Afcons Infrastructure Share Price Target 2025: This article will primarily cover the projected share price targets for Afcons Infrastructure for the years 2024, 2025, 2026, 2028, 2030, and extend to the long-term forecast up to 2040 and 2050. Additionally, we will delve into the company’s fundamentals, market sentiment, income reports, share price history, and quarterly performance. Our comprehensive analysis aims to assist investors in making informed decisions.

About Afcons Infrastructure

Afcons Infrastructure Limited is a leading Indian infrastructure company with over six decades of experience in executing complex and large-scale infrastructure projects. Founded in 1959 and headquartered in Mumbai, it has been part of the Shapoorji Pallonji Group since 2000.

It undertakes engineering, procurement, and construction of projects across maritime infrastructure, railways, bridges, highways, metros, pipelines, ports, barrages, tunnels, and oil and gas. Part of the Shapoorji Pallonji Group, Afcons is known for its technical excellence and innovative engineering solutions. The company has a significant presence in India and internationally, particularly in Africa and the Middle East. Afcons has built landmark projects including metro tunnels, underwater structures, and iconic bridges, and is known for its commitment to quality, safety, and timely delivery.

Afcons Infrastructure Fundamental

Afcons Infrastructure Limited is a leading Indian infrastructure company. It is a small market cap company with ₹18095 crore. The company is listed on both NSE and BSE with the code AFCONS and 544280 respectively. The company has a reserve and surplus of Rs 2734.55 crore, which shows the company’s strong position to fight adverse conditions.

Also Read: Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

The company has annual revenue growth of 6.25%, and net profit growth of 9.46%, which are modest but consistent year-on-year increases. The company has a ROE of 14.37% and ROCE of 22.39%, which show good profitability, indicating the company’s effective use of equity and capital employed. The P/E ratio of 40.23, which is higher than the industry average P/E of 34.65, indicates that it may be slightly overvalued.

The company’s P/B ratio of 3.73, indicates that the stock trades at a premium to its book value, which reflects investor confidence, but may also indicate a rich valuation. Its EPS is 12.23, which indicates stable earnings. The company’s dividend yield is 0.47%, which is low, indicating that the company is reinvesting in the business rather than returning cash to shareholders.

| Description | Value |

|---|---|

| Company Name | Afcons Infrastructure Ltd. |

| Sector | Infrastructure |

| Established | 1959 |

| Website | afcons.com |

| Listing At | BSE, NSE |

| BSE Code | 544280 |

| NSE Code | AFCONS |

| Mkt Cap | ₹18095 Cr |

| Reserves and Surplus | 2734.55 Cr |

| ROE | 14.37% |

| ROCE | 22.39% |

| 52 Week High | ₹513.50 |

| 52 Week Low | ₹420.25 |

| P/E Ratio (TTM) | 40.23 |

| Industry P/E | 34.65 |

| P/B Ratio | 3.73 |

| Face Value | 10 |

| Book Value Per Share | 131.82 |

| EPS (TTM) | 12.23 |

| Dividend Yield | 0.47% |

| Debt to Equity | 0.94 |

| Total Revenue | 13647Cr |

| Revenue Growth | 6.25% |

| Net Profit (Anual) | 449.76Cr |

| Profit Growth | 9.46% |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Afcons Infrastructure Share Price Target 2024

The current sentiment of Afcons Infrastructure is showing buy. he price target of Afcons Infrastructure for 2024 is going to be between Rs 430 to Rs 525.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹430 | ₹525 |

Afcons Infrastructure Price Target 2025

Afcons Infrastructure is India’s leading company in the renewable chemicals, biofuels and bioproducts sector. Its target price range in 2025 is going to be Rs 470 to Rs 590.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹470 | ₹590 |

Afcons Infrastructure Share Price Target 2026

According to market experts, the price target of Afcons Infrastructure for 2026 is going to be between Rs 560 to Rs 610.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹560 | ₹610 |

Also Read: Venus Pipes Share Price Target 2023 to 2050

Afcons Infrastructure Share Price Target 2028

According to market experts, the price target of Afcons Infrastructure for 2028 is going to be between Rs 790 to Rs 890.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹790 | ₹890 |

Afcons Infrastructure Share Price Target 2030

According to market experts, the price target of Afcons Infrastructure for 2030 is going to be between Rs 1170 to Rs 1240.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹1170 | ₹1240 |

Afcons Infrastructure Share Price Target 2040

According to the past trend of the company, the minimum price target of Afcons Infrastructure in 2040 is expected to be RS 2440 and the maximum price target is expected to be RS 2570.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹2440 | ₹2570 |

Also Read: Adani Power price target, share will increase 10 times.

Afcons Infrastructure Share Price Target 2050

According to the past trend of the company, the minimum price target of Afcons Infrastructure in 2050 is expected to be RS 4130 and the maximum price target is expected to be RS 4300.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹4130 | ₹4300 |

Latest News

Afcons Infrastructure shares were listed on NSE and BSE on November 4 at a discount of 7 to 8% at Rs 426 and Rs 430.05 respectively.

Strengths

- With over 60 years of operations, Afcons Infrastructure is an experienced player in the infrastructure sector.

- The company’s ROCE is continuously improving.

- The company’s profit margin has increased along with net profit in the last quarter.

- The debt-to-equity ratio of 0.94 is within acceptable limits.

- The company has reserves and surplus of Rs 2734.55 crore.

- The company’s ROE and ROCE indicate efficient use of capital and strong profitability.

- The company’s annual revenue and profit have been growing steadily, from Rs 9153 Cr to Rs 13285 Cr and from Rs 126 Cr to Rs 442 Cr respectively in the last 4 years.

- The company is using its capital effectively to increase profits.

Risks

- The company is not able to use the shareholders’ funds properly. That is why its ROE has decreased in the last 2 years.

- The company’s P/E ratio of 40.23 is above the industry average, indicating a premium valuation.

- The company is able to offer a dividend yield of only 0.47%, investors seeking regular income may find this stock less attractive.

- The company’s revenue and profit have grown steadily but this growth is low.

- As an infrastructure company, Afcons is exposed to regulatory, political and economic risks that can affect the completion and profitability of large-scale projects.

- The company’s debt level requires caution. Any significant increase can increase financial risk, especially if revenue growth slows down.

Sentiment

The current sentiment of Afcons Infrastructure is showing bullish. It is trading below 0 out of 9 Oscillators in bearish zone.

Public Sentiment

According to Moneycontrol forum the community sentiment is – buy and according to trendlyne the community sentiment is – buy, – sell and – hold.

| Action | Moneycontrol Community | Trendlyne |

|---|---|---|

| Buy | – | – |

| Hold | – | – |

| Sell | – | – |

Technical Indicator

According to Investing.com, 5 out of 7 technical indicators are giving buy signal, 0 are giving sell and 2 are giving neutral signal.

| Action | Rating |

|---|---|

| Buy | 53% |

| Hold | 10% |

| Sell | 37% |

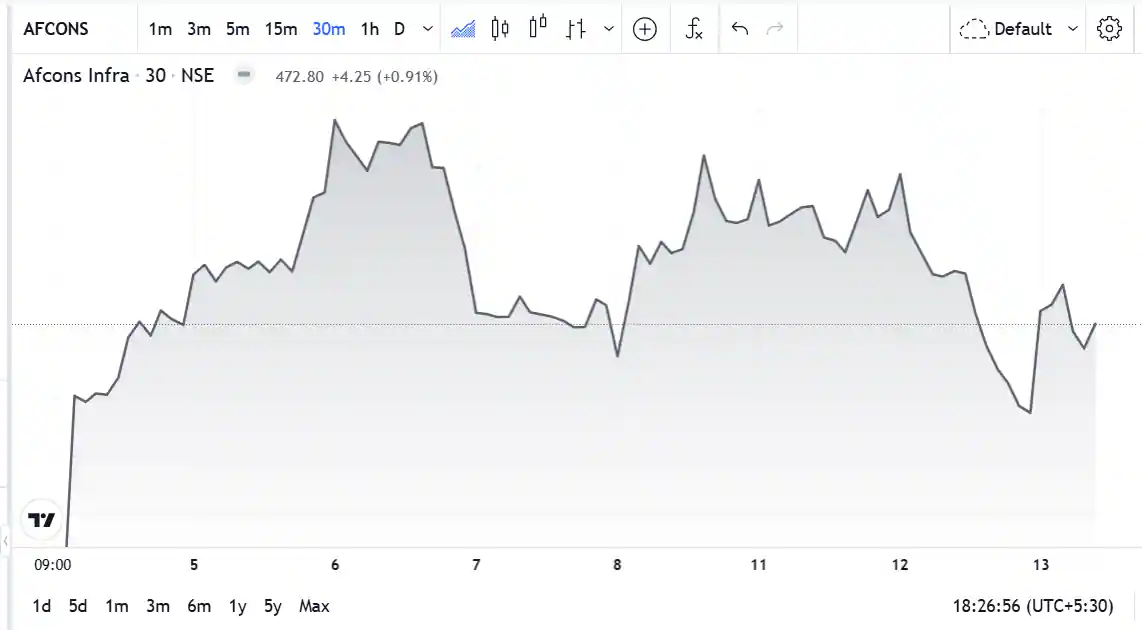

Afcons Infrastructure Share Price History

The issue price of Afcons Infrastructure share was Rs 463, which was listed on NSE and BSE on November 4 at a discount of 7 to 8% at Rs 426 and Rs 430.05 respectively. Its share reached 474.20 with a growth of 11.26% on the very first day. Today, its share has fallen by 0.46% since listing.

Also Read: Tata Steel price target, trust of more than 100 years old company.

Afcons Infrastructure Quarterly Report

| Description | Jun 24 | Jun 23 |

| Revenue + | ₹3213Cr. | ₹3222Cr. |

| Expenses + | ₹3078Cr. | ₹3094Cr. |

| EBITDA | ₹412.58Cr. | ₹354.18Cr. |

| EBIT | ₹282.35Cr. | ₹243.42Cr. |

| Net Profit | ₹91.59Cr. | ₹90.96Cr. |

| Operating Profit Margin | 13.08% | 11.17% |

| Net Profit Margin | 2.90% | 2.87% |

| Earning Per Share | ₹2.68 | ₹10.61 |

| Dividends Per Share | 0.00 | 0.00 |

Afcons Infrastructure Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

|---|---|---|---|---|

| Total Revenue | ₹13285.34Cr | ₹12683.50Cr | ₹10792.51Cr | ₹9153.82Cr |

| Total Expenses | ₹12620.40Cr | ₹12060.48Cr | ₹10509.47Cr | ₹8900.59Cr |

| Profit/Loss | ₹442.12Cr | ₹409.67Cr | ₹259.30Cr | ₹125.93Cr |

Afcons Infrastructure Share Price Target 2024 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹430 | ₹525 |

| 2025 | ₹470 | ₹590 |

| 2026 | ₹560 | ₹610 |

| 2028 | ₹790 | ₹890 |

| 2030 | ₹1170 | ₹1240 |

| 2040 | ₹2440 | ₹2570 |

| 2050 | ₹4130 | ₹4300 |

Also Read: SW Solar price target, guarantee boom in solar sector.

Afcons Infrastructure Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 50.17% |

| Other Domestic Institutions | 7.24% |

| Retail and Others | 28.38% |

| Foreign Institutions | 8.20% |

| Mutual Funds | 6.01% |

| Total | 100.00% |

How to Buy Afcons Infrastructure Shares?

Buying and selling of Afcons Infrastructure can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Godrej Properties | ₹81.35KCr. | 92.24% | ₹1495.30 | ₹3402.70 |

| Phoenix Mills | ₹60.10 KCr. | 96.89% | ₹1652.10 | ₹4137 |

| Prestige Estates Projects | ₹68.92 KCr. | 207.18% | ₹543 | ₹2074.80 |

| Oberoi Realty | ₹6502 KCr | 65.99% | ₹1051.10 | ₹1953.05 |

| Arkade Developers | ₹2470 Cr | -18.02% | ₹119 | ₹128 |

| Macrotech Developers | ₹1.24 LCr. | 78.29% | ₹641.05 | ₹1649.95 |

| IRB INFRA | ₹3032 Cr | 43.49% | ₹34.75 | ₹78.15 |

Afcons Infrastructure Share Price Target: Export Opinion

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Adani ports | ₹3.11 LCr | 94.78% | ₹703.00 | ₹1,457.05 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Havells India | ₹1.20 LCr | 41.69% | ₹1232.85 | ₹1950.05 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

Afcons Infrastructure Limited exhibits strong fundamentals with moderate growth, a good profitability profile, and manageable debt. However, it faces valuation-related risks and sector-specific challenges that could impact the long-term investor. The company appears well-positioned for continued stability, although future performance will depend on effective debt management and continued margin improvement.

Disclaimer– Please note that all the information given here is for general information purpose only and not for investment purposes. Therefore, before investing in any share, take advice from a certified market expert. If you invest, you will be responsible for your profits and losses.

Also Read:

Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Yatra Online shares will make you rich, 100% guarantee.

Den Networks Share Price Target 2024, to 2050

Venus Pipes Share Price Target 2023 to 2050

Q1. What is the Afcons Infrastructure share price target 2025?

Ans: 2025 price target of Afcons Infrastructure will be between Rs.470 to Rs.590.

Q2. What is the Afcons Infrastructure share price target 2030?

Ans: Afcons Infrastructure will trade between Rs 370 and Rs 1170 in 1240.

Q3. What is the Afcons Infrastructure share price target 2024?

Ans: 2024 price target of Afcons Infrastructure will be between Rs.430 to Rs.525.

Q4. What is the Afcons Infrastructure share price target 2040?

Ans: 2040 price target of Afcons Infrastructure will be between Rs.2440 to Rs.2570.

Q5. What is the Afcons Infrastructure share price target 2050?

Ans: 2050 price target of Afcons Infrastructure will be between Rs.4130 to Rs.4300.