Hyundai Motor India Share Price Target 2025: This article is going to mainly focus on Hyundai Motor India Share Price Target 2024, 2025, 2026, 2028, 2030, 2040 to 2050. Along with this, we will also discuss the company’s Fundamental, sentiment, Income Report, Share Price history, and Quarterly Report. Our analysis will help investors in taking the right decision.

About Hyundai Motor India

Hyundai Motor India, a subsidiary of South Korean automotive giant Hyundai Motor, is one of the largest car manufacturers in India. Founded in 1996, it has rapidly become a major player in the Indian automotive market, known for producing high-quality, reliable vehicles across a variety of segments. Hyundai’s Indian portfolio includes popular models such as the Hyundai i20, Creta, and Verna, which cater to diverse consumer needs ranging from compact hatchbacks to premium SUVs.

The company operates a state-of-the-art manufacturing facility in Sriperumbudur, Tamil Nadu, with a significant focus on quality, innovation, and eco-friendly technologies. Hyundai Motor India also invests in electric vehicle infrastructure and has introduced models such as the Kona Electric to support sustainable mobility. Additionally, Hyundai is committed to enhancing customer experience through an extensive sales and service network, making it one of India’s most trusted automotive brands.

Hyundai Motor India Fundamental

Hyundai Motor India is a second largest automobile company in India. It is a large market cap company with ₹1.46 lakh crore. The company is listed on both NSE and BSE with the code HYUNDAI and 544274 respectively. The company has a reserve and surplus of Rs 9853.12 crore, which shows the company’s strong position to fight adverse conditions

Also Read: Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

The company has shown a revenue growth of 16.06% and profit growth of 28.68% in the last financial year and this has been continuing for the last several years. Hyundai Motor India has a return on equity (ROE) of 39.4%, and a return on capital employed (ROCE) of 51.2%, which indicate efficient use of equity and capital. Its P/E ratio (TTM) is 24.19, slightly above the industry average P/E of 22.43, indicating premium valuation due to Hyundai’s growth prospects.

The company’s price-to-book (P/B) ratio is 13.75, which indicates that the stock is trading at a significant premium to its book value, which is common for companies with high profitability and growth potential. Its earnings per share (TTM) is ₹74.58, which indicates strong earnings per share potential. However, the company is focusing on reinvesting earnings for growth rather than paying dividends.

| Description | Value |

|---|---|

| Company Name | Hyundai Motor India Ltd. |

| Sector | Automobile |

| Established | 1996 |

| Website | hyundai.com |

| Listing At | BSE, NSE |

| BSE Code | 544274 |

| NSE Code | HYUNDAI |

| Mkt Cap | ₹1.46 lCr |

| Reserves and Surplus | 9853.12 Cr |

| ROE | 39.4% |

| ROCE | 51.2% |

| 52 Week High | ₹1970 |

| 52 Week Low | ₹1714 |

| P/E Ratio (TTM) | 24.19 |

| Industry P/E | 22.43 |

| P/B Ratio | 13.75 |

| Face Value | 10 |

| Book Value Per Share | 131.26 |

| EPS (TTM) | 74.58 |

| Dividend Yield | 0.00% |

| Debt to Equity | 0.08 |

| Total Revenue | 71302Cr |

| Revenue Growth | 16.06% |

| Net Profit (Anual) | 6060Cr |

| Profit Growth | 28.68% |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Hyundai Motor India Share Price Target 2024

The current sentiment of Hyundai Motor India is showing buy. The price target of Hyundai Motor India for 2024 is going to be between Rs 1700 to Rs 2000.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹1700 | ₹2000 |

Hyundai Motor India Price Target 2025

According to market experts, the price target of Hyundai Motor India for 2025 is going to be between Rs 1900 to Rs 2400.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹1900 | ₹2400 |

Hyundai Motor India Share Price Target 2026

According to market experts, the price target of Hyundai Motor India for 2026 is going to be between Rs 2200 to Rs 2900.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹2200 | ₹2900 |

Also Read: Venus Pipes Share Price Target 2023 to 2050

Hyundai Motor India Share Price Target 2028

According to market experts, the price target of Hyundai Motor India for 2028 is going to be between Rs 3260 to Rs 3950.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹3260 | ₹3950 |

Hyundai Motor India Share Price Target 2030

According to market experts, the price target of Hyundai Motor India for 2030 is going to be between Rs 4740 to Rs 5140.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹4740 | ₹5140 |

Hyundai Motor India Share Price Target 2040

According to the past trend of the company, the minimum price target of Hyundai Motor India in 2040 is expected to be RS 9100 and the maximum price target is expected to be RS 9770.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹9100 | ₹9700 |

Also Read: Adani Power price target, share will increase 10 times.

Hyundai Motor India Share Price Target 2050

According to the past trend of the company, the minimum price target of Hyundai Motor India in 2050 is expected to be RS 16000 and the maximum price target is expected to be RS 17000.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹16000 | ₹17000 |

Latest News

- Hyundai Motor India shares were listed on NSE and BSE on November 22 at a discount of 3.47 to 3.32% at Rs 1934 and Rs 1931 respectively.

- Hyundai India’s net profit fell 16% to Rs 1375 crore in the second quarter of this financial year.

- The company has recorded the highest monthly sales for the third time this October since its inception. Sales have increased by 2% to 70078 units from 68728 units in October last year.

- The company’s exports have increased 6.7% to 14510 units from 13600 units in October last year.

Strengths

- The company has high ROE and ROCE which reflect efficient use of resources and high profitability, which attracts investors.

- The company is almost debt free, with a debt-to-equity ratio of 0.08 indicating minimal dependence on debt, thereby reducing risk from interest expense and financial leverage.

- The company has high ROE and ROCE which reflect efficient use of resources and high profitability, which attracts investors.

- The company is using its capital effectively, which has led to an increase in its ROCE for the last 2 years.

- The company is using shareholders’ funds effectively, which has led to an increase in its ROE.

- Hyundai has shown a consistent upward trend in revenue and profit growth, which indicates a strong business model and effective management.

- The promoters hold 82.5% stake, which reflects strong confidence and stability in the management structure.

- With a market capitalization of ₹1.46 lakh crore, Hyundai holds a strong position in the automobile sector, which helps it attract institutional investors.

Risks

- A higher-than-industry average P/E ratio and a high P/B ratio could pose risks if earnings do not meet market expectations.

- The company’s net cash flow is declining, indicating that the company is unable to generate net cash.

- Quarterly reports show declining profits with declining net profit margins, indicating pressure on profitability.

- The company’s revenue and profit have been declining for the past several quarters.

- The company has failed to pay dividends which may discourage income-focused investors.

- Being part of the automobile industry, Hyundai is sensitive to market cycles, regulatory changes, and fluctuations in consumer demand, which can impact revenue and profit margins.

- A large portion of the company’s shares (7.36%) are held by foreign institutions, which could pose risks due to global economic factors.

Sentiment

The current sentiment of Hyundai Motor India is showing strong bull. It is trading below 5 out of 12 Moving Averages and also trading below 1 out of 9 Oscillators in bearish zone.

Public Sentiment

According to Moneycontrol forum the community sentiment is – buy and according to trendlyne the community sentiment is – buy, – sell and – hold.

| Action | Moneycontrol Community | Trendlyne |

|---|---|---|

| Buy | – | – |

| Hold | – | – |

| Sell | – | – |

Technical Indicator

According to Investing.com, 6 out of 10 technical indicators are giving buy signal, 3 are giving sell and 1 are giving neutral signal.

| Action | Indicator |

|---|---|

| Buy | 6 |

| Hold | 1 |

| Sell | 3 |

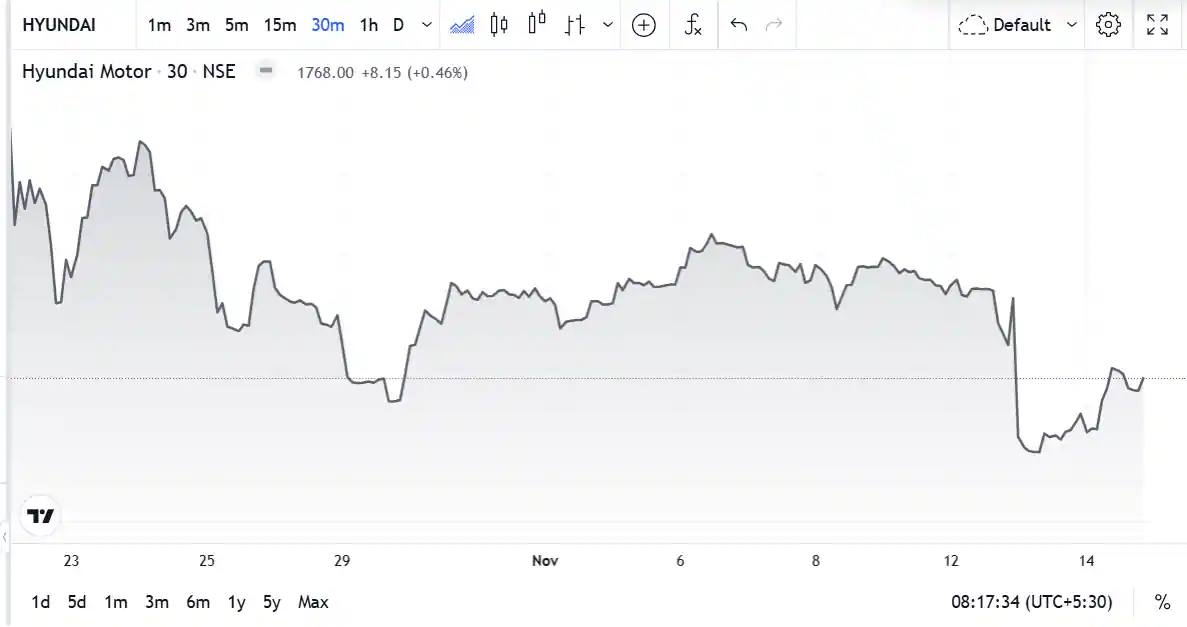

Hyundai Motor India Share Price History

The issue price of Hyundai Motor share was Rs 1960, which was listed on NSE and BSE on October 22 at a discount of 1.3% at Rs 1934 and Rs 1931 respectively. On the first day, its stock fell by 5% and on the second day it saw a rise of 4%. After listing, it has fallen to the lowest price of Rs 1714. In the last one month, its stock has fallen by 3.11%. Today its stock is trading at Rs 1763.05.

Also Read: Tata Steel price target, trust of more than 100 years old company.

Hyundai Motor Quarterly Report

| Description | Sep 24 | Jun 24 | Sep 23 |

| Revenue + | ₹17078 Cr. | ₹17178Cr. | ₹18788Cr. |

| Expenses + | ₹15278 Cr | ₹15231Cr. | ₹16591Cr. |

| EBITDA | ₹2340 Cr | ₹2500Cr. | ₹2779Cr. |

| EBIT | ₹1829 Cr | ₹1979Cr. | ₹2231Cr. |

| Net Profit | ₹1338 Cr | ₹1448Cr. | ₹1602Cr. |

| Operating Profit Margin | 13.87% | 14.73% | 15.09% |

| Net Profit Margin | 7.93% | 8.53% | 8.70% |

| Earning Per Share | ₹16.46 | ₹17.82 | ₹1972 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 |

Hyundai Motor Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

|---|---|---|---|---|

| Total Revenue | ₹71302Cr | ₹61437Cr | ₹47966Cr | ₹41405Cr |

| Total Expenses | ₹63062Cr | ₹55091Cr | ₹44194Cr | ₹38864Cr |

| Profit/Loss | ₹6060Cr | ₹4709Cr | ₹2902Cr | ₹1881Cr |

Hyundai Motor India Share Price Target 2024 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹1700 | ₹2000 |

| 2025 | ₹1900 | ₹2400 |

| 2026 | ₹2200 | ₹2900 |

| 2028 | ₹3260 | ₹3950 |

| 2030 | ₹4740 | ₹5140 |

| 2040 | ₹9100 | ₹9700 |

| 2050 | ₹16000 | ₹17000 |

Also Read: SW Solar price target, guarantee boom in solar sector.

Hyundai Motor Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 82.50% |

| Other Domestic Institutions | 1.94% |

| Retail and Others | 4.37% |

| Foreign Institutions | 7.36% |

| Mutual Funds | 3.83% |

| Total | 100.00% |

How to Buy Hyundai Motor India Shares?

Buying and selling of Hyundai Motor India can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Godrej Properties | ₹81.35KCr. | 92.24% | ₹1495.30 | ₹3402.70 |

| Phoenix Mills | ₹60.10 KCr. | 96.89% | ₹1652.10 | ₹4137 |

| Prestige Estates Projects | ₹68.92 KCr. | 207.18% | ₹543 | ₹2074.80 |

| Oberoi Realty | ₹6502 KCr | 65.99% | ₹1051.10 | ₹1953.05 |

| Arkade Developers | ₹2470 Cr | -18.02% | ₹119 | ₹128 |

| Macrotech Developers | ₹1.24 LCr. | 78.29% | ₹641.05 | ₹1649.95 |

| IRB INFRA | ₹3032 Cr | 43.49% | ₹34.75 | ₹78.15 |

Hyundai Motor India Share Price Target: Export Opinion

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Adani ports | ₹3.11 LCr | 94.78% | ₹703.00 | ₹1,457.05 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Havells India | ₹1.20 LCr | 41.69% | ₹1232.85 | ₹1950.05 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

Hyundai Motor India Limited exhibits strong fundamentals and profitability, with controlled risks mainly related to valuation and market dependence. The company is growing steadily, but investors should monitor it for changes in profit margins and valuation. However, the company is currently unable to pay any dividend which may not appeal to income-focused investors. The company can give investors good returns in the long term.

Disclaimer– Please note that all the information given here is for general information purpose only and not for investment purposes. Therefore, before investing in any share, take advice from a certified market expert. If you invest, you will be responsible for your profits and losses.

Also Read:

Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Yatra Online shares will make you rich, 100% guarantee.

Den Networks Share Price Target 2024, to 2050

Venus Pipes Share Price Target 2023 to 2050

Q1. What is the Hyundai Motor India share price target 2025?

Ans: 2025 price target of Hyundai Motor India will be between Rs.1700 to Rs.2000.

Q2. What is the Hyundai Motor India share price target 2030?

Ans: Hyundai Motor India will trade between Rs 4740 and Rs 5140 in 2030.

Q3. What is the Hyundai Motor India share price target 2024?

Ans: 2024 price target of Hyundai Motor India will be between Rs.1700 to Rs.2000.

Q4. What is the Hyundai Motor India share price target 2040?

Ans: 2040 price target of Hyundai Motor India will be between Rs.9100 to Rs.9700.

Q5. What is the Hyundai Motor India share price target 2050?

Ans: 2050 price target of Hyundai Motor India will be between Rs.16000 to Rs.17000.