Rama Steel Share Price Target 2025: This article is going to mainly focus on Rama Steel Share Price Target 2025, 2026, 2028, 2030, 2040 and 2050. Along with this, we will also discuss the company’s Fundamental, sentiment, Income Report, Share Price history, and Quarterly Report. Our analysis will help investors in taking the right decision.

About Rama Steel

Rama Steel Tubes Limited is a leading manufacturer and exporter of steel tubes, pipes and galvanized steel products in India. It was founded in 1974 by SH Harbanslal Bansal. The company specializes in the production of ERW (Electric Resistance Welded) pipes, galvanized steel pipes and structural steel products used in various industries, including construction, infrastructure, automotive and agriculture.

Rama Steel’s products meet global standards and have a strong presence domestically and internationally, exporting its products to more than 20 countries like UK, USA, Sri Lanka, Ethiopia, Kenya, Kuwait, Germany, South Africa, Congo, Guyana, Yemen.

Rama Steel Fundamental

Rama Steel Tube Limited is a manufacturer and exporter of steel tubes, pipes, automobiles, agricultural products, It is a small cap company with ₹11910 crore. The company is listed on both NSE and BSE with the code RAMASTEEL and 539309 respectively. Reserves and surplus of ₹135.24 crore suggest good financial support, which reflects the company’s strong position to fight adverse conditions.

Trident total revenue for FY24 was Rs1051 crore and net profit was Rs 30 crore, registering a growth of -21.80% and 9.33% respectively. The Company’s ROE (9.96%) and ROCE (12.4%) are moderate but can give consistent profit. The Company’s debt to equity ratio (0.27) indicates manageable debt levels.

Cash flow from operating activities was negative (-₹96.16 crores) in FY23, indicating that the company is unable to generate sufficient cash from the core business. The company’s cash flow from investing activities is negative, reflecting significant capital expenditure . However, cash flow has increased in recent quarters.

Also Read: IRFC Price Target 2025 to 2050

Also Read: IRFC Price Target 2025 to 2050

The company’s price-to-earnings (P/E) ratio is 72.29 which is significantly higher than the industry’s P/E of 24.75, which indicates that the company is overvalued. Its P/B ratio (5.43) indicates premium pricing relative to book value. The company is not paying any dividends to shareholders, and its EPS (TTM) is ₹0.17, which indicates modest profitability.

| Description | Value |

|---|---|

| Company Name | Rama Steel Tube Ltd. |

| Sector | Automobile and Ancillary |

| Established | 1974 |

| Website | ramasteel.com |

| Listing At | BSE, NSE |

| BSE Code | 539309 |

| NSE Code | RAMASTEEL |

| Mkt Cap | ₹1910Cr |

| Reserves and Surplus | ₹135.24Cr |

| ROE | 9.96% |

| ROCE | 12.4% |

| 52 Week High | ₹17.55 |

| 52 Week Low | ₹9.90 |

| P/E Ratio (TTM) | 72.29 |

| Industry P/E | 24.75 |

| P/B Ratio | 5.43 |

| Face Value | 1 |

| Book Value Per Share | ₹2.26 |

| EPS (TTM) | ₹017 |

| Dividend Yield | 0.00% |

| Debt to Equity | 0.27 |

| Total Revenue | ₹1051Cr |

| Revenue Growth | -21.80% |

| Net Profit (Anual) | ₹30Cr |

| Profit Growth | 9.33% |

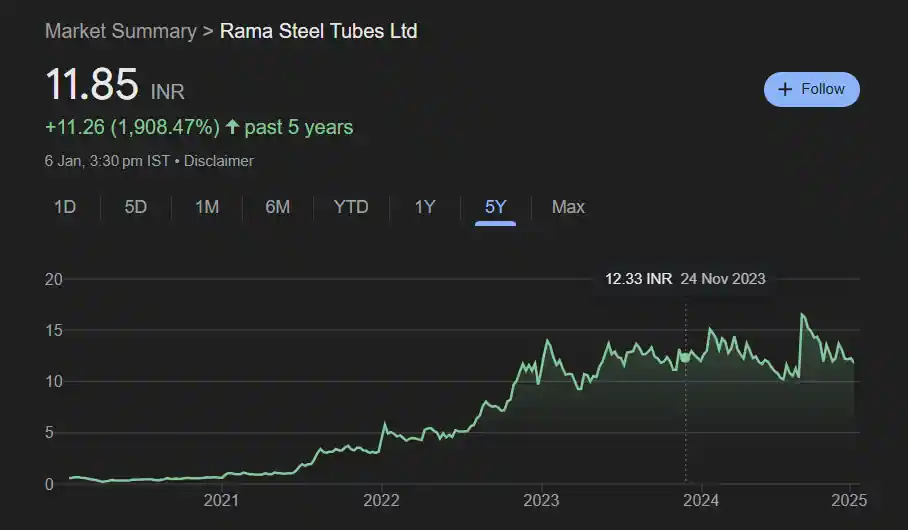

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2024 | 0.33% |

| 2023 | 8.30% |

| 2022 | 145.13% |

| 2021 | 606.28% |

| 2020 | 1.59% |

| 2019 | -49.60% |

| 2020 | -56.29% |

| 2021 | 90.67% |

| 2022 | 20% |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Rama Steel Share Price Target 2025

Rama Steel is a 47-year-old company with more than 5 decades of experience and reputation. The current sentiment of the company is showing buy. The P/E ratio of the company is pointing towards overvaluation, the company is likely to make a correction in 2025. Growth can be seen in its stock after half a year. In 2025, the stock of Rama Steel will trade between ₹ 8.9 to ₹ 13.6.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹8.9 | ₹13.6 |

Rama Steel Share Price Target 2026

According to market exports, the price target of Rama Steel for 2026 is going to be between Rs11.3 to Rs 16.6.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹11.3 | ₹16.6 |

Also Read: Venus Pipes Share Price Target 2023 to 2050

Rama Steel Share Price Target 2028

According to market experts, the price target of Rama Steel for 2028 is going to be between Rs 15.8 to Rs 23.5.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹15.8 | ₹23.5 |

Rama Steel Share Price Target 2030

According to market experts, Rama Steel Share Price Target 2030 is going to be between Rs21.4 to Rs 30.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹21.4 | ₹30 |

Rama Steel Share Price Target 2040

According to the past trend of the company, Rama Steel Share Price Target 2040 is going to be between Rs 38.9 to Rs 55.3.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹38.9 | ₹55.3 |

Also Read: Adani Power price target, share will increase 10 times.

Rama Steel Share Price Target 2050

According to the past trend of the company, Rama Steel Share Price Target 2050 is going to be between Rs 56 to Rs 89.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹56 | ₹89 |

Latest News

Strengths

- The company’s profit has grown steadily over time (from 12.38 Cr in 2021 to 30 Cr in 2024).

- The company has a limited debt to equity ratio (0.27), which reduces financial risk and shows a stable financial position.

- The company’s profitability metrics Return on Equity (ROE) and Return on Capital Employed (ROCE) indicate good returns for its shareholders.

- The company’s cash flow from operating activities has increased in recent quarters.

- The promoters hold 47.96% of the total shares, which shows confidence in the company’s growth prospects.

- The company operates in the automobile and ancillary sector, the demand for which is constantly increasing.

- The company’s annual profit grew by 9.33% in the last financial year, showing a consistent increase in profitability.

Risks

- The company’s P/E ratio is 72.29, which is significantly higher than the industry’s P/E of 24.75, which may be a risky investment.

- The company’s revenue growth is -21.80%, which indicates a significant decline in sales. Which indicates a slowdown in demand or operational inefficiencies.

- The company has no dividend payout (0.00%), which may discourage profit-focused investors.

- Cash flow from operating activities was negative (-₹96.16 crore) in FY23, which indicates that the company is unable to generate sufficient cash from the core business.

- The company’s cash flow from investing activities is negative, which reflects significant capital expenditure.

- Promoters’ stake in the company has decreased.

- The company’s operating profit margin (6.19%) and net profit margin: (2.87%) are very low, making it vulnerable to fluctuations in raw material prices and economic slowdown.

- Retail investors hold 51.87% of the total shares. High retail holdings can lead to increased volatility in stock prices.

- The company’s quarterly net profit is showing considerable volatility.

Sentiment

The current sentiment of Rama Steel is showing strong bearish. It is trading below 8 out of 8 Moving Averages in bearish zone and also trading bellow 6 out of 9 Oscillators in bearish zone, 1 in bullish zone.

Technical Indicator

According to Investing.com, 8 out of 8 technical indicators are giving sell signal, 0 are giving buy and 0 are giving neutral signal.

| Action | Indicator |

|---|---|

| Buy | 0 |

| Neutral | 0 |

| Sell | 8 |

Rama Steel Share Price History

Also Read: Tata Steel price target, trust of more than 100 years old company.

Rama Steel Quarterly Income Report

| Description | Sep 24 | Jun 24 | Mar 24 | Dec23 |

| Revenue + | ₹229.76Cr. | ₹159.84Cr. | ₹212.90Cr. | ₹213.48Cr. |

| Expenses + | ₹225.36Cr | ₹156.62Cr. | ₹203.71Cr. | ₹205.95Cr. |

| EBITDA | ₹6.91Cr | ₹6.33Cr. | ₹13.47Cr. | ₹13.62Cr. |

| EBIT | ₹5.81Cr | ₹4.91Cr. | ₹12.24Cr. | ₹12.50Cr. |

| Net Profit | ₹2.92Cr | ₹2.58Cr. | ₹7.29Cr. | ₹5.70Cr. |

| Operating Profit Margin | 3.15% | 4% | 6.49% | 6.45% |

| Net Profit Margin | 1.33% | 1.63% | 3.51% | 2.70% |

| Earning Per Share | ₹0.02 | ₹0.02 | ₹0.14 | ₹0.08 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

Rama Steel Annual Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

|---|---|---|---|---|

| Total Revenue | ₹1051Cr | ₹1344Cr | ₹777.37Cr | ₹476.58Cr |

| Total Expenses | ₹1014Cr | ₹1310Cr | ₹740.78Cr | ₹463.28Cr |

| Profit/Loss | ₹30Cr | ₹27.44Cr | ₹27.32Cr | ₹12.38Cr |

| Net Profit Margin | 2.87% | 2.05% | 3.56% | 2.63% |

| Earning Per Share | ₹0.54 | ₹1.10 | ₹16.41 | ₹7.21 |

| EBITDA | ₹64.42 | ₹59.90 | ₹51.11 | ₹25.87 |

| EBIT | ₹58.77 | ₹55.17 | ₹46.84 | ₹22.40 |

| Operating Profit Margin | 6.19% | 4.48% | 6.65% | 5.50% |

| Dividends Per share | 0.00 | 0.00 | 0.50 | 0.00 |

Rama Steel Cash Flow

| Particulars | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Opening Cash Balance | ₹18.71Cr. | ₹22.08Cr. | ₹13.12Cr. | ₹6.76Cr. |

| Cash Flow From Operating Activities | ₹-96.16Cr | ₹-34.98Cr. | ₹24.72Cr. | ₹29.80Cr. |

| Cash Flow From Investing Activities | ₹-53.20Cr | ₹-9.23Cr. | ₹-10.17Cr. | ₹-6.83Cr. |

| Cash Flow From Financing Activities | ₹143.26Cr | ₹40.85Cr. | ₹-5.59Cr. | ₹-16.61Cr. |

| Closing Cash Balance | ₹12.61Cr | ₹18.71Cr. | ₹22.08Cr. | ₹13.12Cr. |

| Net Change In Cash | ₹-6.10 | ₹-3.39 | ₹8.96 | ₹6.39 |

Rama Steel Share Price Target 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹8.9 | ₹13.6 |

| 2026 | ₹11.3 | ₹16.6 |

| 2028 | ₹15.8 | ₹23.5 |

| 2030 | ₹21.4 | ₹30 |

| 2040 | ₹38.9 | ₹55.3 |

| 2050 | ₹56 | ₹89 |

Also Read: SW Solar price target, guarantee boom in solar sector.

Rama Steel Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 47.96% |

| Retail and Others | 51.87% |

| Foreign Institution | 0.17% |

| Total | 100.00% |

How to Buy Rama Steel Shares?

Buying and selling of Rama Steel can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

Rama Steel Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Jio Finance Services | ₹1.94 LCr. | 30.10% | ₹232 | ₹394.70 |

| Elcid Investment | ₹3742 KCr. | 5393667% | ₹3.53 | ₹332399.94 |

| Blue Chip India | ₹46.95 KCr. | 269.13% | ₹2.25 | ₹9.80 |

| LIC Housing Finance | ₹32.36KCr | 14.51% | ₹511.85 | ₹826.75 |

| Aadhar Housing Finance | ₹18.31 KCr | 29.05% | ₹292 | ₹516 |

| Can Fin Homes | ₹9.64 KCr. | -6% | ₹680 | ₹951.75 |

| Repco Home Finance | ₹2.61 KCr | 5.34% | ₹366.50 | ₹595 |

Rama Steel Share Price Target: Export Opinion

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Adani ports | ₹3.11 LCr | 94.78% | ₹703.00 | ₹1,457.05 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Havells India | ₹1.20 LCr | 41.69% | ₹1232.85 | ₹1950.05 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

Rama Steel Tubes Ltd. is a well-established company with a strong market presence and low debt levels. However, its high valuation, declining revenues, and cash flow issues point to significant risks. Investors should consider these risks before investing.

Overall, this is a medium-risk, long-term investment with growth potential if the company recovers from its revenue declines and improves profitability.

Disclaimer– Please note that all the information given here is for general information purpose only and not for investment purposes. Therefore, before investing in any share, take advice from a certified market expert. If you invest, you will be responsible for your profits and losses.

Also Read:

Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Yatra Online shares will make you rich, 100% guarantee.

Den Networks Share Price Target 2024, to 2050

Venus Pipes Share Price Target 2023 to 2050

Q1. What is the Rama Steel share price target 2025?

Ans: 2025 price target of Rama Steel will be between Rs.8.9 to Rs.13.6.

Q2. What is the Rama Steel share price target 2030?

Ans: Rama Steel will trade between Rs21.4 and Rs30 in 2030.

Q3. What is the Rama Steel share price target 2040?

Ans: 2040 price target of Rama Steel will be between Rs.38.9 to Rs.55.3.

Q4. What is the Rama Steel share price target 2050?

Ans: 2050 price target of Rama Steel will be between Rs.56 to Rs.89.