Today in this article we will discuss in detail Tata Power Share Price Target 2025, 2026, 2028, 2030, 2040 and 2050. Before setting the share price target of the company, we will also discuss in detail the share price history, fundamental, technical indicators of the company.

Long term investors should do all the above analysis before investing their money. So that the investor can get profit in future.

What is Tata Power

Tata Power is a part of the Indian multinational business Tata Group. It is an integrated power company whose main business is Generation, Transmission and Distribution of electricity. The company has a diversified portfolio of 14,707MW of which 40% is clean energy generation. Presently the company is engaged in power generation in fields like thermal, hydro, solar, wind and liquid fuel.

Tata Power Company was established in 1911. The headquarters of the company is in Mumbai. The founder of the company is Dorabji Tata.

Tata Power Fundamental

The company is quite stable in the Indian market with Mkt Cap of Rs 144,221 Cr. The company’s ROE is 14.7% and ROCE is 12.2% which shows that the company is efficiently earning profits from its shareholders’ equity and is also making good use of its invested capital.

However, there is a loss in the profit growth of the company which may be due to strategic investment for future growth. It will be important to keep an eye on the recent trends before investing in the company. Analyze the company’s quarterly reports to see if profitability is improving.

The company’s P/E ratio is 37.27 and P/B ratio is 4.27, which may indicate that the stock is currently overvalued. The EPS (TTM) of the company is 11.57 which is good from investment point of view.

| Company Name | The Tata Power Company Ltd. |

| Sector | Power Generation/Distribution |

| Established | 1911 |

| Website | https://www.tatapower.com/ |

| Listing At | NSE, BSE |

| Mkt Cap | 144,221 Cr. |

| ROE | 14.7 % |

| ROCE | 12.2 % |

| 52 Week High | 464.20 |

| 52 Week Low | 216.30 |

| P/E Ratio (TTM) | 37.27 |

| P/B Ratio | 4.27 |

| Face Value | 1 |

| Book Value Per Share | 101.26 |

| EPS (TTM) | 11.57 |

| Dividend Yield | 0.46 |

| Net Sales | 21,945.75 Cr. |

| Sales Growth | .60% |

| Net Profit (Anual) | 2,229.86 Cr. |

| Profit Growth | -31.76% |

Tata Power Share Price Target 2023, 2024, 2025, 2026, 2028, 2030, 2040 और 2050

Tata Power Share Price Target 2023

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 207 | 211 |

| February | 202 | 214 |

| March | 190 | 202 |

| April | 194 | 200 |

| May | 201 | 211 |

| June | 213 | 220 |

| July | 222 | 234 |

| August | 235 | 245 |

| September | 246 | 260 |

| October | 240 | 260 |

| November | 240 | 265 |

| December | 270 | 315 |

Tata Power Share Price Target 2024

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 330 | 380 |

| February | 370 | 390 |

| March | 377 | 393 |

| April | 400 | 445 |

| May | 436 | 449 |

| June | 430 | 460 |

| July | 442 | 465 |

| August | 460 | 472 |

| September | 468 | 490 |

| October | 488 | 513 |

| November | 500 | 528 |

| December | 525 | 540 |

Tata Power Share Price Target 2025

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 535 | 548 |

| February | 542 | 565 |

| March | 530 | 544 |

| April | 532 | 546 |

| May | 545 | 580 |

| June | 552 | 566 |

| July | 560 | 578 |

| August | 575 | 592 |

| September | 590 | 604 |

| October | 600 | 632 |

| November | 615 | 625 |

| December | 600 | 612 |

Tata Power Share Price Target 2026

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 610 | 628 |

| February | 622 | 643 |

| March | 628 | 642 |

| April | 633 | 649 |

| May | 618 | 635 |

| June | 620 | 644 |

| July | 640 | 684 |

| August | 680 | 702 |

| September | 694 | 708 |

| October | 678 | 700 |

| November | 692 | 712 |

| December | 700 | 735 |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Tata Power Share Price Target 2028

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 832 | 854 |

| February | 835 | 850 |

| March | 842 | 859 |

| April | 848 | 888 |

| May | 867 | 882 |

| June | 880 | 922 |

| July | 920 | 947 |

| August | 935 | 982 |

| September | 953 | 980 |

| October | 940 | 955 |

| November | 942 | 956 |

| December | 945 | 962 |

Tata Power Share Price Target 2030

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 1022 | 1040 |

| February | 1025 | 1035 |

| March | 1030 | 1072 |

| April | 1032 | 1058 |

| May | 1050 | 1094 |

| June | 1090 | 1124 |

| July | 1102 | 1132 |

| August | 1130 | 1158 |

| September | 1132 | 1168 |

| October | 1135 | 1144 |

| November | 1102 | 1124 |

| December | 1120 | 1180 |

Tata Power Share Price Target 2040

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 1626 | 1652 |

| February | 1630 | 1644 |

| March | 1640 | 1682 |

| April | 1658 | 1685 |

| May | 1602 | 1650 |

| June | 1605 | 1024 |

| July | 1620 | 1662 |

| August | 1660 | 1698 |

| September | 1682 | 1690 |

| October | 1688 | 1722 |

| November | 1720 | 1755 |

| December | 1735 | 1750 |

Tata Power Share Price Target 2050

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 2334 | 2354 |

| February | 2345 | 2358 |

| March | 2350 | 2362 |

| April | 2360 | 2382 |

| May | 2380 | 2405 |

| June | 2392 | 2424 |

| July | 2420 | 2462 |

| August | 2442 | 2478 |

| September | 2470 | 2504 |

| October | 2482 | 2498 |

| November | 2495 | 2552 |

| December | 2550 | 2610 |

Also Read: Adani Power price target, share will increase 10 times.

Tata Power Listing Date

Tata Power is listed on both the Indian market exchanges NSE and BSE. It was listed on January 3, 2000 at Rs 6.54. Its current share price is Rs 452.

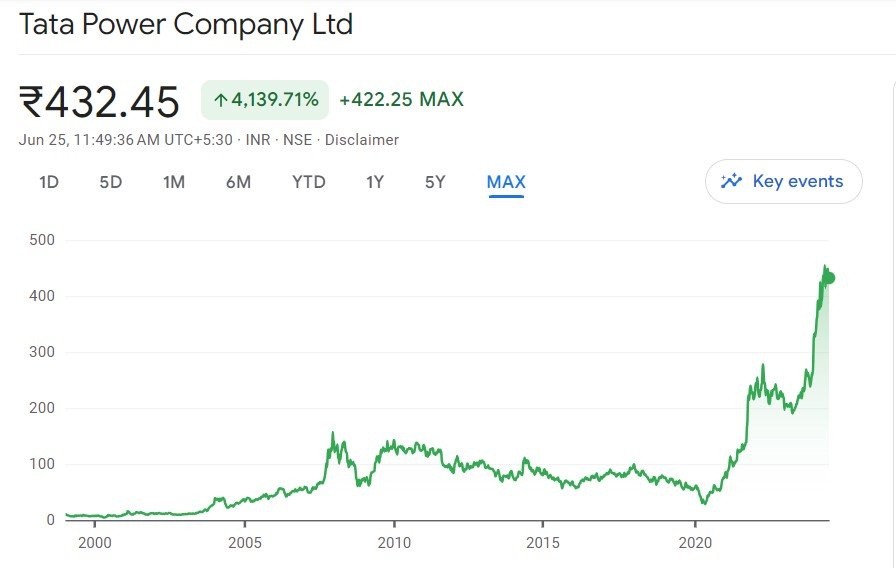

Tata Power Share Price History

Before investing money in the shares of Tata Power Company, let us know about its Share Price History.

At the time of listing, one share of the company was worth Rs 6.54 and today on June 26, 2024, the shares of the company have increased to Rs 430.75. In these last 24 years, the share price of the company has increased by 6486.31%. The share price of the company has seen a growth of about 35.32% from January this year till now (10/06/2024).

Tata Power’s price performance shows that the company has seen a lot of volatility in the short term (1 week and 1 month). The company has seen a loss of 4.64% in the last one week and a loss of 3.68% in the last month. But the company has enjoyed strong profits in the long run. The stock has seen a notable growth of 29.69% year-to-date (YTD) and 97.32% in the last one year. The stock has shown a good growth of 255.70% in the last 3 years.

Tata Power Share Price Growth Chart

The progress of any company can be easily estimated from its growth chart. Analyzing the growth chart of Tata Power company shows that the company has given continuous profits to its investors since 2020. Its share price is continuously increasing and experts believe that it will give very good returns in future also. The company has given a return of 291.31% in the last 3 years, which is a very good return.

Tata Power Profit/Loss – Last 5 Years Report

Tata Power Income Report

| INCOME | Mar 24 | Mar 23 | Mar 22 | Mar 21 | Mar 20 |

|---|---|---|---|---|---|

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | |

| Revenue From Operations [Gross] | 20,093.36 | 17,437.45 | 10,898.03 | 6,050.40 | 7,529.36 |

| Revenue From Operations [Net] | 20,093.36 | 17,437.45 | 10,898.03 | 6,050.40 | 7,529.36 |

| Other Operating Revenues | 0.00 | 290.33 | 209.90 | 130.19 | 197.03 |

| Total Operating Revenues | 20,093.36 | 17,727.78 | 11,107.93 | 6,180.59 | 7,726.39 |

| Other Income | 1,852.39 | 4,085.39 | 2,987.11 | 1,248.96 | 582.62 |

| Total Revenue | 21,945.75 | 21,813.17 | 14,095.04 | 7,429.55 | 8,309.01 |

Tata Power Expenses

| Expenses | Mar 24 | Mar 23 | Mar 22 | Mar 21 | Mar 20 |

|---|---|---|---|---|---|

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | |

| Cost of Power Purchased | 0.00 | 1,395.16 | 797.64 | 504.30 | 457.59 |

| Cost Of Fuel | 0.00 | 12,023.79 | 6,569.00 | 2,186.38 | 2,765.61 |

| Operating And Direct Expenses | 0.00 | 260.02 | 258.84 | 258.18 | 214.00 |

| Employee Benefit Expenses | 794.71 | 746.17 | 737.59 | 649.07 | 610.71 |

| Finance Costs | 2,257.45 | 2,226.60 | 2,188.94 | 1,518.77 | 1,510.38 |

| Depreciation And Amortisation Expenses | 1,188.46 | 1,167.47 | 1,134.23 | 668.89 | 685.75 |

| Other Expenses | 15,398.02 | 1,691.26 | 1,197.46 | 765.68 | 756.69 |

| Total Expenses | 19,638.64 | 19,510.47 | 12,883.70 | 6,551.27 | 7,000.73 |

Tata Power Profit/Loss

The total revenue of the company has been continuously increasing for the last 4 years, which is very good news from the point of view of investment in the company. The maximum increase in the total revenue of the company has been seen between March 2021 and 2022. Meanwhile, the company also had the highest profit. By March 2024, the total revenue of the company is Rs 21,945.75 crore and total expenses are Rs 19,638.64 crore.

Also Read: Yatra Online shares will make you rich, 100% guarantee.

The company had made the highest profit of Rs 3,267.90 crore in March 23, which is the highest in the last 5 years. The company has registered a profit of Rs 2,229.86 crore in March 24.

Tata Power company has been continuously giving good profits. Long term investors can earn good profits in future by investing their money.

| Profit/Loss | Mar 24 | Mar 23 | Mar 22 | Mar21 | Mar 20 |

|---|---|---|---|---|---|

| 12 mths | 12 mths | 12 mths | 12mths | 12 mths | |

| Profit/Loss Before Exceptional, ExtraOrdinary Items And Tax | 2,307.11 | 2,302.70 | 1,211.34 | 878.28 | 1,308.28 |

| Exceptional Items | 203.99 | 1,808.27 | 1,546.46 | 190.33 | -957.75 |

| Profit/Loss After Tax And Before ExtraOrdinary Items | 2,229.86 | 3,267.90 | 3,250.76 | 967.64 | 558.35 |

| Profit/Loss From Continuing Operations | 2,229.86 | 3,267.90 | 3,250.76 | 967.64 | 558.35 |

| Profit/Loss For The Period | 2,229.86 | 3,267.90 | 2,782.93 | 921.45 | 148.12 |

Tata Power Other Additional Information

| EARNINGS PER SHARE | Mar 24 | Mar 23 | Mar 22 | Mar 21 | Mar 20 |

|---|---|---|---|---|---|

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | |

| Basic EPS (Rs.) | 6.97 | 10.22 | 8.61 | 2.49 | 0.08 |

| Diluted EPS (Rs.) | 6.97 | 10.22 | 8.61 | 2.49 | 0.08 |

| DIVIDEND AND DIVIDEND PERCENTAGE | |||||

| Equity Share Dividend (Rs. Cr.) | 0.00 | 559.18 | 495.28 | 419.24 | 351.99 |

| Equity Dividend Rate (%) | 200.00 | 200.00 | 175.00 | 155.00 | 155.00 |

Tata Power Balance Sheet – Last 5 Years Report:

EQUITIES AND LIABILITIE

| SHAREHOLDER’S FUNDS | MAR 24 | MAR 23 | MAR 22 | MAR 21 | MAR 20 |

|---|---|---|---|---|---|

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | |

| Equity Share Capital | 319.56 | 319.56 | 319.56 | 319.56 | 270.50 |

| Total Share Capital | 319.56 | 319.56 | 319.56 | 319.56 | 270.50 |

| Reserves and Surplus | 15,468.10 | 13,380.03 | 10,560.24 | 16,559.00 | 13,491.47 |

| Total Reserves and Surplus | 15,468.10 | 13,380.03 | 10,560.24 | 16,559.00 | 13,491.47 |

| Total Shareholders Funds | 15,787.66 | 13,699.59 | 10,879.80 | 16,878.56 | 13,761.97 |

| NON-CURRENT LIABILITIES | |||||

| Long Term Borrowings | 13,373.21 | 11,272.30 | 18,087.97 | 13,168.52 | 9,825.33 |

| Deferred Tax Liabilities [Net] | 996.19 | 617.29 | 0.00 | 135.36 | 307.25 |

| Other Long Term Liabilities | 3,739.35 | 3,728.83 | 3,325.33 | 377.51 | 412.97 |

| Long Term Provisions | 280.70 | 285.94 | 274.00 | 261.38 | 222.46 |

| Total Non-Current Liabilities | 18,389.45 | 15,904.36 | 21,687.30 | 13,942.77 | 10,768.01 |

| CURRENT LIABILITIES | |||||

| Short Term Borrowings | 6,152.95 | 10,593.18 | 6,620.41 | 5,595.70 | 6,212.31 |

| Trade Payables | 4,081.38 | 1,985.02 | 4,079.89 | 1,137.00 | 1,001.87 |

| Other Current Liabilities | 6,049.69 | 5,972.80 | 3,841.41 | 3,789.55 | 4,310.30 |

| Short Term Provisions | 27.82 | 17.76 | 44.59 | 25.37 | 62.02 |

| Total Current Liabilities | 16,311.84 | 18,568.76 | 14,586.30 | 10,547.62 | 11,586.50 |

| Total Capital And Liabilities | 50,488.95 | 48,172.71 | 47,153.40 | 42,868.95 | 37,616.48 |

ASSETS

| NON-CURRENT ASSETS | Mar ’24 | Mar ’24 | Mar ’24 | Mar ’24 | Mar ’24 |

|---|---|---|---|---|---|

| 12 mths | 12 mths | 12 mths | 12 mths | 12 mths | |

| Tangible Assets | 25,340.80 | 23,699.59 | 23,708.53 | 8,200.75 | 7,974.07 |

| Intangible Assets | 0.00 | 22.46 | 37.43 | 55.39 | 62.22 |

| Capital Work-In-Progress | 0.00 | 1,272.56 | 965.15 | 285.45 | 402.87 |

| Other Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Fixed Assets | 25,340.80 | 24,994.61 | 24,711.11 | 8,541.59 | 8,439.16 |

| Non-Current Investments | 13,013.80 | 12,064.55 | 10,711.38 | 26,128.40 | 21,327.20 |

| Deferred Tax Assets [Net] | 0.00 | 0.00 | 250.00 | 0.00 | 0.00 |

| Long Term Loans Advances | 4.25 | 2.68 | 453.17 | 490.18 | 42.10 |

| Other Non-Current Assets | 3,952.76 | 3,011.41 | 2,605.66 | 2,463.95 | 1,920.44 |

| Total Non-Current Assets | 42,311.61 | 40,073.25 | 38,731.32 | 37,624.12 | 31,728.90 |

| CURRENT ASSETS | |||||

| Current Investments | 392.40 | 64.17 | 67.60 | 240.01 | 20.00 |

| Inventories | 2,119.53 | 2,457.95 | 2,292.33 | 632.94 | 635.01 |

| Trade Receivables | 1,582.37 | 2,020.90 | 1,085.51 | 910.87 | 1,108.68 |

| Cash And Cash Equivalents | 618.59 | 295.92 | 78.55 | 142.67 | 178.94 |

| Short Term Loans Advances | 0.00 | 0.00 | 1,328.48 | 1,523.89 | 550.09 |

| Other Current Assets | 3,464.45 | 3,260.52 | 3,569.61 | 1,794.45 | 3,394.86 |

| Total Current Assets | 8,177.34 | 8,099.46 | 8,422.08 | 5,244.83 | 5,887.58 |

| Total Assets | 50,488.95 | 48,172.71 | 47,153.40 | 42,868.95 | 37,616.48 |

OTHER ADDITIONAL INFORMATION

| OTHER ADDITIONAL INFORMATION | Mar’24 | Mar ’24 | Mar ’24 | Mar ’24 | Mar ’24 |

|---|---|---|---|---|---|

| 12mths | 12mths | 12mths | 12mths | 12mths | |

| CONTINGENT LIABILITIES, COMMITMENTS | |||||

| Contingent Liabilities | 0.00 | 7,610.04 | 4,975.32 | 17,904.26 | 17,148.46 |

| BONUS DETAILS | |||||

| Bonus Equity Share Capital | — | 1.13 | 1.13 | 1.13 | 1.13 |

| NON-CURRENT INVESTMENTS | |||||

| Non-Current Investments Quoted Market Value | — | 1,472.21 | 3,089.45 | 236.28 | 161.01 |

| Non-Current Investments Unquoted Book Value | — | 11,423.86 | 10,091.00 | 26,090.45 | 21,304.86 |

| CURRENT INVESTMENTS | |||||

| Current Investments Quoted Market Value | — | — | — | — | — |

| Current Investments Unquoted Book Value | — | 64.17 | 67.60 | 240.01 | 20.00 |

Also Read: SW Solar price target, guarantee boom in solar sector.

Tata Power Quarterly Report

| Mar 24 | Dec 23 | Sep 23 | Jun 23 | |

| Sales + | 4,961 | 4,926 | 5,014 | 5,192 |

| Expenses + | 4,206 | 4,029 | 3,994 | 4,149 |

| EBITDA | 1459 | 1366 | 1255 | 1673 |

| EBIT | 1304 | 1219 | 1049 | 1196 |

| Net Profit | 846 | 527 | 410 | 446 |

| Profit Before Tax | 765 | 685 | 462 | 599 |

| Operating Profit Margin | 15% | 18% | 20% | 20% |

| Net Profit Margin | 17.06% | 10.70% | 8.18% | 8.60% |

| Earning Per Share | 2.65 | 1.65 | 1.28 | 1.40 |

| Depreciation | 328 | 284 | 287 | 290 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

Tata Power Share Price Target: Export Opinion

How to Buy Tata Power Share

In India, there are two exchanges (NSE, BSE) for buying and selling shares of a company. Shares of companies registered on NSE and BSE are bought and sold through Indian brokers. These brokers are registered by SEBI so that there is no possibility of any kind of fraud. Names of some Indian brokers are being mentioned –

- Zerodha

- Groww

- Angel One

- Upstox

Tata Power Shareholding Pattern

Before investing in Tata Power, let us know what is the percentage of shares of the company in which departments. Generally, the Promoter Share Holding percentage of any company should be between 50%-75%. Promoter share of Tata Power in March 2024 is 46.86%.

| Promoter | 46.86% |

| Other Domestic Institutions | 10.19% |

| Retail and Others | 27.91% |

| Foreign Institutions | 9.45% |

| Mutual Funds | 5.59% |

| Total | 100.00 |

Tata Power Latest News

1. Tata Power’s subsidiary Tata Power Renewable Energy (TPREL) has installed over 850 charging points at over 30 bus depots in cities like Delhi, Mumbai, Ahmedabad, Bengaluru, Jammu, Srinagar, Dharwad, Lucknow and Goa. The capacity of these charging points is 180 to 240 KW with an average charging time of 1 to 1:30 hours.

2. Analysts at ICICI Securities said that Tata Power has made the first move into the electric vehicle charging market in the stock market, hence they have given ‘Buy’ rating to Tata Power with a target price of Rs 490 per share.

3. The main business of Tata Power company is on electricity related works. On May 30, 2024, there was a news related to smart meter. Under this news, 250 million smart meters are to be installed in India by 2025 in place of traditional meters.

4. Rupesh Sankhe, senior research analyst at Elara Capital, said, “Only 1.5 crore meters have been installed so far. Therefore, there is a lot of opportunity for power companies. Companies like Tata Power, Genus Power and HPL Electric & Power launched smart meters last year. Orders have been received to implement the meter. It can be expected from this news that the share price of the company will increase in future.

Strengths

- Mkt Cap of Tata Power Company is Rs 144,221 Cr. Which is a very good sign from investment point of view.

- The ROA of the company has improved in the last 2 years due to which the profits are increasing. An improvement in a company’s ROA is a positive sign indicating that the company management is efficient and able to reduce costs.

- The cash flow from operations of the company has improved over the last 2 years and the company has given a return of 257.93% in the last three solos. This means that the company is able to generate cash flow on its own which demonstrates its strong position.

- The company has also improved its annual net profit in the last few years, which indicates improvement in the company’s financial position and premium, which seems to be giving good profits from investment point of view.

- The ROE of the company is 11.42% and ROCE is 11.3% from which it can be expected that the company will give good profits in future.

- The book value per share of the company has improved in the last 2 years, which means that the price per share of the company is continuously increasing.

Also Read: Yatra Online shares will make you rich, 100% guarantee.

Risks

- The company’s return on equity over the last three years has been 11.3%.

- The company’s Debt to Equity Ratio being 1.5 is a matter of concern for investors.

- Due to reduced cash flow, the company may not have cash available to invest in new growth opportunities.

- The company is displaying increasing debt and declining net cash flow, potentially indicating a risky financial position.

- The company’s stock is trading at 4.42 times its book value. This means that the company’s stock is overvalued, which may also indicate that the stock price may fall in the future.

Points to Consider Before Investing

- Mkt Cap: Mkt Cap of Tata Power is Rs144,221 Cr.

- The company is working on fields like thermal, hydro, solar, wind and liquid fuel for power generation on its new project.

- Company receiving orders for smart meters in India.

- Debt to Equity: Before investing, the Debt to Equity ratio of the company should be known.

- ROE and ROCE: The ROE of the company is 11.42% and ROCE is 11.3%, it is very important to analyze these ratios before investment.

- P/E Ratio: P/E Ratio of Tata Power company is 37.27% and Sector PE is 23.70%.

At present the company is continuously working on fields like thermal, hydro, solar, wind and liquid fuel for power generation. After analyzing all these aspects, it is expected that its share price will increase in future.

Competitors of Tata Power

- NTPC

- Power Grid Corp

- Adani Power

- Tata Power

- JSW Energy

- Adani Energy

- NHPC

- SJVN

Similar Stocks

| Company Name | Mkt Cap (Rs. Cr.) | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| NTPC Ltd. | 349,661 | 95.16% | 171.85 | 393.20 |

| Adani Power Ltd. | 295,846 | 189.43% | 231.00 | 895.85 |

| Power Grid Corporation of India Ltd. | 287,714 | 75.67% | 348.70 | 172.50 |

| Adani Energy Solutions Ltd. | 113,785 | 31.59% | 686.00 | 1,250.00 |

| JSW Energy Ltd. | 109,401 | 164.69% | 249.00 | 663.80 |

Profitable Stocks

| Company Name | Mkt cap(Cr.) | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Mahindra and Mahindra Ltd. | 355,332 | 103.17% | 1,237.45 | 2,867.60 |

| Wipro Ltd. | 253,353 | 20.30% | 375.05 | 545.90 |

| Infosys Ltd. | 636,734 | 18.98% | 1,262.25 | 1,733.00 |

| Heritage Foods Ltd. | 6,136 | 211.03% | 202.65 | 661.25 |

| Jubilant Foodworks Ltd. | 34,212 | 5.16% | 421.05 | 586.95 |

Conclusion

From Tata Power company’s market capital, per year profit, balance sheet, fundamental analysis and shareholding pattern of the company, it can be estimated that the company can give very good returns in the future.

Tata Power is a large and established company which maintains its strong position in India’s growing energy market. The company expects good profits in future from smart meter layout. Along with all these figures, investors should also consider the debt level and valuation of the company. At present the company is moving towards growth. Can give good profits to investors in future.

Disclaimer – Please note that we are not SEBI-registered advisors. Our post is for educational purposes only. Therefore, before investing in any share, take advice from a SEBI certified expert. If you invest, you yourself will be responsible for your profit and loss, not us.

Also Read:

Yatra Online shares will make you rich, 100% guarantee.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Den Networks Share Price Target 2024, to 2050

Venus Pipes stock increased by 525%, became a millionaire in 1 year.

Q1. What is Tata Power Share Price Target 2024?

Ans: The target price of Tata Power for 2024 is Rs 330 to Rs 540.

Q2. What is Tata Power Share Price Target 2025?

Ans: The target price of Tata Power for 2025 is Rs 535 to Rs 612.

Q3. What is Tata Power Share Price Target 2030?

Ans: The target price of Tata Power for 2030 is Rs 1022 to Rs 1180.

Q4. What is Tata Power Share Price Target 2035?

Ans: The target price of Tata Power for 2035 is Rs 1375 to Rs 1445.

Q5. What is Tata Power Share Price Target 2040?

Ans: The target price of Tata Power for 2040 is Rs 1626 to Rs 1750.

Q6. What is Tata Power Share Price Target 2050?

Ans: The target price of Tata Power for 2050 is Rs 2334 to Rs 2610.

Q7. What is Tata Power Share Price Target 2026?

Ans: The target price of Tata Power for 2026 is Rs 610 to Rs 735.

Q8. What is Tata Power Share Price Target 2028?

Ans: The target price of Tata Power for 2028 is Rs 832 to Rs 962.