In this article, we will explore the future share price targets of NHPC for the years 2025, 2026, 2028, 2030, 2040, and 2050. Additionally, we will discuss NHPC’s fundamentals, market sentiment, financial performance, and quarterly reports to assist investors in making informed decisions.

About NHPC

Established in 1975, NHPC Limited stands as India’s foremost government-owned hydropower entity, spearheading the nation’s renewable energy transition. Headquartered in Faridabad, Haryana, the corporation specializes in the development, operation, and maintenance of hydropower infrastructure while expanding its footprint into solar and wind energy sectors. With a mission to drive sustainable power solutions, NHPC combines engineering expertise with innovation to meet India’s growing energy demands.

As of December 2024, NHPC commands an installed capacity of 7,232.90 MW, derived from 22 hydropower plants, five solar installations, and one wind energy project. The company is actively advancing 16 additional ventures—comprising hydropower, solar, and joint ventures—to augment its capacity by 10,804 MW. Furthermore, nine projects totaling 4,291 MW await regulatory approval, underscoring NHPC’s commitment to scaling renewable energy infrastructure.

NHPC Fundamentals

SNHPC Limited stands as India’s foremost government-owned hydropower entity, spearheading the nation’s renewable energy transition. The company’s market capitalization is ₹77256 Cr, making it a large-cap stock. NHPC has strong financial reserves of ₹27223.58 Cr, showing stability and the ability to handle future projects or challenges. The company is listed on both NSE and BSE with the code NHPC and 533098 respectively.

Total revenue stood at ₹10994 Crore in FY24, showing a negative growth of 2.58% over ₹11285 Crore in FY23. Net profit accelerated to ₹3633 Crore in FY24, showing a negative growth of 15.02% over FY23. However company has remained consistently profitable for several years and its operating profit margin is high. The company’s dividend yield is 2.47%, which indicates regular dividend payout to investors.

Also Read: Big company big returns Bajaj Housing Finance share price target

The company’s P/E ratio (25.90) is slightly high to the industry P/E (22.66), meaning it is priced higher than its peers. The P/B ratio of 1.92 indicates that the stock is trading at two times to its book value. NHPC Green Energy’s ROE (9.61%) reflects inappropriate use of equity and ROCE (7.67%) reflects low operating efficiency despite strong profitability.

| Description | Value |

|---|---|

| Company Name | NHPC Ltd. |

| Sector | Power Generation and Distribution |

| Established | 7 November 1975 |

| Website | nhpcindia.com |

| Listing At | BSE, NSE |

| BSE Code | 533098 |

| NSE Code | NHPC |

| Mkt Cap | ₹77256Cr |

| Reserves and Surplus | ₹27223.58Cr |

| ROE | 9.61% |

| ROCE | 7.67% |

| 52 Week High | ₹118.40 |

| 52 Week Low | ₹72.15 |

| P/E Ratio (TTM) | 25.90 |

| Industry P/E | 22.66 |

| P/B Ratio | 1.92 |

| Face Value | 10 |

| Book Value Per Share | ₹39.97 |

| EPS (TTM) | ₹2.97 |

| Dividend Yield | 2.47% |

| Debt to Equity | 0.85 |

| Total Revenue | ₹10994Cr |

| Revenue Growth | -2.58% |

| Net Profit (Anual) | ₹3633Cr |

| Profit Growth | -15.02% |

Also Read: Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

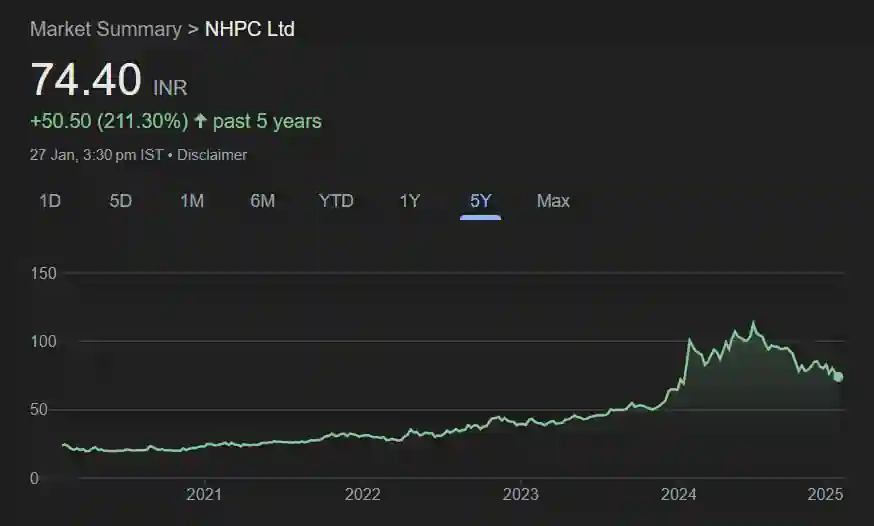

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2024 | 24.91% |

| 2023 | 62.52% |

| 2022 | 28.43% |

| 2021 | 36.64% |

| 2020 | -5.43% |

| 2019 | -7.88% |

| 2018 | -20.37% |

| 2017 | 23.44% |

| 2016 | 25.65% |

| 2015 | 11.67% |

| 2014 | -3.58% |

| 2013 | -23.58% |

| 2012 | 41% |

| 2011 | -35.99% |

| 2010 | -17.18% |

NHPC Share Price Target 2025

The current sentiment of Gail is showing strong bearish. the Gail share price target 2025 is going to be between Rs 48 to Rs 120.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹48 | ₹120 |

NHPC Share Price Target 2026

According to market experts, the price target of Gail for 2026 is going to be between Rs70 to Rs 140.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹70 | ₹140 |

Also Read: Venus Pipes Share Price Target 2023 to 2050

NHPC Share Price Target 2028

According to market experts, the price target of Gail for 2028 is going to be between Rs 120 to Rs 213.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹120 | ₹213 |

NHPC Share Price Target 2030

According to market experts, Gail Share Price Target 2030 is going to be between Rs160 to Rs 276.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹160 | ₹276 |

NHPC Share Price Target 2040

According to the past trend of the company, Gail Share Price Target 2040 is going to be between Rs 450 to Rs 646.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹450 | ₹646 |

NHPC Share Price Target 2050

According to the past trend of the company, Gail Share Price Target 2050 is going to be between Rs 736 to Rs 1056.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹736 | ₹1056 |

Also Read: Adani Power price target, share will increase 10 times.

NHPC Share Price Target: Export Opinion

Strengths

- Robust Liquidity: A healthy operating cash flow of ₹6,938 crore (2024) ensures financial flexibility for ongoing and future projects.

- Profitability Metrics: Consistent net profit margins averaging 40% and EBITDA margins exceeding 65% highlight operational efficiency.

- Investor Confidence: Promoters retain a 67.40% stake, complemented by institutional holdings of 14.44%, signaling strong market trust.

- Dividend Reliability: Regular dividend payouts appeal to income-focused investors, supported by reserves of ₹27,223.58 crore for strategic investments.

- Margin Growth: Operating profit margins have risen sequentially over four consecutive quarters, reflecting improving cost management.

Risks

- Revenue Contraction: FY 2024 saw a 2.58% drop in revenue and a 15.02% profit decline, signaling operational or market headwinds.

- Sector Concentration: Overreliance on the power sector exposes NHPC to policy shifts, renewable energy transitions, and regional disruptions.

- Debt Concerns: A debt-to-equity ratio of 0.85 raises leverage risks, particularly if earnings face pressure from macroeconomic factors like inflation or rising interest rates.

- Asset Utilization: Suboptimal asset efficiency suggests untapped potential in profit generation.

- Technical Indicators: A MACD below the signal line hints at short-term bearish market sentiment.

NHPC Share Price History Chart

NHPC Quarterly Income Report

| Description | Sep 24 | Jun 24 | Mar 24 | Dec23 |

| Revenue + | ₹2922Cr. | ₹2786Cr. | ₹2242Cr. | ₹2318Cr. |

| Expenses + | ₹1689Cr | ₹1513Cr. | ₹1285Cr. | ₹1638Cr. |

| EBITDA | ₹1802Cr | ₹1783Cr. | ₹1333Cr. | ₹1059Cr. |

| EBIT | ₹1531Cr | ₹1502Cr. | ₹1052Cr. | ₹781.18Cr. |

| Net Profit | ₹905.25Cr | ₹1024Cr. | ₹697.76Cr. | ₹546.13Cr. |

| Operating Profit Margin | 71.89% | 76.18% | 90.60% | 63.81% |

| Net Profit Margin | 35.48% | 42.33% | 42.25% | 32.18% |

| Earning Per Share | ₹0.90 | ₹1.02 | ₹0.69 | ₹0.54 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 1.40 |

NHPC Annual Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

|---|---|---|---|---|

| Total Revenue | ₹10994Cr | ₹11285Cr | ₹10108Cr | ₹10711Cr |

| Total Expenses | ₹6350Cr | ₹6028Cr | ₹5679Cr | ₹6138Cr |

| Profit/Loss | ₹3633Cr | ₹4275Cr | ₹4984Cr | ₹3488Cr |

| Net Profit Margin | 41.70% | 40.04% | 41.14% | 37.24% |

| Earning Per Share | ₹3.61 | ₹3.89 | ₹3.51 | ₹3.26 |

| EBITDA | ₹6234 | ₹6941 | ₹6150 | ₹6247 |

| EBIT | ₹5050 | ₹5726 | ₹4960 | ₹4955 |

| Operating Profit Margin | 70.76% | 65.09% | 54.43% | 65.84% |

| Dividends Per share | 1.90 | 1.85 | 1.81 | 1.60 |

Also Read: Tata Steel price target, trust of more than 100 years old company.

NHPC Cash Flow

| Particulars | 2024 | 2023 | 2022 | 2021 |

|---|---|---|---|---|

| Opening Cash Balance | ₹1034Cr. | ₹1316Cr. | ₹447.27Cr. | ₹42.17Cr. |

| Cash Flow From Operating Activities | ₹6938Cr | ₹4705Cr. | ₹4590Cr. | ₹5070Cr. |

| Cash Flow From Investing Activities | ₹-5968Cr | ₹-4191Cr. | ₹-3084Cr. | ₹-1607Cr. |

| Cash Flow From Financing Activities | ₹-581.48Cr | ₹-794.57Cr. | ₹-638.36Cr. | ₹-3058Cr. |

| Closing Cash Balance | ₹1422Cr | ₹134Cr. | ₹1315Cr. | ₹447.27Cr. |

| Net Change In Cash | ₹387.87 | ₹-281.35 | ₹867.40 | ₹405.10 |

NHPC Share Price Target 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹48 | ₹120 |

| 2026 | ₹70 | ₹140 |

| 2028 | ₹120 | ₹213 |

| 2030 | ₹160 | ₹276 |

| 2040 | ₹450 | ₹646 |

| 2050 | ₹736 | ₹1056 |

NHPC Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 67.40% |

| Other Domestic Institution | 5.66% |

| Retail and Others | 13.78% |

| Foreign Institution | 8.78% |

| Mutual Funds | 4.38% |

| Total | 100.00% |

How to Buy NHPC Shares?

Buying and selling of NHPC can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

NHPC Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| SJVN power | ₹38.56KCr. | -5.35% | ₹95.34 | ₹98.75 |

| Reliance Power | ₹15.92KCr. | 39.12% | ₹39.31 | ₹40.54 |

| Transrail lighting | ₹7.47 KCr. | 0.21% | ₹552.90 | ₹576.70 |

| Tata Power | ₹1.16 LCr. | 4.71% | ₹355.10 | ₹365.90 |

| JP Power | ₹11.09KCr | 1.82% | ₹16.08 | ₹16.41 |

| Waaree Renewables | ₹10.59 KCr | 60.90% | ₹960 | ₹1034.95 |

| Rattan Power | ₹6.79 KCr. | 27.04% | ₹12.45 | ₹13.04 |

| Urja Global | ₹846.82 Cr | -11.10% | ₹14.53 | ₹41.65 |

| Adani Power | ₹2.01LCr. | 0.90% | ₹518.70 | ₹537.95 |

| SW Solar | ₹8.31KCr. | -31.86% | ₹354.30 | ₹372.45 |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| TCS | ₹1544LCr | 14.87% | ₹3591.50 | ₹4592.25 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Bharti Airtel | ₹9.66 LCr | 51.59% | ₹1051.60 | ₹1779 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

NHPC remains a cornerstone for conservative investors seeking stability and steady dividends, backed by its dominant market position and resilient cash flows. However, recent profit dips and sector-specific vulnerabilities warrant caution for growth-oriented stakeholders. To sustain long-term relevance, the company must prioritize diversifying revenue streams, enhancing operational efficiency, and reducing leverage. While its strong promoter backing and institutional confidence provide a safety net, NHPC’s ability to adapt to evolving energy policies and technological advancements will determine its future trajectory.

In summary, NHPC offers a balanced proposition—combining reliability with moderate risk—for portfolios favoring steady returns, though agility in addressing sectoral challenges will be critical to unlocking higher growth potential.

Disclaimer– Please note that all the information given here is for general information purpose only and not for investment purposes. Therefore, before investing in any share, take advice from a certified market expert. If you invest, you will be responsible for your profits and losses.

Also Read:

Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Yatra Online shares will make you rich, 100% guarantee.

Den Networks Share Price Target 2024, to 2050

Venus Pipes Share Price Target 2023 to 2050

Q1. What is the NHPC share price target 2025?

Ans: 2025 price target of NHPC will be between Rs.48 to Rs.120.

Q2. What is the NHPC share price target 2030?

Ans: NHPC will trade between Rs160 and Rs 276 in 2030.

Q4. What is the NHPC share price target 2040?

Ans: 2040 price target of NHPC will be between Rs.450 to Rs.646.

Q5. What is the NHPC share price target 2050?

Ans: 2050 price target of NHPC will be between Rs.736 to Rs.1056.