Air Canada stock prediction 2025: This article is going to mainly focus on Air Canada stock prediction 2024, 2025, 2026, 2028, 2030, 2040 to 2050. Along with this, we will also discuss the company’s Fundamental, sentiment, Income Report, Share Price history, and Quarterly Report. Our analysis will help investors in taking the right decision.

About Air Canada

Air Canada is Canada’s largest airline, founded in 1937. This airline is known for its latest convenience, reliability and safety.

Air Canada serves more than 150 daily flights to 80 international airports on six continents. There is a movement of 400 flights (frequency) with 52 airports in the US. Air Canada serves 500 departures from 51 airports in the domestic network.

Air Canada operates a modern fleet, offering a variety of travel classes including Economy, Premium Economy, Business and Signature Class to meet various passenger needs. As a member of the Star Alliance network, Air Canada connects passengers to a vast global network.

Air Canada has announced a Climate Action Plan in March 2021, under which it has set a target of net zero emissions by 2050.

Air Canada Fundamental

Air Canada is listed in the Airlines sector with a market capitalization of CAD 5581.7 million. Over the past year, Air Canada has shown strong financial performance with a significant revenue growth of 31.87%, totaling CAD 2,183 crore. The company has also achieved a net profit of CAD 732 crore, which represents an impressive profit growth of 83.45% over the last year.

Air Canada’s return on equity (ROE) is exceptionally high at 603.77%, indicating effective management and strong profitability. With earnings per share (EPS) of CAD 4.48 and an earnings yield of 28.86%, the company appears to provide investors with adequate value. However, it is important to note that Air Canada has a debt-to-equity ratio of 10.71, indicating significant reliance on debt financing.

| Company Name | Air Canada |

| Sector | Airlines |

| Established | 1937 |

| Website | aircanada.com |

| Mkt Cap | 558.17 Cr CAD |

| ROE | 603.77% |

| ROA | 4.12% |

| ROIC | 9.02% |

| 52 Week High | 23.21 CAD |

| 52 Week Low | 14.47 CAD |

| P/E Ratio (TTM) | 3.47 |

| P/B Ratio | 4.79 |

| Book Value | 117 Cr |

| Book Value Per Share | 3.25 |

| EPS (TTM) | 4.48 |

| Earning Yield | 28.86% |

| Debt to Equity Ratio | 10.71 |

| Total Revenue | 2183Cr |

| Revenue Growth | 31.87% |

| Net Profit (Anual) | 732 Cr |

| Profit Growth | 83.45% |

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 31 Dec 2023 | 31.87% |

| 2022 | 158.69% |

| 2021 | 9.72% |

| 2020 | -69.51% |

| 2019 | 6.27% |

Also Read: Yatra Online shares will make you rich, 100% guarantee.

Air Canada Stock Prediction 2024

The current sentiment of Air Canada is showing buy. According to market experts, Air Canada stock prediction 2024 is CAD13.25 to CAD20.29.

| Year | Price Prediction (Min) | Price Prediction (Max) |

|---|---|---|

| 2024 | CAD 13.25 | CAD 20.29 |

Air Canada Stock Prediction 2025

Air Canada is Canada’s largest airlines company. According to market experts, Air Canada stock prediction 2025 is CAD18.35 to CAD24.31.

| Year | Price Prediction (Min) | Price Prediction (Max) |

|---|---|---|

| 2025 | CAD 18.35 | CAD 24.31 |

Air Canada Stock Prediction 2026

According to market experts, Air Canada stock prediction 2026 is CAD20.12 to CAD28.34.

| Year | Price Prediction (Min) | Price Prediction (Max) |

|---|---|---|

| 2026 | CAD 20.12 | CAD 28.34 |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Air Canada Stock Prediction 2028

According to market experts, Air Canada stock prediction 2028 is CAD22.38 to CAD30.46.

| Year | Price Prediction (Min) | Price Prediction (Max) |

|---|---|---|

| 2028 | CAD 22.38 | CAD 30.46 |

Air Canada Stock Prediction 2030

According to market experts, Air Canada stock prediction 20230 is CAD25.37 to CAD36.29.

| Year | Price Prediction (Min) | Price Prediction (Max) |

|---|---|---|

| 2030 | CAD 25.37 | CAD 36.29 |

Air Canada Stock Prediction 2040

According to market experts, Air Canada stock prediction 2040 is CAD55.56 to CAD63.78.

| Year | Price Prediction (Min) | Price Prediction (Max) |

|---|---|---|

| 2040 | CAD 55.56 | CAD 63.78 |

Also Read: Adani Power price target, share will increase 10 times.

Air Canada Stock Prediction 2050

According to market experts, Air Canada stock prediction 2050 is CAD89.39 to CAD96.49.

| Year | Price Prediction (Min) | Price Prediction (Max) |

|---|---|---|

| 2050 | CAD 89.39 | CAD 96.49 |

Sentiment

According to Tipranks, the current sentiment of Air Canada is bearish. Out of 10 technical indicators, 1 is bullish, 6 are neutral and 3 are showing bearish sentiments and out of 12 moving averages, 1 is bullish, 0 are neutral and 11 are showing bearish sentiments.

Analyst Rating

Air Canada has received 11 buy, 2 hold, and 0 sell ratings from Tipranks‘ 13 analysts over the past 3 months.

| Action | Rating |

|---|---|

| Buy | 85% |

| Hold | 15% |

| Sell | 0% |

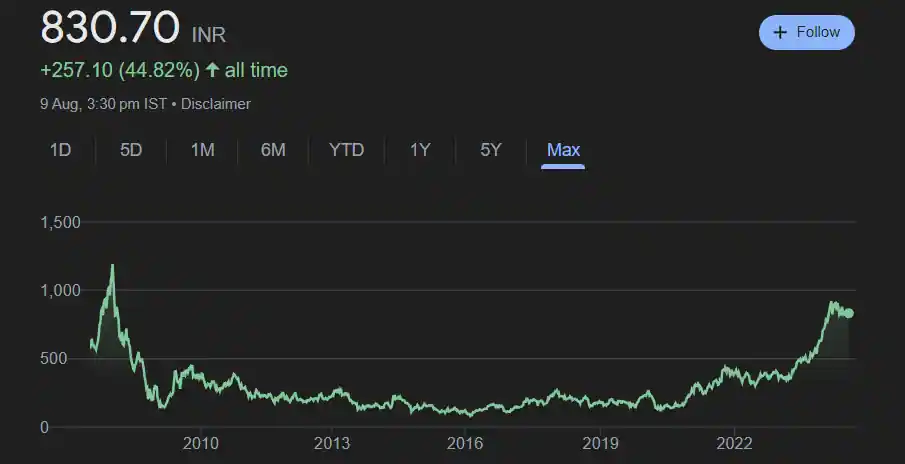

Air Canada Stock Price History

Air Canada was listed in November 2006 at around 20 CAD. From 2006 to 2008, its stock continued to fall and fell to 0.91 CAD. Its stock remained almost constant from 2009 to 2013, after which its stock witnessed a rise and this rise continued till 2019 in which Air Canada stock reached its highest ever stock value of 50.90 CAD. But within the next three months its stock crashed. Its stock has fallen 64%, 32% and 14% in the last 5 years, 1 year and 6 months respectively.

Also Read: Tata Steel price target, trust of more than 100 years old company.

Air Canada Quarterly Report

| Jun 24 | Mar 24 | Dec 23 | Sep 23 | |

| Revenue | 552Cr | 523Cr | 518Cr | 634Cr |

| Expenses + | 376Cr | 391Cr | 380Cr | 363Cr |

| EBITDA | 91Cr | 45Cr | 37Cr | 183Cr |

| EBIT | 47Cr | 1Cr | 142Cr | 80Cr |

| Gross Profit | 176Cr | 132Cr | 137Cr | 272Cr |

| Free Cash Flow | 45 | 106 | 67 | 14 |

| Profit Margin | 7.43% | -1.55% | 3.56% | 19.70% |

| EPS (Diluted) | 1.05 | -0.23 | 0.41 | 3.09 |

| EPS Growth | -55.22% | — | -13.03 | — |

Air Canada Income Report

| Description | Dec 23 | Dec 22 | Dec 21 | Dec 20 | Dec 19 |

|---|---|---|---|---|---|

| Total Revenue | 2183Cr | 1656Cr | 640Cr | 583Cr | 1913Cr |

| Expenses | 1451Cr | 1256Cr | 640Cr | 670Cr | 1299Cr |

| Profit/Loss | 732Cr | 400Cr | 0 Cr | 86Cr | 614Cr |

Strengths

- High Return on Equity (ROE): Air Canada boasts an exceptionally high ROE of 603.77%, indicating efficient use of equity to generate profits.

- Earnings Growth: The company’s EPS growth rate is substantial at 220.91%, reflecting strong recovery and profitability.

- Revenue Growth: Consistent revenue growth, with a notable 31.87% increase in the last year, showcases resilience and strong demand recovery.

- Profit Margins: The profit margin stands at 7.92%, with an operating margin of 9.05%, which are solid figures in the highly competitive airline industry.

- Earnings Yield: With an earnings yield of 28.86%, Air Canada is attractive from a value investment perspective, indicating potential for high returns.

Risks

- High Debt Levels: The debt-to-equity ratio of 10.71 indicates significant leverage, which can be risky, especially in downturns or periods of rising interest rates.

- Volatile Profit Margins: The profit margins have been highly volatile in the past, with negative margins recorded during downturn years like 2020.

- Economic Sensitivity: As an airline, Air Canada is highly sensitive to economic cycles, fuel price volatility, and global travel restrictions, which can drastically affect performance.

- Historical Losses: The company has a history of losses, particularly during the pandemic years (2020-2021), which could pose a risk if similar external shocks occur.

- High P/B Ratio: A P/B ratio of 4.79 suggests the stock might be overvalued relative to its book value, potentially indicating a premium price.

Air Canada Stock Prediction 2024 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | 13.25 | 20.29 |

| 2025 | 18.35 | 24.31 |

| 2026 | 20.12 | 28.34 |

| 2028 | 22.38 | 30.46 |

| 2030 | 25.37 | 36.29 |

| 2040 | 55.56 | 63.78 |

| 2050 | 89.39 | 96.49 |

Also Read: SW Solar price target, guarantee boom in solar sector.

Air Canada Shareholders

| General Public | 85.9% |

| Institutions | 13.9% |

| Individual Insiders | 0.203% |

| Total | 100.00% |

Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Godrej Properties | ₹81.35KCr. | 92.24% | ₹1495.30 | ₹3402.70 |

| Phoenix Mills | ₹60.10 KCr. | 96.89% | ₹1652.10 | ₹4137 |

| Prestige Estates Projects | ₹68.92 KCr. | 207.18% | ₹543 | ₹2074.80 |

| Oberoi Realty | ₹6502 KCr | 65.99% | ₹1051.10 | ₹1953.05 |

| Macrotech Developers | ₹1.24 LCr. | 78.29% | ₹641.05 | ₹1649.95 |

Profitable Stocks

| Company Name | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| JSW Energy | ₹119748.34Cr. | 143.4% | ₹286 | ₹752 |

| IIFL Securities Ltd | ₹5,834Cr. | 194.30% | ₹63.0 | ₹240 |

| NTPC | ₹382000.21Cr. | 95.23% | ₹200 | ₹395 |

| Marksans Pharma Ltd | ₹9,224Cr. | 77.29% | ₹93.8 | ₹205 |

| Ashoka Buildcon Ltd | ₹7,310Cr. | 154.59% | ₹89.0 | ₹262 |

Conclusion

Air Canada shows strong financial improvement and profitability with high returns on equity and earnings yield. However, its high debt levels and sensitivity to economic cycles present significant risks that investors should consider carefully.

Disclaimer– Please note that all the information given here is for general information purpose only and not for investment purposes. Therefore, before investing in any share, take advice from a certified market expert. If you invest, you will be responsible for your profits and losses.

Also Read:

Yatra Online shares will make you rich, 100% guarantee.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Den Networks Share Price Target 2024, to 2050

Q1. What is the stock prediction of Air Canada in 2025?

Ans: Air Canada stock prediction 2025 is CAD18.35 to CAD24.31.

Q2. What is the stock predictio of Air Canada in 2030?

Ans: Air Canada stock prediction 20230 is CAD25.37 to CAD36.29.

Q3. What is the stock predictio of Air Canada in 2024?

Ans: Air Canada stock prediction 2024 is CAD13.25 to CAD20.29.

Q4. What is the stock predictio of Air Canada in 2040?

Ans: Air Canada stock prediction 2040 is CAD55.56 to CAD63.78.

Q5. What is the stock predictio of Air Canada in 2050?

Ans: Air Canada stock prediction 2050 is CAD89.39 to CAD96.49.