Franklin Industries Share Price Target 2025: This article is going to mainly focus on Franklin Industries Share Price Target 2024, 2025, 2026, 2028, 2030, 2040 to 2050. Along with this, we will also discuss the company’s Fundamental, sentiment, Income Report, Share Price history, and Quarterly Report. Our analysis will help investors in taking the right decision.

About Franklin Industries

Franklin Industries Limited is a leading provider of contract farming services, promoting sustainable agricultural practices to ensure profitability for both the farmer and the company. It was founded in 1983. The company partners with farmers through contracts, guiding them to cultivate crops such as cucumbers, onions and castor based on market demand. The company also arranges for the sale of crops at the maximum price. Additionally, Franklin Industries leases agricultural land to cultivate these crops directly, ensuring better control, cost efficiency and quality.

By sharing a portion of the produce with contract farmers, the company uplifts local farming communities. Focusing on modern agricultural practices and cutting-edge technology, Franklin Industries ensures high-quality produce that meets global demands while minimising environmental impact.

Franklin Industries Fundamental

Franklin Industries Limited is a leading provider of contract farming services. It is a company with a very small market cap of ₹62 crore. The company is listed on BSE with code 540190. The company has a reserve and surplus of Rs 10.91 crore, which reflects the company’s strong position to fight adverse conditions.

Franklin Industries’ total revenue for FY24 was Rs 50.96 crore and net profit was Rs 10.46 crore, registering an exceptional growth of 148.34% and 4880.95% respectively. The exceptional growth in net profit is possibly due to low base effect. The company’s return on equity (ROE) of 112% and return on capital employed (ROCE) of 120% are exceptionally high, indicating good efficiency in generating returns for shareholders and effective use of capital. The company’s debt-to-equity ratio is 0.00, which indicates that the company is debt free.

Also Read: Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

The company’s P/E ratio of 3.28 is much lower than the industry P/E ratio of 57.25, which indicates low valuation and the P/B ratio of 0.98 is trading close to its book value. The company is not paying any dividend to its shareholders, which means it is reinvesting the dividend for the growth of the company.

| Description | Value |

|---|---|

| Company Name | Franklin Industries Ltd. |

| Sector | Contract Farming |

| Established | 1983 |

| Website | franklinindustries.in |

| Listing At | BSE |

| BSE Code | 540190 |

| Mkt Cap | ₹62Cr |

| Reserves and Surplus | ₹10.91 Cr |

| ROE | 112% |

| ROCE | 120% |

| 52 Week High | ₹4.13 |

| 52 Week Low | ₹1.10 |

| P/E Ratio (TTM) | 3.28 |

| Industry P/E | 57.25 |

| P/B Ratio | 0.98 |

| Face Value | 1 |

| Book Value Per Share | ₹2.18 |

| EPS (TTM) | ₹0.65 |

| Dividend Yield | 0.00% |

| Debt to Equity | 0.00 |

| Total Revenue | ₹50.96Cr |

| Revenue Growth | 148.34% |

| Net Profit (Anual) | ₹10.46Cr |

| Profit Growth | 4880.95% |

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2023 | 318.18% |

| 2022 | -13.16% |

| 2021 | -20.83% |

| 2020 | 23.08% |

| 2019 | -38.10% |

| 2018 | 75.00% |

| 2017 | 33.33% |

| 2016 | -20.17% |

| 2015 | 16.40% |

| 2014 | 95.85% |

| 2013 | 48.58% |

| 2012 | 17.54% |

| 2011 | -24.09% |

| 2010 | -4.19% |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Franklin Industries Share Price Target 2024

The current sentiment of Franklin Industries is showing bullish. the Franklin Industries share price target 2024 is going to be between Rs 1 to Rs 5.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹1 | ₹5 |

Franklin Industries Price Target 2025

According to market experts, the Franklin Industries share price target 2025 is going to be between Rs 2 to Rs 6.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹2 | ₹6 |

Franklin Industries Share Price Target 2026

According to market experts, the price target of Franklin Industries for 2026 is going to be between Rs 5 to Rs 14.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹5 | ₹14 |

Also Read: Venus Pipes Share Price Target 2023 to 2050

Franklin Industries Share Price Target 2028

According to market experts, the price target of Franklin Industries for 2028 is going to be between Rs 13 to Rs 23.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹13 | ₹23 |

Franklin Industries Share Price Target 2030

According to market experts, Franklin Industries Share Price Target 2030 is going to be between Rs 21 to Rs 32.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹21 | ₹32 |

Franklin Industries Share Price Target 2040

According to the past trend of the company, Franklin Industries Share Price Target 2040 is going to be between Rs 120 to Rs 175.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹120 | ₹175 |

Also Read: Adani Power price target, share will increase 10 times.

Franklin Industries Share Price Target 2050

According to the past trend of the company, Franklin Industries Share Price Target 2050 is going to be between Rs 230 to Rs 296.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹230 | ₹296 |

Strengths

- The technical indicator MACD has crossed above the signal line.

- The company is debt-free. The absence of debt improves financial stability and reduces risk.

- High ROE (112%) and ROCE (120%) indicate strong financial performance and efficient capital utilization.

- The company’s price is the highest among short, medium, and long term moving averages.

- The company has recorded excellent revenue growth of 148.34% and exceptional profit growth of 4880.95% in the last year.

- The company’s net cash flow and cash are growing.

- The company’s revenue has been growing continuously for the last 4 years. And its net profit margin has increased unexpectedly in the last 2 years.

- The company’s P/E (3.28) is well below the industry average (57.25), which indicates undervaluation.

- The company has a reserve of ₹10.91 crore which indicates financial stability.

- Face value of ₹1 and rising EPS indicate good returns if growth is sustained.

- The company has shown the highest recovery from its lowest level in last 52 weeks.

Risks

- 99.92% of the company’s shareholding is held by retail investors, leading to a lack of institutional support, which could increase volatility.

- The company has not distributed any dividends, which may discourage income-focused investors.

- Operating in the contract farming sector, the company may be exposed to risks related to climate change, policy regulation and commodity price fluctuations.

- Net profit margin is the lowest at 14.72% in the last 4 quarters.

- As a small-cap company with a market cap of ₹62 crore, Franklin Industries may face high market volatility and low liquidity.

- Exceptional growth in revenues and profits may not be sustainable in the long term, especially if there is no consistent pattern in expense control.

Sentiment

The current sentiment of Franklin Industries is showing bullish. It is trading above 10 out of 12 Moving Averages and also trading below 3 out of 9 Oscillators in bearish zone, 4 in bullish zone, and 2 in neutral.

Technical Indicator

According to Investing.com, 4 out of 11 technical indicators are giving buy signal, 4 are giving sell and 3 are giving neutral signal.

| Action | Indicator |

|---|---|

| Buy | 4 |

| Hold | 3 |

| Sell | 4 |

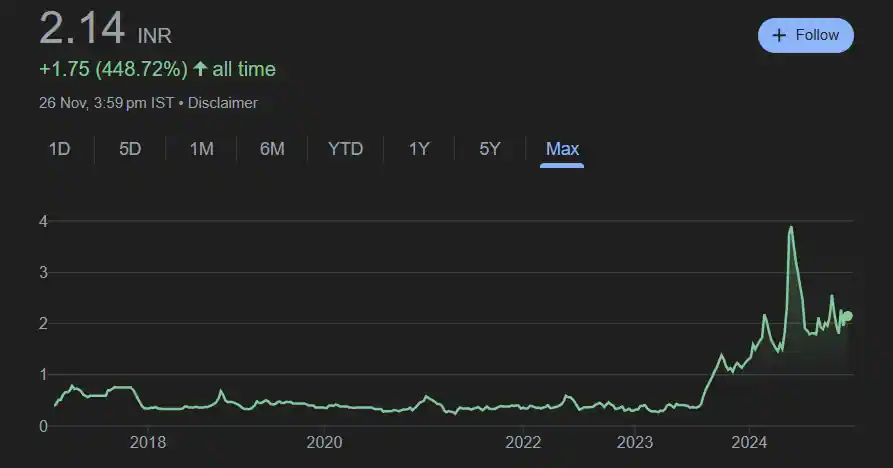

Franklin Industries Share Price History

Franklin Industries was listed on BSE on 24 November 2016 at around Rs 0.39. In the next 2 months, its stock registered a growth of almost 100%. In the next 1 year, the stock fell below the listing price. From 2018 to July 2023, its stock remained constant below the listing price, although it occasionally saw a rise.

Between August 2023 and May 2024, its stock grew 983% to reach Rs 3.90. In the next 5 months, its stock fell 453. In the last 5 months, the company’s stock has grown by 491.67%. In the last 1 year and 6 months, its stock has seen a growth of 76% and -46% respectively.

Also Read: Tata Steel price target, trust of more than 100 years old company.

Franklin Industries Quarterly Report

| Description | Sep 24 | Jun 24 | Mar 24 | Dec 23 |

| Revenue + | ₹27.11Cr. | ₹26.63Cr. | ₹18.36Cr. | ₹16.73Cr. |

| Expenses + | ₹22.88Cr | ₹20.67Cr. | ₹13.53Cr. | ₹12.06Cr. |

| EBITDA | ₹4.24Cr | ₹5.98Cr. | ₹4.84Cr. | ₹4.67Cr. |

| EBIT | ₹4.23Cr | ₹5.97Cr. | ₹4.82Cr. | ₹4.66Cr. |

| Net Profit | ₹3.99 Cr | ₹5.65Cr. | ₹5.66Cr. | ₹3.45Cr. |

| Operating Profit Margin | 15.64% | 22.42% | 26.74% | 27.97% |

| Net Profit Margin | 14.72% | 21.22% | 31.34% | 20.62% |

| Earning Per Share | ₹0.14 | ₹0.98 | ₹1.57 | ₹9.55 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

Franklin Industries Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

|---|---|---|---|---|

| Total Revenue | ₹50.96Cr | ₹20.52Cr | ₹17.08Cr | ₹15.17Cr |

| Total Expenses | ₹39.64Cr | ₹17.68Cr | ₹17.07Cr | ₹15.12Cr |

| Profit/Loss | ₹10.46Cr | ₹0.21Cr | ₹0.01Cr | ₹0.04Cr |

| Net Profit Margin | 20.68% | 10.23% | 0.06% | 0.27% |

| Earning Per Share | 2.89₹ | ₹0.59 | ₹0.02 | ₹0.11 |

| Dividends Per share | 0.00 | 0.00 | 0.00 | 0.00 |

Franklin Industries Share Price Target 2024, 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹1 | ₹5 |

| 2025 | ₹2 | ₹6 |

| 2026 | ₹5 | ₹14 |

| 2028 | ₹13 | ₹23 |

| 2030 | ₹21 | ₹32 |

| 2040 | ₹120 | ₹175 |

| 2050 | ₹230 | ₹296 |

Also Read: SW Solar price target, guarantee boom in solar sector.

Franklin Industries Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Other Domestic Institutions | 0.08% |

| Retail and Others | 99.92% |

| Total | 100.00% |

How to Buy Franklin Industries Shares?

Buying and selling of Franklin Industries can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Godrej Properties | ₹81.35KCr. | 92.24% | ₹1495.30 | ₹3402.70 |

| Phoenix Mills | ₹60.10 KCr. | 96.89% | ₹1652.10 | ₹4137 |

| Prestige Estates Projects | ₹68.92 KCr. | 207.18% | ₹543 | ₹2074.80 |

| Oberoi Realty | ₹6502 KCr | 65.99% | ₹1051.10 | ₹1953.05 |

| Arkade Developers | ₹2470 Cr | -18.02% | ₹119 | ₹128 |

| Macrotech Developers | ₹1.24 LCr. | 78.29% | ₹641.05 | ₹1649.95 |

| IRB INFRA | ₹3032 Cr | 43.49% | ₹34.75 | ₹78.15 |

Franklin Industries Share Price Target: Export Opinion

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Adani ports | ₹3.11 LCr | 94.78% | ₹703.00 | ₹1,457.05 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Havells India | ₹1.20 LCr | 41.69% | ₹1232.85 | ₹1950.05 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

Franklin Industries Limited displays an attractive financial profile with significant growth in revenue and profitability. Its debt-free status, high ROE, and low valuation compared to industry peers demonstrate an attractive investment potential. However, the company’s profit margins are quite volatile and rely heavily on retail investors, which could lead to increased share price volatility.

Overall, Franklin Industries offers promising prospects for growth-oriented investors, but the associated risks require careful consideration.

Disclaimer– Please note that all the information given here is for general information purpose only and not for investment purposes. Therefore, before investing in any share, take advice from a certified market expert. If you invest, you will be responsible for your profits and losses.

Also Read:

Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Yatra Online shares will make you rich, 100% guarantee.

Den Networks Share Price Target 2024, to 2050

Venus Pipes Share Price Target 2023 to 2050

Q1. What is the Franklin Industries share price target 2025?

Ans: 2025 price target of Franklin Industries will be between Rs.2 to Rs.6.

Q2. What is the Franklin Industries share price target 2030?

Ans: Franklin Industries will trade between Rs 21 and Rs 32 in 2030.

Q3. What is the Franklin Industries share price target 2024?

Ans: 2024 price target of Franklin Industries will be between Rs.1 to Rs.5.

Q4. What is the Franklin Industries share price target 2040?

Ans: 2040 price target of Franklin Industries will be between Rs.120 to Rs.175.

Q5. What is the Franklin Industries share price target 2050?

Ans: 2050 price target of Franklin Industries will be between Rs.230 to Rs.296.