Tata Teleservices Share Price Target 2025: This article is going to mainly focus on Tata Teleservices Share Price Target 2024, 2025, 2026, 2028, 2030, 2040 and 2050. Along with this, we will also discuss the company’s Fundamental, sentiment, Income Report, Share Price history, and Quarterly Report. Our analysis will help investors in taking the right decision.

About Tata Teleservices

Tata Teleservices (Maharashtra) Limited (TTML) is a trusted name in business connectivity founded in 1996 under the parent organization Tata Group.

Tata Teleservices (Maharashtra) Limited (TTML) is a leading provider of communications and connectivity solutions in India, operating under the brand name Tata Tele Business Services (TTBS). Targeted primarily at enterprise customers, TTML offers a comprehensive portfolio of ICT services including connectivity, collaboration, cloud, security, IoT and marketing solutions.

TTBS differentiates itself by offering integrated telecommunications solutions beyond basic connectivity to its customers, providing flexible, scalable and secure managed services to businesses. By focusing on the needs of small and medium businesses (SMBs), TTML establishes itself as a trusted technology partner, helping enterprises ensure resilience and business continuity.

With a commitment to understanding unique customer needs, TTML aims to empower its customers with innovative solutions that enhance competitiveness and help them “go big”. This customer-centric approach has earned TTML a reputation as one of the most reliable telecom service providers in the industry.

Tata Teleservices Fundamental

Tata Teleservices operates in the telecommunications sector, providing various telecommunications and enterprise services since 1996. Despite being backed by the Tata Group, the company’s financial position is posing notable challenges. It is a small market cap company with ₹15403 crore. The company is listed on both NSE and BSE with the code TTML and 532371 respectively. The company’s reserves and surplus is ₹-28169.59 crore, reflecting deep accumulated deficit.

Tata Teleservices Total Revenue stood at ₹1208 crore (FY24), showing limited growth (CAGR ~3.2% from FY21). The company’s total expenses are twice its revenue due to which net loss continues, the company has incurred a loss of ₹-1228 crore in FY24. However, ROE (6.68%), and ROCE (47.9%) highlight efficient capital utilization but indicate negative equity impact.

Also Read: Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

The company’s net profit margin is -103.09% (negative) and operating margin is healthy at ~45.62%, which indicates controlled operating efficiency, but debt and interest costs significantly reduce profitability.

Tata Teleservices’ P/E ratio (TTM) (-12.12) is negative which indicates no profitability and high dependence on debt despite negative equity. The book value per share is ₹-97.26, indicating a substantial reduction in shareholder equity. It is not giving any direct returns to shareholders.

| Description | Value |

|---|---|

| Company Name | Tata teleservices Ltd. |

| Sector | Telecom |

| Established | 1996 |

| Website | tatatelebusiness.com |

| Listing At | BSE, NSE |

| BSE Code | 532371 |

| NSE Code | TTML |

| Mkt Cap | ₹15403Cr |

| Reserves and Surplus | ₹-28169.59Cr |

| ROE | 6.68% |

| ROCE | 47.9% |

| 52 Week High | ₹111.40 |

| 52 Week Low | ₹65.05 |

| P/E Ratio (TTM) | -12.12 |

| Industry P/E | 113.78 |

| P/B Ratio | 0.00 |

| Face Value | 10 |

| Book Value Per Share | ₹-97.26 |

| EPS (TTM) | ₹-6.50 |

| Dividend Yield | 0.00% |

| Debt to Equity | -1.04 |

| Total Revenue | ₹1208Cr |

| Revenue Growth | -7.57% |

| Net Profit (Anual) | ₹-1228Cr |

| Profit Growth | -7.25% |

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2023 | -1.19% |

| 2022 | -55.05% |

| 2021 | 2495.60% |

| 2020 | 261.36% |

| 2019 | -45% |

| 2018 | -43.26% |

| 2017 | 17.50% |

| 2016 | -26.83% |

| 2015 | 7.89% |

| 2014 | 2.7% |

| 2013 | -29.66% |

| 2012 | 0.48% |

| 2011 | -38.66% |

| 2010 | -27.49% |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Tata Teleservices Share Price Target 2023

The current sentiment of Tata Teleservices is showing sell. the Tata Teleservices share price target 2023 is going to be between Rs 270 to Rs 620.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2023 | ₹270 | ₹620 |

Tata Teleservices Share Price Target 2024

The current sentiment of Tata Teleservices is showing bearish. the Tata Teleservices share price target 2024 is going to be between Rs 600 to Rs 980.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹45 | ₹120 |

Tata Teleservices Price Target 2025

According to market experts, the Tata Teleservices share price target 2025 is going to be between Rs 850 to Rs 1280.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹60 | ₹140 |

Tata Teleservices Share Price Target 2026

According to market experts, the price target of Tata Teleservices for 2026 is going to be between Rs 1200 to Rs 1530.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹96 | ₹186 |

Also Read: Venus Pipes Share Price Target 2023 to 2050

Tata Teleservices Share Price Target 2028

According to market experts, the price target of Tata Teleservices for 2028 is going to be between Rs 1760 to Rs 2200.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹195 | ₹266 |

Tata Teleservices Share Price Target 2030

According to market experts, Tata Teleservices Share Price Target 2030 is going to be between Rs 2300 to Rs 2800.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹320 | ₹398 |

Tata Teleservices Share Price Target 2040

According to the past trend of the company, Tata Teleservices Share Price Target 2040 is going to be between Rs 500 to Rs 6200.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹728 | ₹830 |

Also Read: Adani Power price target, share will increase 10 times.

Tata Teleservices Share Price Target 2050

According to the past trend of the company, Tata Teleservices Share Price Target 2050 is going to be between Rs 11000 to Rs 11900.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹1150 | ₹1280 |

Latest News

Shares of telecom companies like Vodafone Idea and Tata Teleservices surged up to 18.6% after the Union Cabinet approved bank guarantee relief for spectrum dues. Vodafone Idea emerged as the biggest beneficiary, with its shares jumping 18.6% to Rs 8.28. The decision offers significant relief to the telecom sector, boosting investor confidence.

Strengths

- 74.36% of Tata Teleservices shares are held by promoters, which has increased investor confidence.

- The company’s revenue has increased from ₹296.76 crores to ₹345.03 crores in the last 4 quarters.

- The company’s operating profit margin remains strong (~40-48%).

- Positive operating cash flow despite losses indicates stable operating capacity.

- Operating cash flow is the highest in the last 5 years at ₹558.08 crores.

- Investors have confidence due to the company being a part of the Tata Group.

- The telecom sector is set for expansion due to digitalization and 5G adoption.

Risks

- Substantial negative reserves and high debt make financial stability uncertain.

- The company’s net profit margin has remained negative for the past several years.

- With negative profit margins and negative EPS (TTM), the company has not shown any profitability for the past several years.

- The company’s expens has been twice the revenue for the past several years.

- Negative book value and a P/E ratio much lower than the industry P/E (113.78) indicate challenges in keeping pace with industry performance.

- The company is also not paying any dividend to its investors.

- Retailers and others hold ~23.16% stake, indicating limited investor interest apart from the promoters.

- The company is paying more interest than earnings.

Sentiment

The current sentiment of Tata Teleservices is showing strong bullish. It is trading above 5 out of 8 Moving Averages and also trading above 5 out of 9 Oscillators in bullish zone, 2 in bearish zone, and 2 in neutral.

Technical Indicator

According to Investing.com, 7 out of 10 technical indicators are giving buy signal, 1 are giving sell and 2 are giving neutral signal.

| Action | Indicator |

|---|---|

| Buy | 7 |

| Hold | 2 |

| Sell | 1 |

Tata Teleservices Share Price History

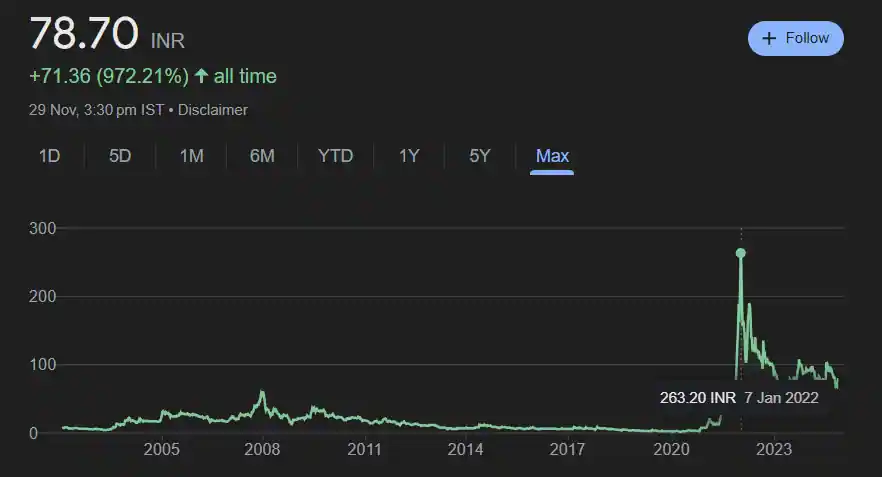

Tata Teleservices was listed on the Indian Stock Exchange NSE and BSE on 20 October 2000; after listing, the company’s stock declined for the next three years, although its stock started rising from 2003 onwards and in January 2008, its stock reached Rs 60.87 with a return of 1249%. After this, its stock kept falling and fell to Rs 2.75 in October 2020, from the very next day its stock saw a bumper jump and by 7 January 2022, its stock reached Rs 263.20 with a growth of 9471%.

Between 7 January and 4 March, its stock fell by 61%, after many ups and downs, today its stock is trading at Rs 78.70. In the last 5 years, the company has given a return of 2761% to its investors. However, in the last 1 year, 6 months and 1 month, the company has shown growth of -16.37%, 4.58% and 8.99% respectively.

Also Read: Tata Steel price target, trust of more than 100 years old company.

Tata Teleservices Quarterly Report

| Description | Sep 24 | Jun 24 | Mar 24 | Dec 23 |

| Revenue + | ₹345.03Cr. | ₹327.17Cr. | ₹324.90Cr. | ₹296.76Cr. |

| Expenses + | ₹675.42Cr | ₹650.57Cr. | ₹634.24Cr. | ₹606.45Cr. |

| EBITDA | ₹139.99Cr | ₹140.38Cr. | ₹144.12Cr. | ₹141.32Cr. |

| EBIT | ₹98.18Cr | ₹99.50Cr. | ₹104.74Cr. | ₹103.04Cr. |

| Net Profit | ₹-330.39Cr | ₹-323.40Cr. | ₹-309.34Cr. | ₹-307.69Cr. |

| Operating Profit Margin | 40.75% | 43.39% | 44.58% | 47.74% |

| Net Profit Margin | -96.18% | -100.44% | -96.17% | -103.94% |

| Earning Per Share | ₹-1.69 | ₹-1.65 | ₹-1.58 | ₹-1.57 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

Tata Teleservices Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

|---|---|---|---|---|

| Total Revenue | ₹1208Cr | ₹1123Cr | ₹1111Cr | ₹1068Cr |

| Total Expenses | ₹2436Cr | ₹2262Cr | ₹2326Cr | ₹2285Cr |

| Profit/Loss | ₹-1228Cr | ₹-1145Cr | ₹-1215Cr | ₹-1997Cr |

| Net Profit Margin | -103.09% | -103.48% | -111.08% | -116.86% |

| Earning Per Share | ₹-6.28 | ₹-5.86 | ₹-6.22 | ₹-10.21 |

| EBITDA | ₹543.50 | ₹503.99 | ₹484.55 | ₹-266.82 |

| EBIT | ₹393.14 | ₹356.83 | ₹324.34 | ₹-435.55 |

| Operating Profit Margin | 45.62% | 45.56% | 44.30% | 48.89% |

| Dividends Per share | 0.00 | 0.00 | 0.00 | 0.00 |

Tata Teleservices Cash Flow

| Particulars | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Opening Cash Balance | ₹16.70Cr. | ₹43.01Cr. | ₹84.53Cr. | ₹171.13Cr. |

| Cash Flow From Operating Activities | ₹558.08Cr | ₹530.08Cr. | ₹567.22Cr. | ₹-359.72Cr. |

| Cash Flow From Investing Activities | ₹-66.20Cr | ₹-129.52Cr. | ₹-176.52Cr. | ₹510.12Cr. |

| Cash Flow From Financing Activities | ₹-494.37Cr | ₹-426.87Cr. | ₹-432.22Cr. | ₹-237Cr. |

| Closing Cash Balance | ₹14.21Cr | ₹16.70Cr. | ₹43.01Cr. | ₹84.53Cr. |

| Net Change In Cash | ₹-2.49 | ₹-26.31 | ₹-41.52 | ₹-86.60 |

Tata Teleservices Share Price Target 2024, 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2023 | ₹270 | ₹620 |

| 2024 | ₹45 | ₹120 |

| 2025 | ₹60 | ₹140 |

| 2026 | ₹96 | ₹186 |

| 2028 | ₹195 | ₹266 |

| 2030 | ₹320 | ₹398 |

| 2040 | ₹728 | ₹830 |

| 2050 | ₹1150 | ₹1280 |

Also Read: SW Solar price target, guarantee boom in solar sector.

Tata Teleservices Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 74.36% |

| Other Domestic Institutions | 0.01% |

| Retail and Others | 23.16% |

| Foreign Institutions | 2.39% |

| Mutual Funds | 0.08% |

| Total | 100.00% |

How to Buy Tata Teleservices Shares?

Buying and selling of Tata Teleservices can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Bharti Airtel | ₹9.86 LCr. | 60.54% | ₹960 | ₹1789 |

| Bharti Hexacom | ₹69.33 KCr. | 69.56% | ₹755 | ₹1568 |

| Railtel Corporation of India | ₹12.80 KCr. | 45.39% | ₹273.75 | ₹617.80 |

| Vodafone Idea | ₹48.61KCr | -36.98% | ₹6.61 | ₹19.18 |

| Nazara Technologies | ₹7.11 KCr | 25.67% | ₹591.50 | ₹1117 |

| Hathway Cable and Datacom | ₹3.23 KCr. | 12.20% | ₹14.82 | ₹27.95 |

| Nelco | ₹2.32 KCr | 38.38% | ₹642.55 | ₹1335 |

Tata Teleservices Share Price Target: Export Opinion

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Adani ports | ₹3.11 LCr | 94.78% | ₹703.00 | ₹1,457.05 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Havells India | ₹1.20 LCr | 41.69% | ₹1232.85 | ₹1950.05 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

Tata Teleservices Limited has been showing consistent revenue growth, operational efficiency and strong ability to generate cash flows, which is a testament to the company’s operational strength. However, the company continues to be in losses due to high interest payouts.

Financial instability remains a significant risk due to the company’s high debt, persistent losses and weak shareholder returns. Strong promoter support and sector potential point to a promising long-term outlook. Investors should continue to closely monitor debt reduction strategies and revenue growth trends.

Disclaimer– Please note that all the information given here is for general information purpose only and not for investment purposes. Therefore, before investing in any share, take advice from a certified market expert. If you invest, you will be responsible for your profits and losses.

Also Read:

Then don’t say that I didn’t tell you, buy Waaree Energies shares right now.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Yatra Online shares will make you rich, 100% guarantee.

Den Networks Share Price Target 2024, to 2050

Venus Pipes Share Price Target 2023 to 2050

Q1. What is the Tata Teleservices share price target 2025?

Ans: 2025 price target of Tata Teleservices will be between Rs.60 to Rs.140.

Q2. What is the Tata Teleservices share price target 2030?

Ans: Tata Teleservices will trade between Rs 320 and Rs398 in 2030.

Q3. What is the Tata Teleservices share price target 2024?

Ans: 2024 price target of Tata Teleservices will be between Rs.45 to Rs.120.

Q4. What is the Tata Teleservices share price target 2040?

Ans: 2040 price target of Tata Teleservices will be between Rs.728 to Rs.830.

Q5. What is the Tata Teleservices share price target 2050?

Ans: 2050 price target of Tata Teleservices will be between Rs.1150 to Rs.1280.