Phoenix Mills Share Price Target 2025: This article is going to mainly focus on Phoenix Mills Share Price Target 2024, 2025, 2026, 2028, 2030, 2040 to 2050. Along with this, we will also discuss the company’s Fundamental, sentiment, Income Report, Share Price history, and Quarterly Report. Our analysis will help investors in taking the right decision.

About Phoenix Mills

Phoenix Mills is India’s largest retail LED mixed use developer, founded in 1905 by Ramnarain Ruia. Basically this company does business in 4 ways-

Retail Asset: This company develops and manages its own retail assets.

Residential Assets: The company develops residential assets and then sells them.

Commercial Assets: Under this it develops commercial assets and gives them on lease.

Hospitality Assets: Under this, it develops and runs its own hotels and restaurants.

Phoenix Mills Fundamental

Phoenix Mills is a well-known real estate company with a market cap of 59.92KCr. The company’s ROE is 11.62% and ROCE is 6.67% which promises good returns to investors. But PE and PB ratio is very high which is probably indicating stability in its growth and its stock may also fall in the coming time. In the last financial year, there has been a growth of 6.29% in the total revenue of the company but there has also been a decline of 3.5% in its profit.

| Company Name | Phoenix Mills Ltd |

| Sector | Real estate |

| Established | 1905 |

| Website | thephoenixmills.com |

| Listing At | NSE, BSE |

| BSE Code | 503100 |

| NSE Code | PHOENIXLTD |

| Mkt Cap | ₹59.92 KCr |

| Reserves and Surplus | 5023.32Cr |

| ROE | 11.62% |

| ROCE | 6.67% |

| 52 Week High | ₹4137 |

| 52 Week Low | ₹1652.10 |

| P/E Ratio (TTM) | 55.05 |

| P/B Ratio | 6.35 |

| Face Value | 2 |

| Book Value Per Share | 529.18 |

| EPS (TTM) | 61.06 |

| Dividend Yield | 0.15% |

| Debt to Equity | 0.14 |

| Total Revenue | 574.44Cr |

| Revenue Growth | 6.29% |

| Net Profit (Anual) | 280.21Cr |

| Profit Growth | -3.50% |

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2023 | 57.80% |

| 2022 | 44.36% |

| 2021 | 27.22% |

| 2020 | -6.98% |

| 2019 | 47.75% |

| 2018 | -10.10% |

| 2017 | 66.12% |

| 2016 | 11.75% |

| 2015 | -10.13% |

| 2014 | 64.09% |

Also Read: Tata Power share price target, guaranteed returns.

Phoenix Mills Share Price Target 2024

Phoenix Mills is showing current sentiment Buy. According to experts, Phoenix Mills price target for 2024 will trade between Rs 2705 to 4122.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹2705 | ₹4122 |

Phoenix Mills Share Price Target 2025

Phoenix Mills is India’s largest real estate company. Its target price range in 2025 is going to be Rs 820 to Rs 980.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹3642 | ₹4980 |

Phoenix Mills Share Price Target 2026

According to market experts, the minimum target price of the Phoenix Mills for 2026 is going to be RS 4122 and the maximum target price is RS 5432.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹4122 | ₹5432 |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Phoenix Mills Share Price Target 2028

According to market experts, the minimum target price of the Phoenix Mills for 2028 is going to be RS 4830 and the maximum target price is RS 6134.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹4830 | ₹6134 |

Phoenix Mills Share Price Target 2030

According to market experts, the minimum target price of the Phoenix Mills for 2030 is going to be RS 5547 and the maximum target price is RS 6989.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹5547 | ₹6989 |

Phoenix Mills Share Price Target 2040

According to the past trend of the company, the minimum price target of Phoenix Mills in 2040 is expected to be RS 7483 to RS 9321.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹7483 | ₹9321 |

Phoenix Mills Share Price Target 2050

According to the past trend of the company, the minimum price target of Phoenix Mills in 2050 is expected to be RS 9894 to RS 12056.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹9894 | ₹12056 |

Strengths

- Low debt levels: The company has a well maintained debt-equity ratio of 0.14, which reduces the financial risk and interest burden on the company.

- Solid Shareholders’ Funds: There has been a steady increase in the reserves and surplus of the company, reaching ₹5023.32 crore.

- Return Metrics: Return on Equity (ROE) of 11.62% and Return on Capital Employed (ROCE) of 6.67% demonstrate the company’s ability to generate returns for its investors.

- The net cash flow of the company is continuously increasing.

Also Read: Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

Risks

- MACD of Phoenix Mills is below the signal and center line indicating strong bearish momentum.

- Mutual funds have reduced their stake in the last quarter.

- High Valuation: P/E ratio of 55.05 and P/B ratio of 6.35 shows that Phoenix Mills is trading at high valuation relative to its earnings and book value, which may also cause the stock to fall.

- Decline in profit growth: Net profit has declined by 3.50% compared to last year.

- Dividend Yield: The dividend yield is very low at 0.15%, making it less attractive to income-focused investors.

- High fixed assets: The company has significant investments in non-current assets, which may pose liquidity risks if these assets do not generate adequate returns.

- Rising Expenses: Operating expenses are increasing, which if not controlled, may put pressure on profit margins in the future.

Sentiment

The current sentiment of Phoenix Mills is showing bearish. It is trading below 4 out of 8 SMAs and also trading below 5 out of 9 Oscillators in bearish zone.

Analyst Rating

Here are the ratings given to Phoenix Mills by 15 analysts at Refinitiv.

| Action | Rating |

|---|---|

| Buy | 93% |

| Hold | 7% |

| Sell | 0% |

Phoenix Mills Share Price History

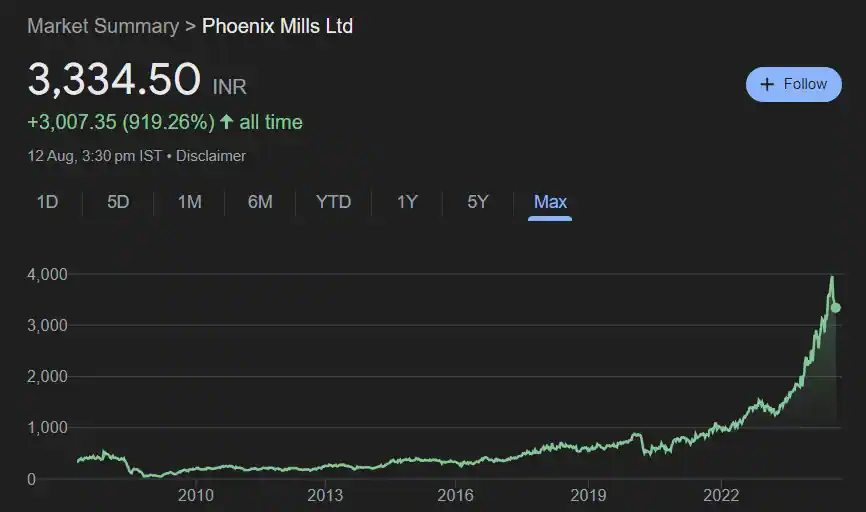

After listing on BSE on 23 April 2007, Phoenix Mills traded below Rs 500 till 2016 but since then its share has gained momentum and in February 2020 it even touched Rs 850. The very next month its stock fell drastically. Since then, after a lot of ups and downs in its stock, today its stock is trading at Rs 3334. Its shares have grown by 423% in the last 5 years. Its shares have increased by 94.19% and 25.60% respectively in the last 1 year and 6 months. However, its shares have also registered a decline of 14.56% in the last one month.

Also Read: Venus Pipes Share Price Target 2023 to 2050

Phoenix Mills Quarterly Report

| Jun 24 | Mar 24 | Dec 23 | Sep 23 | |

| Sales + | ₹124.27Cr. | ₹120.89Cr. | ₹124.66Cr. | ₹205.09Cr. |

| Expenses + | ₹66.10Cr. | ₹63.52Cr. | ₹66.72Cr. | ₹62.94Cr. |

| EBITDA | ₹83.07Cr. | ₹84.07Cr. | ₹82.24Cr. | ₹166.15Cr. |

| EBIT | ₹122.31Cr. | ₹73.31Cr. | ₹74.15Cr. | ₹158.12Cr. |

| Net Profit | ₹96Cr. | ₹52.87Cr. | ₹50.22Cr. | ₹125.94Cr. |

| Operating Profit Margin | 110.33% | 72.72% | 68.62% | 147.83% |

| Net Profit Margin | 44.75% | 45.74% | 41.91% | 112.05% |

| Earning Per Share | ₹2.72 | ₹2.91 | ₹2.81 | ₹7.05 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

Phoenix Mills Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 | Mar 20 |

|---|---|---|---|---|---|

| Total Revenue | ₹574.44Cr | ₹540.43Cr | ₹373.03Cr | ₹546.75Cr | ₹486.91Cr |

| Total Expenses | ₹253.21Cr | ₹252.64Cr | ₹211.65Cr | ₹230.50Cr | ₹307.35Cr |

| Profit/Loss Before Tax | ₹321.23Cr | ₹336.23Cr | ₹161.37Cr | ₹316.25Cr | ₹178.31Cr |

Phoenix Mills Price Target 2024 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹2705 | ₹4122 |

| 2025 | ₹3642 | ₹4980 |

| 2026 | ₹4122 | ₹5432 |

| 2028 | ₹4830 | ₹6134 |

| 2030 | ₹5547 | ₹6989 |

| 2040 | ₹7483 | ₹9321 |

| 2050 | ₹9894 | ₹12056 |

Phoenix Mills Shareholding Pattern

| Promoter | 47.27% |

| Other Domestic Institutions | 1.07% |

| Retail and Others | 3.98% |

| Foreign Institutions | 35.41% |

| Mutual funds | 12.27% |

| Total | 100.00% |

Also Read: Adani Power price target, share will increase 10 times.

How to Buy DPhoenix MillsLF Shares?

Buying and selling of Phoenix Mills shares can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- Groww

- Angel One

- Upstox

Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Godrej Properties | ₹81.35KCr. | 92.24% | ₹1495.30 | ₹3402.70 |

| Phoenix Mills | ₹60.10 KCr. | 96.89% | ₹1652.10 | ₹4137 |

| Prestige Estates Projects | ₹68.92 KCr. | 207.18% | ₹543 | ₹2074.80 |

| Oberoi Realty | ₹6502 KCr | 65.99% | ₹1051.10 | ₹1953.05 |

| Arkade Developers | ₹2470 Cr | -18.02% | ₹119 | ₹128 |

| Macrotech Developers | ₹1.24 LCr. | 78.29% | ₹641.05 | ₹1649.95 |

| IRB INFRA | ₹3032 Cr | 43.49% | ₹34.75 | ₹78.15 |

Phoenix Mills Share Price Target: Export Opinion

Profitable Stocks

| Company Name | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| JSW Energy | ₹119748.34Cr. | 143.4% | ₹286 | ₹752 |

| IIFL Securities Ltd | ₹5,834Cr. | 194.30% | ₹63.0 | ₹240 |

| NTPC | ₹382000.21Cr. | 95.23% | ₹200 | ₹395 |

| Marksans Pharma Ltd | ₹9,224Cr. | 77.29% | ₹93.8 | ₹205 |

| Ashoka Buildcon Ltd | ₹7,310Cr. | 154.59% | ₹89.0 | ₹262 |

Conclusion

Phoenix Mills Limited is a financially stable company, supported by low debt and solid shareholder equity. However, high valuations, declining profit growth and low dividend yields are potential risks that could impact investors’ returns. While the company has shown resilience and operating efficiency, potential investors should consider these risks, especially in the context of its high valuation and profit growth challenges. Long-term growth prospects remain, but careful monitoring of performance and valuation is advised.

Disclaimer – Please note that all the information given here is for general information purpose only and not for investment purposes. Therefore, before investing in any share, take advice from a certified market expert. If you invest, you will be responsible for your profits and losses.

Also Read:

Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Yatra Online shares will make you rich, 100% guarantee.

Den Networks Share Price Target 2024, to 2050

Venus Pipes Share Price Target 2023 to 2050

Q1. What is the price target of Phoenix Mills in 2025?

Ans: 2025 Phoenix Mills price target will trade between Rs3642 to Rs4980.

Q2. What is the price target of Phoenix Mills in 2030?

Ans: 2030 Phoenix Mills price target will trade between Rs5547 to Rs6989.

Q3. What is the price target of Phoenix Mills in 2024?

Ans: 2024 Phoenix Mills price target will trade between Rs2705 to Rs4122.

Q4. What is the price target of Phoenix Mills in 2040?

Ans: 2040 Phoenix Mills price target will trade between Rs7483 to Rs9321.

Q5. What is the price target of Phoenix Mills in 2050?

Ans: 2050 Phoenix Mills price target will trade between Rs98 to Rs12056.