IFCI Share Price Target 2025: This article is going to mainly focus on IFCI Share Price Target 2025, 2026, 2028, 2030, 2040 and 2050. Along with this, we will also discuss the company’s Fundamental, sentiment, Income Report, Share Price history, and Quarterly Report. Our analysis will help investors in taking the right decision.

About IFCI

IFCI is a systemically important non-deposit taking non-banking finance company (NBFC-ND-SI) in the public sector, founded in 1948. It, with six subsidiaries and one associate, supports industrial development by funding projects in sectors such as infrastructure, real estate, manufacturing and services. Major projects funded by IFCI include Adani Mundra Ports, GMR Goa International Airport and Salasar Highway.

IFCI acts as a project management agency (PMA) for production-linked incentive (PLI) schemes under “Atmanirbhar Bharat”, which promotes domestic manufacturing. It also provides financial, ESG and project advisory services to corporates.

Social Impact Initiatives:

- IFCI promotes SC entrepreneurship with a fund of Rs 200 crore for Scheduled Castes (SCs).

- Since 2015, it provides credit guarantees to banks assisting SC entrepreneurs.

IFCI has played a key role in establishing key market intermediaries, consulting firms, educational institutions and skill development centres, supporting India’s industrial and socio-economic development.

IFCI Fundamental

IFCI is a Public Sector Non-Deposit Taking Non-Banking Finance Company (NBFC-ND-SI) It is a small market cap company with ₹17542 crore. The company is listed on both NSE and BSE with the code IFCI and 500106 respectively. The company’s reserves and surplus is ₹-1775.41 crore, reflecting deep accumulated deficit.

IFCI total revenue for FY24 was Rs 2115 crore and net profit was Rs 241.05 crore, registering a growth of 22.39% and 301.24% respectively. The Company’s ROE of 2.14% with limited return on equity and ROCE of 10.2% indicates good operating performance. The Company’s debt to equity ratio (0.86) indicates manageable debt levels.

Also Read: Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

The company’s price-to-earnings (P/E) ratio is 139.83 which is significantly higher than the industry’s P/E of 18.86, which indicates that the company is overvalued. IFCI stock is trading at 2.99 times its book value, indicating a premium valuation. The company has not paid any dividend for the last several years, which makes it less attractive to income-focused investors.

| Description | Value |

|---|---|

| Company Name | IFCI Ltd. |

| Sector | Finance |

| Established | 1948 |

| Website | ifciltd.com |

| Listing At | BSE, NSE |

| BSE Code | 500106 |

| NSE Code | IFCI |

| Mkt Cap | ₹17542Cr |

| Reserves and Surplus | ₹-1775.41Cr |

| ROE | 2.14% |

| ROCE | 10.2% |

| 52 Week High | ₹91.40 |

| 52 Week Low | ₹68.40 |

| P/E Ratio (TTM) | 139.83 |

| Industry P/E | 18.86 |

| P/B Ratio | 2.99 |

| Face Value | 10 |

| Book Value Per Share | ₹22.43 |

| EPS (TTM) | ₹0.48 |

| Dividend Yield | 0.00% |

| Debt to Equity | 0.86 |

| Total Revenue | ₹2115Cr |

| Revenue Growth | 22.39% |

| Net Profit (Anual) | ₹241.05Cr |

| Profit Growth | 301.24% |

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2023 | 111.23% |

| 2022 | -15.08% |

| 2021 | 77.60% |

| 2020 | 38.64% |

| 2019 | -55.85% |

| 2018 | -51.46% |

| 2017 | 13.24% |

| 2016 | -1.45% |

| 2015 | 27.08% |

| 2014 | 47.28% |

| 2013 | -23.28% |

| 2012 | 53.32% |

| 2011 | -67.53% |

| 2010 | -23.71% |

Also Read: Tata Gold Price Target, money printing machine for small investors.

IFCI Price Target 2025

According to market experts, the IFCI share price target 2025 is going to be between Rs 40 to Rs 120.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹40 | ₹120 |

IFCI Share Price Target 2026

According to market experts, the price target of IFCI for 2026 is going to be between Rs70 to Rs 155.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹70 | ₹155 |

Also Read: Venus Pipes Share Price Target 2023 to 2050

IFCI Share Price Target 2028

According to market experts, the price target of IFCI for 2028 is going to be between Rs 140 to Rs 210.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹140 | ₹210 |

IFCI Share Price Target 2030

According to market experts, IFCI Share Price Target 2030 is going to be between Rs 290 to Rs 350.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹290 | ₹350 |

IFCI Share Price Target 2040

According to the past trend of the company, IFCI Share Price Target 2040 is going to be between Rs 960 to Rs 1090.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹960 | ₹1090 |

Also Read: Adani Power price target, share will increase 10 times.

IFCI Share Price Target 2050

According to the past trend of the company, IFCI Share Price Target 2050 is going to be between Rs 1900 to Rs 2100.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹1900 | ₹2100 |

Latest News

IFCI Ltd shares surged 14.7% on Monday, hitting an intraday high of Rs 66.59 on BSE after its board approved the consolidation of IFCI Group companies.

Strengths

- The company’s revenue has increased by 22.39% compared to last year. Which is the highest in the last 4 years.

- The company’s net cash flow and cash from operating activity have increased.

- The company’s annual EPS growth is strong.

- High operating profit margin has remained consistently above 80% in recent quarters.

- The company’s net profit margin remained positive in FY 2024, which stood at 11.38%.

- The company’s debt-to-equity ratio is under control at 0.86.

- The promoters hold 71.72% stake in the company, which ensures management stability.

Risks

- The company’s negative reserves (₹-1,775.41 crore) indicate past financial struggles.

- The company’s P/E ratio of 139.83 is well above the industry average, indicating overvaluation risk.

- The company’s quarterly net profit margin fluctuates widely, raising earnings sustainability concerns.

- The company has reported a decline in the last two quarters.

- The company’s ROE is very low, indicating limited return on equity.

- Its net profit margin has been negative for the last 3 quarters.

- The company has not declared any dividend in recent years, limiting investor returns.

- The company operates in a highly competitive industry.

- The company has been in losses for the last three years except FY 24.

Sentiment

The current sentiment of IFCI is showing strong bullish. It is trading above 7 out of 8 Moving Averages and also trading above 8 out of 9 Oscillators in bullish zone, 0 in bearish zone, and 1 in neutral.

Technical Indicator

According to Investing.com, 9 out of 10 technical indicators are giving buy signal, 0 are giving sell and 1 are giving neutral signal.

| Action | Indicator |

|---|---|

| Buy | 9 |

| Hold | 1 |

| Sell | 0 |

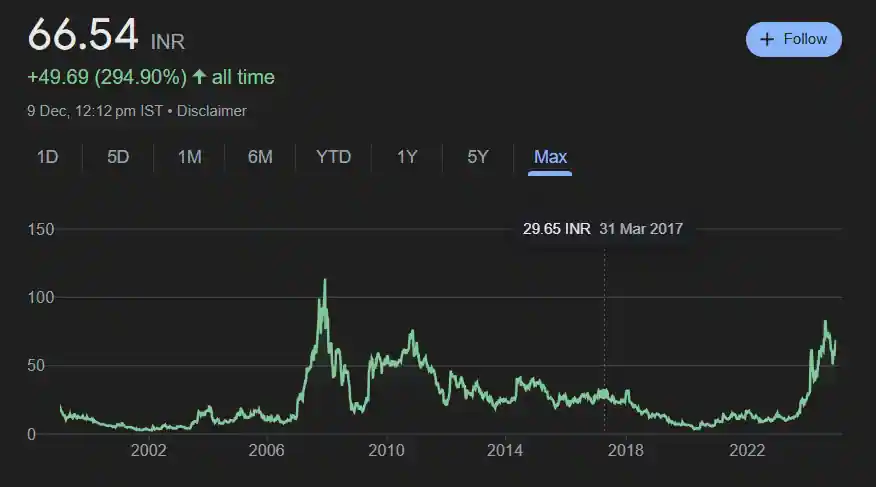

IFCI Share Price History

IFCI was listed on the stock exchange on 26 April 1995. The company had a bumper jump in 2007 and the stock reached the highest price ever. But in the next one year, its stock crashed again. After 2008, the company showed a very good growth trend but since 2010 it has been falling continuously.

The company has shown growth once again from 2020 and has given a return of 895% in the last 5 years. In the last 1 year, 6 months and 1 month, the company has given a return of 147.51%, 10.62% and 9.11% respectively.

Also Read: Tata Steel price target, trust of more than 100 years old company.

IFCI Quarterly Report

| Description | Sep 24 | Jun 24 | Mar 24 | Dec 23 |

| Revenue + | ₹300.63Cr. | ₹123.19Cr. | ₹436.26Cr. | ₹215.70Cr. |

| Expenses + | ₹300Cr | ₹159.22Cr. | ₹107.74Cr. | ₹190.97Cr. |

| EBITDA | ₹6.06Cr | ₹6.05Cr. | ₹6.05Cr. | ₹6.05Cr. |

| EBIT | ₹136.69Cr | ₹98.36Cr. | ₹474.74Cr. | ₹168.54Cr. |

| Net Profit | ₹-21.56Cr | ₹-148.24Cr. | ₹215.51Cr. | ₹-10.06Cr. |

| Operating Profit Margin | 89.37% | 85.32% | 125.57% | 81.30% |

| Net Profit Margin | -13.50% | -121.13% | -4.68% | -% |

| Earning Per Share | ₹-0.08 | ₹-0.57 | ₹0.87 | ₹-0.04 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

IFCI Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

|---|---|---|---|---|

| Total Revenue | ₹2115Cr | ₹1728Cr | ₹1596Cr | ₹2094Cr |

| Total Expenses | ₹1367Cr | ₹1701Cr | ₹3118Cr | ₹4181Cr |

| Profit/Loss | ₹241.05Cr | ₹-119.78Cr | ₹-1761Cr | ₹-1912Cr |

| Net Profit Margin | 11.38% | -6.93% | -110.37% | -91.19% |

| Earning Per Share | ₹0.42 | ₹-0.95 | ₹-8.71 | ₹-10.24 |

| EBITDA | ₹1403 | ₹741.63 | ₹-513.85 | ₹-865.17 |

| EBIT | ₹1322 | ₹667.70 | ₹-580.24 | ₹-937.56 |

| Operating Profit Margin | 66.24% | 42.91% | -32.20% | -41.27% |

| Dividends Per share | 0.00 | 0.00 | 0.00 | 0.00 |

IFCI Cash Flow

| Particulars | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Opening Cash Balance | ₹110.38Cr. | ₹110.38Cr. | ₹112.43Cr. | ₹0.00Cr. |

| Cash Flow From Operating Activities | ₹32.42Cr | ₹32.42Cr. | ₹-483.40Cr. | ₹0.00Cr. |

| Cash Flow From Investing Activities | ₹-0.34Cr | ₹-0.34Cr. | ₹-18.65Cr. | ₹0.00Cr. |

| Cash Flow From Financing Activities | ₹500Cr | ₹500Cr. | ₹500Cr. | ₹0.00Cr. |

| Closing Cash Balance | ₹642.46Cr | ₹642.46Cr. | ₹110.38Cr. | ₹0.00Cr. |

| Net Change In Cash | ₹532.08 | ₹532.08 | ₹-2.05 | ₹0.00 |

IFCI Share Price Target 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2023 | ₹270 | ₹620 |

| 2024 | ₹20 | ₹80 |

| 2025 | ₹40 | ₹120 |

| 2026 | ₹70 | ₹155 |

| 2028 | ₹140 | ₹210 |

| 2030 | ₹290 | ₹350 |

| 2040 | ₹960 | ₹1090 |

| 2050 | ₹1900 | ₹2100 |

Also Read: SW Solar price target, guarantee boom in solar sector.

IFCI Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 71.72% |

| Other Domestic Institutions | 1.56% |

| Retail and Others | 24.06% |

| Foreign Institutions | 2.54% |

| Mutual Funds | 0.011% |

| Total | 100.00% |

How to Buy IFCI Shares?

Buying and selling of IFCI can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

IFCI Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Bharti Airtel | ₹9.86 LCr. | 60.54% | ₹960 | ₹1789 |

| Bharti Hexacom | ₹69.33 KCr. | 69.56% | ₹755 | ₹1568 |

| Railtel Corporation of India | ₹12.80 KCr. | 45.39% | ₹273.75 | ₹617.80 |

| Vodafone Idea | ₹48.61KCr | -36.98% | ₹6.61 | ₹19.18 |

| Nazara Technologies | ₹7.11 KCr | 25.67% | ₹591.50 | ₹1117 |

| Hathway Cable and Datacom | ₹3.23 KCr. | 12.20% | ₹14.82 | ₹27.95 |

| Nelco | ₹2.32 KCr | 38.38% | ₹642.55 | ₹1335 |

IFCI Share Price Target: Export Opinion

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Adani ports | ₹3.11 LCr | 94.78% | ₹703.00 | ₹1,457.05 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Havells India | ₹1.20 LCr | 41.69% | ₹1232.85 | ₹1950.05 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

IFCI has shown significant improvement in the company’s profitability, profitability metrics and operational efficiency. However, its high valuation, negative reserves and unstable profit pose risks. The company has been continuously incurring losses for the last several years, so people are not able to show trust in the company. It can be considered for long term investment. However, investors should keep an eye on future earnings stability and management’s efforts to strengthen financial reserves.

Disclaimer– Please note that all the information given here is for general information purpose only and not for investment purposes. Therefore, before investing in any share, take advice from a certified market expert. If you invest, you will be responsible for your profits and losses.

Also Read:

Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Yatra Online shares will make you rich, 100% guarantee.

Den Networks Share Price Target 2024, to 2050

Venus Pipes Share Price Target 2023 to 2050

Q1. What is the IFCI share price target 2025?

Ans: 2025 price target of IFCI will be between Rs.40 to Rs.120.

Q2. What is the IFCI share price target 2030?

Ans: IFCI will trade between Rs 290 and Rs 320 in 2030.

Q3. What is the IFCI share price target 2024?

Ans: 2024 price target of IFCI will be between Rs.20 to Rs.80.

Q4. What is the IFCI share price target 2040?

Ans: 2040 price target of IFCI will be between Rs.960 to Rs.1090.

Q5. What is the IFCI share price target 2050?

Ans: 2050 price target of IFCI will be between Rs.1900 to Rs.2100.