Apollo Micro Systems Share Price Target 2025: This article is going to mainly focus on Apollo Micro Systems Share Price Target 2025, 2026, 2028, 2030, 2040 and 2050. Along with this, we will also discuss the company’s Fundamental, sentiment, Income Report, Share Price history, and Quarterly Report. Our analysis will help investors in taking the right decision.

About Apollo Micro Systems

Apollo Micro Systems Fundamental

Also Read: Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

| Description | Value |

|---|---|

| Company Name | Apollo Micro Systems Ltd. |

| Sector | Aviation |

| Established | 1985 |

| Website | apollo-micro.com |

| Listing At | BSE, NSE |

| BSE Code | 540879 |

| NSE Code | APOLLO |

| Mkt Cap | ₹3796Cr |

| Reserves and Surplus | ₹479.93Cr |

| ROE | 8.18% |

| ROCE | 12% |

| 52 Week High | ₹147.55 |

| 52 Week Low | ₹87.99 |

| P/E Ratio (TTM) | 80.95 |

| Industry P/E | 43.07 |

| P/B Ratio | 6.60 |

| Face Value | 1 |

| Book Value Per Share | ₹18.75 |

| EPS (TTM) | ₹1.53 |

| Dividend Yield | 0.04% |

| Debt to Equity | 0.37 |

| Total Revenue | ₹373.46Cr |

| Revenue Growth | 25.17% |

| Net Profit (Anual) | ₹31.11Cr |

| Profit Growth | 66.01% |

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2024 | 1.34% |

| 2023 | 290.37% |

| 2022 | 77.34% |

| 2021 | 32.74% |

| 2020 | 68.48% |

| 2019 | -40.31% |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Apollo Micro Systems Share Price Target 2025

The current sentiment of Apollo Micro Systems is showing bearish. the Apollo Micro Systems share price target 2025 is going to be between Rs 500 to Rs 1500.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹500 | ₹1500 |

Apollo Micro Systems Share Price Target 2026

According to market exports, the price target of Apollo Micro Systems for 2026 is going to be between Rs300 to Rs 460.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹300 | ₹460 |

Also Read: Venus Pipes Share Price Target 2023 to 2050

Apollo Micro Systems Share Price Target 2028

According to market experts, the price target of Apollo Micro Systems for 2028 is going to be between Rs 540 to Rs 710.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹540 | ₹710 |

Apollo Micro Systems Share Price Target 2030

According to market experts, Apollo Micro Systems Share Price Target 2030 is going to be between Rs700 to Rs 920.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹700 | ₹920 |

Apollo Micro Systems Share Price Target 2040

According to the past trend of the company, Apollo Micro Systems Share Price Target 2040 is going to be between Rs 1100 to Rs 1500.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹1100 | ₹1500 |

Also Read: Adani Power price target, share will increase 10 times.

Apollo Micro Systems Share Price Target 2050

According to the past trend of the company, Apollo Micro Systems Share Price Target 2050 is going to be between Rs 1500 to Rs 2100.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹1500 | ₹2100 |

Latest News

Strengths

- The company’s net cash flow has increased in the last 2 quarters

- The 59.33% promoter stake in the company reflects confidence in the business.

- The company has been successful in making profits in the last 2 quarters.

- The company’s profit margin has turned from negative to positive in the last 2 quarters.

- It has no debt, which shows that there is no extra burden on the company.

Risks

- Negative profitability metrics (ROE and ROCE) indicate poor returns on equity and capital.

- The company’s operating and profit margins have been negative, raising significant operational concerns.

- Declining EPS and negative net profit indicate persistent value erosion.

- The company has recorded minimal revenues over the past few years.

- Promoters have reduced their stake.

- High expenses relative to revenues indicate inefficient cost management.

- The P/B ratio (347.84) indicates that the stock is overvalued relative to its book value.

- When comparing the company’s P/E ratio (-372.42) to the industry average (21.51), the firm significantly underperforms its peers.

- Retail investors hold a 40.23% stake, and given the stock’s erratic financial performance, this group may be at risk of capital losses.

- No dividend payouts mean investors have limited options for returns.

- EBITDA and EBIT margins have been highly volatile, reflecting operating inefficiencies.

- Limited cash flow generation over the past few years reflects limited ability to invest in growth initiatives.

Sentiment

The current sentiment of Apollo Micro Systems is showing strong bearish. It is trading below 5 out of 8 Moving Averages in bearish zone and also trading bellow 6 out of 9 Oscillators in bearish zone, 1 in bullish zone.

Technical Indicator

According to Investing.com, 6 out of 7 technical indicators are giving sell signal, 0 are giving buy and 1 are giving neutral signal.

| Action | Indicator |

|---|---|

| Buy | 0 |

| Neutral | 1 |

| Sell | 6 |

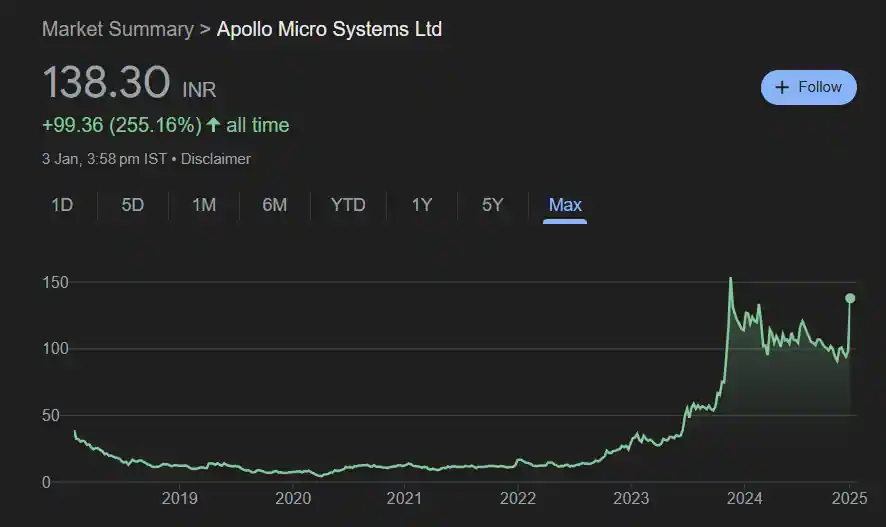

Apollo Micro Systems Share Price History

Also Read: Tata Steel price target, trust of more than 100 years old company.

Apollo Micro Systems Quarterly Income Report

| Description | Sep 24 | Jun 24 | Mar 24 | Dec23 |

| Revenue + | ₹161.57Cr. | ₹92.03Cr. | ₹136.59Cr. | ₹92.04Cr. |

| Expenses + | ₹138.91Cr | ₹79.88Cr. | ₹118.14Cr. | ₹77.48Cr. |

| EBITDA | ₹33.68Cr | ₹23.21Cr. | ₹29.91Cr. | ₹24.69Cr. |

| EBIT | ₹29.93Cr | ₹19.75Cr. | ₹26.76Cr. | ₹21.86Cr. |

| Net Profit | ₹15.87Cr | ₹8.61Cr. | ₹13.13Cr. | ₹10.11Cr. |

| Operating Profit Margin | 20.96% | 25.45% | 22.08% | 27.03% |

| Net Profit Margin | 9.87% | 9.44% | 9.69% | 11.07% |

| Earning Per Share | ₹0.53 | ₹0.29 | ₹0.49 | ₹0.38 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

Apollo Micro Systems Annual Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

|---|---|---|---|---|

| Total Revenue | ₹373.46Cr | ₹298.35Cr | ₹243.95Cr | ₹203.71Cr |

| Total Expenses | ₹329.37Cr | ₹266.17Cr | ₹223.70Cr | ₹189.25Cr |

| Profit/Loss | ₹31.11Cr | ₹18.74Cr | ₹14.62Cr | ₹10.25Cr |

| Net Profit Margin | 8.37% | 7% | 6.01% | 5.05% |

| Earning Per Share | ₹1.17 | ₹6.12 | ₹7.04 | ₹4.94 |

| EBITDA | ₹85.69 | ₹61.69 | ₹46.28 | ₹39.16 |

| EBIT | ₹74.40 | ₹51.33 | ₹37.30 | ₹30.47 |

| Operating Profit Margin | 23.06% | 21.82% | 19.03% | 19.29% |

| Dividends Per share | 0.05 | 0.25 | 0.25 | 0.25 |

Apollo Micro Systems Cash Flow

| Particulars | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Opening Cash Balance | ₹0.34Cr. | ₹0.13Cr. | ₹0.09Cr. | ₹7.89Cr. |

| Cash Flow From Operating Activities | ₹-16.29Cr | ₹43.18Cr. | ₹6.19Cr. | ₹46.91Cr. |

| Cash Flow From Investing Activities | ₹-34.76Cr | ₹-24.30Cr. | ₹-22.67Cr. | ₹-18.69Cr. |

| Cash Flow From Financing Activities | ₹50.95Cr | ₹-18.67Cr. | ₹16.51Cr. | ₹-36.03Cr. |

| Closing Cash Balance | ₹0.25Cr | ₹0.34Cr. | ₹0.13Cr. | ₹0.09Cr. |

| Net Change In Cash | ₹-0.09 | ₹0.22 | ₹0.04 | ₹-7.81 |

Apollo Micro Systems Share Price Target 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹500 | ₹1500 |

| 2026 | ₹300 | ₹460 |

| 2028 | ₹540 | ₹710 |

| 2030 | ₹700 | ₹920 |

| 2040 | ₹1100 | ₹1500 |

| 2050 | ₹1500 | ₹2100 |

Also Read: SW Solar price target, guarantee boom in solar sector.

Apollo Micro Systems Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 59.33% |

| Retail and Others | 40.23% |

| Other Domestic Institution | 0.43% |

| Total | 100.00% |

How to Buy Apollo Micro Systems Shares?

Buying and selling of Apollo Micro Systems can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

Apollo Micro Systems Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Jio Finance Services | ₹1.94 LCr. | 30.10% | ₹232 | ₹394.70 |

| Elcid Investment | ₹3742 KCr. | 5393667% | ₹3.53 | ₹332399.94 |

| Blue Chip India | ₹46.95 KCr. | 269.13% | ₹2.25 | ₹9.80 |

| LIC Housing Finance | ₹32.36KCr | 14.51% | ₹511.85 | ₹826.75 |

| Aadhar Housing Finance | ₹18.31 KCr | 29.05% | ₹292 | ₹516 |

| Can Fin Homes | ₹9.64 KCr. | -6% | ₹680 | ₹951.75 |

| Repco Home Finance | ₹2.61 KCr | 5.34% | ₹366.50 | ₹595 |

Apollo Micro Systems Share Price Target: Export Opinion

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Adani ports | ₹3.11 LCr | 94.78% | ₹703.00 | ₹1,457.05 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Havells India | ₹1.20 LCr | 41.69% | ₹1232.85 | ₹1950.05 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

Apollo Micro Systems Limited is facing severe financial distress with a high risk profile. Although it has historical market presence and promoter confidence, the company’s inability to generate profits, sustain revenue growth or deliver shareholder value should ring alarm bells for investors. Investors should exercise caution and consider the key risks before investing.

Disclaimer– Please note that all the information given here is for general information purpose only and not for investment purposes. Therefore, before investing in any share, take advice from a certified market expert. If you invest, you will be responsible for your profits and losses.

Also Read:

Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Yatra Online shares will make you rich, 100% guarantee.

Den Networks Share Price Target 2024, to 2050

Venus Pipes Share Price Target 2023 to 2050

Q1. What is the Apollo Micro Systems share price target 2025?

Ans: 2025 price target of Apollo Micro Systems will be between Rs.500 to Rs.1500.

Q2. What is the Apollo Micro Systems share price target 2030?

Ans: Apollo Micro Systems will trade between Rs700 and Rs920 in 2030.

Q3. What is the Apollo Micro Systems share price target 2040?

Ans: 2040 price target of Apollo Micro Systems will be between Rs.1100 to Rs.1500.

Q4. What is the Apollo Micro Systems share price target 2050?

Ans: 2050 price target of Apollo Micro Systems will be between Rs.1500 to Rs.2100.