Urja Global Share Price Target 2025: This article is going to mainly focus on Urja Global Share Price Target 2024, 2025, 2026, 2028, 2030, 2040 to 2050. Along with this, we will also discuss the company’s Fundamental, sentiment, Income Report, Share Price history, and Quarterly Report. Our analysis will help investors in taking the right decision.

About Urja Global

Urja Global Limited is India’s leading developer and operator, established in 1992. This company is engaged in works like designing, making, installation, maintenance of solar power plants. It is a Government of India approved channel partner of the Ministry of New and Renewable Energy.

The company has more than 30 years of experience in this field, this company especially works on renewable energy to supply electricity in remote villages, hilly areas, deserts, jungles and uninhabited areas.

Urja Global Fundamental

Urja Global Limited is a small cap company with a market cap of Rs 1212 Cr which generated revenue of Rs 44.54Cr with a growth of 10.30%. The ROE and ROCE of the company are 1.22% and 1.78% respectively. The company is trading at 6.89 times its book value.

Urja Global is trading at Rs 21.75, 91.49% below the 52 week maximum price and 59.54% above the 52 week lowest price. The debt of the company is very low which shows its strong position.

| Description | Value |

|---|---|

| Company Name | Urja Global Ltd |

| Sector | Power Generation and Distribution |

| Established | 1946 |

| Website | urjaglobal.in |

| Listing At | NSE, BSE |

| BSE Code | 526987 |

| NSE Code | URJA |

| Mkt Cap | ₹1212Cr |

| Reserves and Surplus | 91.62Cr |

| ROE | 1.22% |

| ROCE | 1.78% |

| 52 Week High | ₹41.65 |

| 52 Week Low | ₹8.80 |

| P/E Ratio (TTM) | 455.20 |

| P/B Ratio | 6.89 |

| Face Value | 1 |

| Book Value Per Share | 3.16 |

| EPS (TTM) | 0.05 |

| Dividend Yield | 0.0% |

| Debt to Equity | 0.03 |

| Total Revenue | 44.54Cr |

| Revenue Growth | 10.30% |

| Net Profit (Anual) | 1.78Cr |

| Profit Growth | 32.83% |

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2023 | 47.74% |

| 2022 | -52.05% |

| 2021 | 241.28% |

| 2020 | 261.90% |

| 2019 | -49.09% |

| 2018 | -37.26% |

Urja Global Share Price Target 2024

The current sentiment of Urja Global is showing sell. Its stock is going to remain almost constant for 2024. Urja Global’s maximum price target for 2024 is Rs 45.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹ 14 | ₹45 |

Urja Global Share Price Target 2025

Urja Global is India’s leading power generation company. Its target price range in 2025 is going to be Rs 18 to Rs 56.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹18 | ₹56 |

Urja Global Share Price Target 2026

According to market experts, the minimum target price of the company for 2026 is going to be RS 26 and the maximum target price is RS 67.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹26 | ₹67 |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Urja Global Share Price Target 2028

According to market experts, the minimum target price of the company for 2028 is going to be RS 58 and the maximum target price is RS 103.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹58 | ₹103 |

Urja Global Share Price Target 2030

According to market experts, the minimum target price of the company for 2030 is going to be RS 115 and the maximum target price is RS 186.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹115 | ₹186 |

Urja Global Share Price Target 2040

According to the past trend of the company, the minimum price target of Urja Global in 2040 is expected to be RS 284 and the maximum price target is expected to be RS 323.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹284 | ₹323 |

Also Read: Adani Power price target, share will increase 10 times.

Urja Global Share Price Target 2050

According to the past trend of the company, the minimum price target of Urja Global in 2050 is expected to be RS 489 and the maximum price target is expected to be RS 544.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹489 | ₹544 |

Sentiment

The current sentiment of Urja Global is showing bearish. It is trading above 5 out of 8 SMAs and also trading above 5 out of 9 Oscillators in bullish zone.

Analyst Rating

According to Investing.com, out of 11 technical indicators, 6 are pointing towards Sell, 3 are Neutral and 2 are pointing towards Buy.

| Action | Rating |

|---|---|

| Buy | 64% |

| Hold | 0% |

| Sell | 36% |

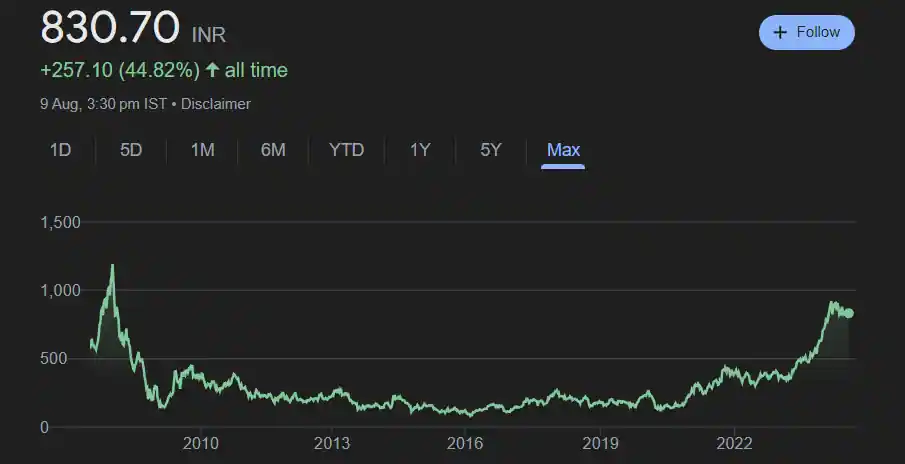

Urja Global Share Price History

Urja Global was listed on the Indian Stock Exchange on 28 March 2017 at Rs 1.39. Its stock fell 41.73% in the next 4 months after listing. Its shares witnessed a bumper rise of 969.14% in the next 6 months, after which its shares kept falling continuously till 2020. From March 2020 to January 2022, its share again rose by 3379.17%, after that its share started falling again and rose again in January 2024 as you can see in the graph.

Also Read: Tata Steel price target, trust of more than 100 years old company.

Urja Global Quarterly Report

| Description | Jun 24 | Mar 24 | Dec 23 | Sep 23 |

| Sales + | ₹10.71Cr. | ₹12.65Cr. | ₹11.51Cr. | ₹10.71Cr. |

| Expenses + | ₹9.89Cr. | ₹12.48Cr. | ₹10.52Cr. | ₹9.89Cr. |

| EBITDA | ₹0.83Cr. | ₹0.18Cr. | ₹1Cr. | ₹83Cr. |

| EBIT | ₹0.82Cr. | ₹0.17Cr. | ₹0.99Cr. | ₹0.82Cr. |

| Net Profit | ₹0.82Cr. | ₹0.17Cr. | ₹0.99Cr. | ₹0.82Cr. |

| Operating Profit Margin | 7.96% | 1.44% | 8.96% | 8.01% |

| Net Profit Margin | 7.77% | 1.36% | 8.87% | 7.92% |

| Earning Per Share | ₹0.02 | ₹0 | ₹0.02 | ₹0.02 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

Urja Global Income Report

The revenue of Urja Global Limited has continuously decreased since 2020 but there has been no decline in its profit. Compared to last year, the company’s revenue has grown by 10.30% and profit by 32.83%.

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 | Mar 20 |

|---|---|---|---|---|---|

| Total Revenue | ₹44.54Cr | ₹40.38Cr | ₹63.76Cr | ₹131.28Cr | ₹146.36Cr |

| Total Expenses | ₹41.96Cr | ₹38.59Cr | ₹62.88Cr | ₹129.13Cr | ₹144.12Cr |

| Profit/Loss | ₹1.78Cr | ₹1.34Cr | ₹0.66Cr | ₹1.71Cr | ₹1.61Cr |

Strengths

- The debt to equity ratio of the company is 0.03 which shows its low debt.

- The company has Rs 91.62 Cr of Reserves and Surplus which shows its earnings to fight future negative situations.

- The company has made a rapid recovery from the lowest price of the last 52 weeks.

Risks

- The EPS of the company is quite low which makes it less attractive to investors.

- The company is trading at 6.89 times its book value.

- Its revenue has been continuously decreasing for the last several years, if it continues to fall like this then the company will be unable to generate profit.

- The PE ratio of the company is very high at 455.20.

- The company’s profit has been declining for the last 2 quarters.

- The ROE of the company is 1.7% which is very low which indicates that the company is not able to utilize the shareholders’ capital properly to generate profit.

Urja Global Share Price Target 2024 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹14 | ₹45 |

| 2025 | ₹18 | ₹56 |

| 2026 | ₹26 | ₹67 |

| 2028 | ₹58 | ₹103 |

| 2030 | ₹115 | ₹186 |

| 2040 | ₹284 | ₹323 |

| 2050 | ₹489 | ₹544 |

Also Read: SW Solar price target, guarantee boom in solar sector.

Urja Global Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 19.43% |

| Retail and Others | 80.13% |

| Foreign Institutions | 0.44% |

| Total | 100.00% |

How to Buy Urja Global Shares?

Buying and selling of Urja Global shares can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Godrej Properties | ₹81.35KCr. | 92.24% | ₹1495.30 | ₹3402.70 |

| Phoenix Mills | ₹60.10 KCr. | 96.89% | ₹1652.10 | ₹4137 |

| Prestige Estates Projects | ₹68.92 KCr. | 207.18% | ₹543 | ₹2074.80 |

| Oberoi Realty | ₹6502 KCr | 65.99% | ₹1051.10 | ₹1953.05 |

| Macrotech Developers | ₹1.24 LCr. | 78.29% | ₹641.05 | ₹1649.95 |

Also Read: Den Networks Share Price Target 2024, to 2050

Urja Global Share Price Target: Export Opinion

Profitable Stocks

| Company Name | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| JSW Energy | ₹119748.34Cr. | 143.4% | ₹286 | ₹752 |

| IIFL Securities Ltd | ₹5,834Cr. | 194.30% | ₹63.0 | ₹240 |

| NTPC | ₹382000.21Cr. | 95.23% | ₹200 | ₹395 |

| Marksans Pharma Ltd | ₹9,224Cr. | 77.29% | ₹93.8 | ₹205 |

| Ashoka Buildcon Ltd | ₹7,310Cr. | 154.59% | ₹89.0 | ₹262 |

Conclusion

Urja is one of the leading companies in the global power generation and renewable sector. The company has the potential to give huge returns to long term investors but its revenue has been continuously decreasing for the last several years which is a matter of concern. Long term investors should keep an eye on the company’s revenue, profit and upcoming projects.

Disclaimer– Please note that all the information given here is for general information purpose only and not for investment purposes. Therefore, before investing in any share, take advice from a certified market expert. If you invest, you will be responsible for your profits and losses.

Also Read:

Yatra Online shares will make you rich, 100% guarantee.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Den Networks Share Price Target 2024, to 2050

Q1. What is the target price of Urja Global in 2024?

Ans: Urja Global’s target price for 2024 is Rs18 to Rs56.

Q2. What is the target price of Urja Global in 2025?

Ans: Urja Global’s target price for 2025 is Rs18 to Rs56.

Q3. What is the target price of Urja Global in 2030?

Ans: Urja Global’s target price for 2030 is Rs18 to Rs56.

Q4. What is the target price of Urja Global in 2040?

Ans: Urja Global’s target price for 2040 is Rs18 to Rs56.

Q5. What is the target price of Urja Global in 2050?

Ans: Urja Global’s target price for 2050 is Rs18 to Rs56.

Q6. Is Urja Global debt free?

Ans: Urja Global is almost debt free renewable company, its debt to equity ratio is 0.03.