ratio: A negative P/E ratio indicates that the company is not making profits relative to its share price, due to which investors are showing less interest in its stock.

- Low Return on Equity and Capital Employed: The ROE and ROCE of the company are negative, which means that the company is not generating adequate returns on its investments.

- Lack of Dividend: A company without a dividend may discourage income-focused investors.

- Yatra Online’s EPS being negative indicates that the company is incurring loss per share. Which is a danger signal for potential investors.

- The company’s Piotrosky score on a 0 to 9 Piotrosky scale is 2, indicating weak financial health of the company.

- The company is selling a lot at low margins, which is a matter of concern for any company.

Points to Consider Before Investing

1. A large portion of Yatra’s business comes from airline bookings (about 50%), if airlines end their deals with Yatra, it could hurt their earnings.

2. The financial ratio of the company is very weak, you should keep an eye on it before investing.

3. The company has been unable to generate profit for the last several years, hence you may have to face huge losses.

4. The RSI of the company is indicating weakness from which it can be inferred that the stock price is going to fall.

5. The history of the company is very short so it is quite difficult to understand its share pattern.

6. You should be prepared for loss before investing in this company.

Yatra Online share prediction: expert opinion

Similar Stocks

| Company Name | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Thomas Cook (India) Ltd. | ₹11.33 kCr | 223.80% | ₹73.65 | ₹249.74 |

| Easy Trip Planners Ltd. | ₹7.53 kCr | 2.41% | ₹37.00 | ₹54.00 |

| BLS International Services Ltd. | ₹14.48 kCr | 81.39% | ₹191.50 | ₹429.95 |

| International Travel House Ltd. | ₹483.67 kCr | 107.83% | ₹281.90 | ₹781.00 |

| Wise Travel India Ltd | ₹690 Cr | 28.76% | ₹155.35 | ₹319.60 |

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Adani ports | ₹3.11 LCr | 94.78% | ₹703.00 | ₹1,457.05 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| ABB India | ₹1.78 LCr | 96.03% | ₹3,850.00 | ₹9,145.00 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Havells India | ₹1.20 LCr | 41.69% | ₹1232.85 | ₹1950.05 |

| Trent | ₹1.9 LCr | 203.94% | ₹1,657.45 | ₹5459.00 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Adani Total Gas | ₹1.14 LCr | 53.34% | ₹522.00 | ₹1259.40 |

Conclusion

Yatra Online Limited has shown significant sales growth and has low debt levels, which are key strengths. However, the company is not currently profitable, has shown high volatility in its financial performance, and does not pay any dividends. High negative P/E ratios and low returns on equity and capital employed are related to risk. Potential investors should carefully evaluate these strengths and risks, considering the company’s efforts to improve profitability and stabilize its financial performance.

Disclaimer – Please note that we are not SEBI-registered advisors. Our post is for educational purposes only. Therefore, before investing in any share, take advice from a SEBI certified expert. If you invest, you yourself will be responsible for your profit and loss, not us.

Also Read:

Yatra Online shares will make you rich, 100% guarantee.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Den Networks Share Price Target 2024, to 2050

Venus Pipes stock increased by 525%, became a millionaire in 1 year.

Q1. Is Yatra.com an Indian company?

Ans: Yes, Yatra.com is an Indian travel agency founded in 2006 by Dhruv Shringi, Sabina Chopra and Manish Amin.

Q2. What is the debt of Yatra?

Ans: Total debt of Yatra Online is 43.28 cr.

Q3. Why is Yatra IPO falling?

Ans: The travel services sector is affected by external factors such as the pandemic, geopolitical issues and economic slowdown. Apart from this, it also depends largely on airline ticket business and has to face tough competition from travel agencies like MakeMyTrip, ClearTrip.

Q4. Who is the CEO of Yatra Online?

Ans: Dhruv Shringi is the co-founder and CEO of Yatra Online travel agency.

Q5. Is yatra online a good buy?

Ans: No, its fundamentals are very weak and the company has not made any profit for many years. Apart from this, the company is not able to do anything new to beat the competition.

Q6. What is Yatra Online Share Price Target 2024

Ans: Yatra Online share price target range for 2024 is ₹122-150.

Q7. What is Yatra Online Share Price Target 2025

Ans: Yatra Online share price target range for 2025 is ₹132-180.

Q8. What is Yatra Online Share Price Target 2026

Ans: Yatra Online share price target range for 2026 is ₹175-226.

Q9. What is Yatra Online Share Price Target 2028

Ans: Yatra Online share price target range for 2028 is ₹120-158.

Q10. What is Yatra Online Share Price Target 2030

Ans: Yatra Online share price target range for 2030 is ₹414-474.

Q11. What is Yatra Online Share Price Target 2035

Ans: Yatra Online share price target range for 2035 is ₹719-774.

Q12. What is Yatra Online Share Price Target 2040

Ans: Yatra Online share price target range for 2040 is ₹928-982.

Q13. Who is brand ambassador of Yatra?

Ans: Ranbir Kapoor is the brand ambassador of India’s leading travel company Yatra.