In this article, we will analyze the Zenith Steel Share Price Target in detail, and see how its stock will perform in the future, along with its 5-year income, revenue, profit, loss, and also discuss its current market sentiment. Let’s know Zenith Steel Share Price Targett 2024 to 2050 and export opinion.

About Zenith Steel

Zenith steel is an India’s largest steel pipes and industries which is established in 1960 and their commercial production start in 1962. The company manufacturing and selling the many types of things like electric resistance welded and many types of pipes which is generally uses in water transportation and the company also make his field in agriculture for farmers help for their work like pipes and their bore well.

The company has 58 years experience in the export of steel pipes and tubes. They are one of the largest suppliers of ERW Black & Galvanized pipes to the United States of America market from India. They undertakes different different types of domestic and international projects.

Zenith Steel Pipes & Industries Fundamental

Zenith steel is a small cap company with a market cap of Rs 142 Cr which generated revenue of Rs 148Cr with a growth of -0.13%. The ROE and ROCE of the company are 0.18% and -6.26% respectively. And it’s P/E ratio -513.50 whose book value per share of ₹-18.05.

Zenith Steel Pipes & Industries Ltd. posted a revenue of ₹148.52 Crore in this financial year, their net loss was ₹-0.67 Crore and their debt to equity ratio is -0.84.

| Description | Value |

|---|---|

| Company Name | ZENITH STEEL PIPES & INDUSTRIES LTD |

| Sector | Manufacturing & Selling of ERW and SAW Pipes |

| Established | 1960 |

| Website | zenithsteelpipes.com |

| Listing At | NSE, BSE |

| BSE Code | 531845 |

| NSE Code | ZENITHSTL |

| Mkt Cap | ₹142 Cr |

| Reserves and Surplus | 392.95 Cr |

| ROE | 0.18 % |

| ROCE | -6.26% |

| 52 Week High | ₹15.45 |

| 52 Week Low | ₹3.90 |

| P/E Ratio (TTM) | -513.50 |

| P/B Ratio | 0.0 |

| Face Value | 10 |

| Book Value Per Share | -18.05 |

| EPS (TTM) | -0.05 |

| Dividend Yield | 0.0% |

| Debt to Equity | -0.84 |

| Total Revenue | 148.52Cr |

| Revenue Growth | -0.13 Cr |

| Net Profit (Annual) | -0.67 Cr |

| Profit Growth | -1.03% |

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2023 | 46.73% |

| 2022 | 311.54% |

| 2021 | 62.50% |

| 2020 | 45.45% |

| 2019 | -21.43% |

| 2018 | 40.00% |

| 2017 | -37.50% |

| 2016 | -11.11% |

| 2015 | -10.00% |

Zenith Steel Target 2024

Zenith Steel Pipes & Industries currently shows a sell sentiment, with its stock expected to stay relatively steady in 2024. The company’s maximum price target for 2024 is set at Rs 16.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹ 4 | ₹16 |

Zenith Steel Target 2025

Zenith Steel Pipes & Industries is India’s leading steel market company. Its target price range in 2025 is going to be Rs 8 to Rs 22.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹8 | ₹22 |

Zenith Steel Target 2026

According to market experts, the minimum target price of the company for 2026 is going to be RS 13 and the maximum target price is RS 44.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹13 | ₹44 |

Also Read: Tata Gold Price Target, money printing machine for small investors.

Zenith Steel Target 2028

According to market experts, the minimum target price of the company for 2028 is going to be RS 18 and the maximum target price is RS 50.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹18 | ₹50 |

Zenith Steel Target 2030

According to market experts, the minimum target price of the company for 2030 is going to be Rs 24 and the maximum target price is RS 62.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹24 | ₹62 |

Zenith Steel Target 2040

According to the past trend of the company, the minimum price target of Zenith Steel Pipes & Industries in 2040 is expected to be RS 110 and the maximum price target is expected to be RS 190.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹110 | ₹190 |

Also Read: Adani Power price target, share will increase 10 times.

Zenith Steel Target 2050

According to the past trend of the company, the minimum price target of Zenith Steel Pipes & Industries in 2050 is expected to be RS 210 and the maximum price target is expected to be RS 450.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹210 | ₹450 |

Sentiment

The current sentiment of Zenith Steel Pipes is showing bearish. It is trading below 5 out of 8 SMAs and also trading below 5 out of 9 Oscillators in bearish zone.

Analyst Rating

According to Investing.com, out of 7 technical indicators, 6 are pointing towards Sell, 1 are pointing towards Buy.

| Action | Rating |

|---|---|

| Buy | 14% |

| Hold | 0% |

| Sell | 86% |

Zenith Steel Share Price History

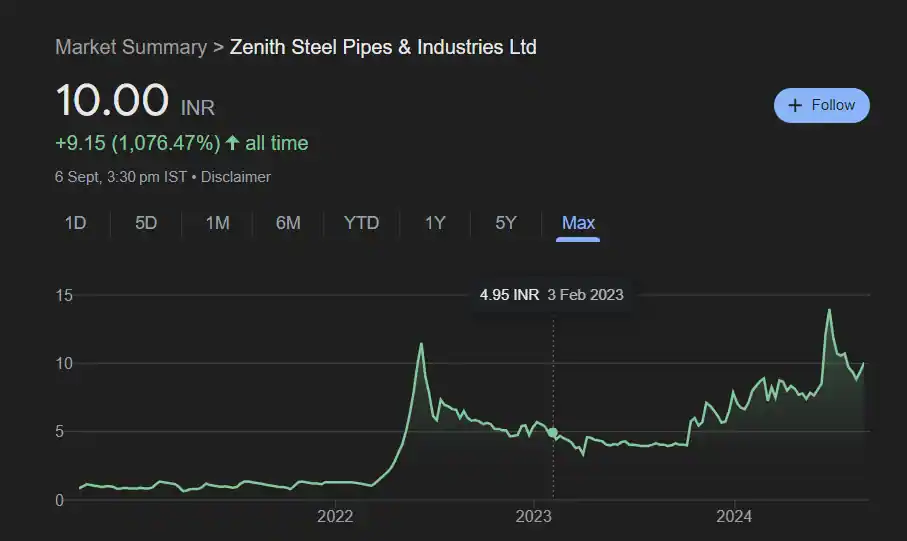

Zenith Steel Pipes and Industries was listed on the Indian Stock Exchange on 21 March 2020 at Rs 0.85. Its stock stable between ₹0.85 to ₹1.30 for 1.5 years after listing. than after the March 2022 its shares make rise between ₹2 to ₹11 next two months and after than its stable again ₹6 to ₹11 till today date as you can see the graph.

Also Read: Tata Steel price target, trust of more than 100 years old company.

Zenith Steel Quarterly Report

| Description | Jun 24 | Mar 24 | Dec 23 | Sep 23 |

| Sales + | ₹30.35Cr | ₹47.61Cr. | ₹46.02Cr. | ₹28.16Cr. |

| Expenses + | ₹32.25Cr. | ₹43.40Cr. | ₹46.69Cr. | ₹29.82Cr. |

| EBITDA | ₹0.81Cr. | ₹5.51Cr. | ₹0.74Cr. | ₹0.26Cr. |

| EBIT | ₹-1.29Cr. | ₹4.94Cr. | ₹0.06Cr. | ₹-0.93Cr. |

| Net Profit | ₹-1.92Cr. | ₹4.12Cr. | ₹0.74Cr. | ₹-1.69Cr. |

| Operating Profit Margin | -2.88% | 12.59% | 1.46% | -1.05% |

| Net Profit Margin | -6.67% | 9.78% | -1.48% | -5.98% |

| Earning Per Share | ₹-0.13 | ₹0.29 | ₹0.11 | ₹0.12 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

Zenith Steel Income Report

The revenue of Zenith Steel Pipes and Industries Limited has increased since 2020 but the company not make profit more than last year which is shown in table clearly. However when we compared the this year Expenses, Revenue, P/L than the company make loss this year.

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 | Mar 20 |

|---|---|---|---|---|---|

| Total Revenue | ₹148.52Cr | ₹171.12Cr | ₹147.26Cr | ₹70.21Cr | ₹69.26Cr |

| Total Expenses | ₹148.95Cr | ₹167.51Cr | ₹152.71Cr | ₹74.72Cr | ₹97.25Cr |

| Profit/Loss | ₹-0.67Cr | ₹0.33Cr | ₹-0.10Cr | ₹-20.94Cr | ₹-27.98Cr |

Strengths

- The debt to equity ratio of the company is -0.84 which shows its low debt.

- The company has reserves and surplus of Rs 392.95 crore, which reflects its strong position to fight future negative situations.

- The company has made a rapid recovery from the lowest price of the last 52 weeks which is ₹15.45

Risks

- The EPS of the company is quite low which makes it less attractive to investors.

- Its revenue has been continuously increasing for the last several years, but in last year its not make more profit that means the company not more profit than his previous year but may be its make profit in his next year.

- The PE ratio of the company is very high at -513.50.

- The company’s profit has been good for the last 3 quarters but in the last one quarter its gone down nearly 20%

- The ROE of the company is -6.26% which is very low which indicates that the company is not able to utilize the shareholders’ capital properly to generate profit.

Zenith Steel Share Price Target 2024 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹4 | ₹16 |

| 2025 | ₹8 | ₹22 |

| 2026 | ₹13 | ₹44 |

| 2028 | ₹18 | ₹50 |

| 2030 | ₹24 | ₹62 |

| 2040 | ₹110 | ₹190 |

| 2050 | ₹210 | ₹450 |

Also Read: SW Solar price target, guarantee boom in solar sector.

Zenith Steel Pipes & Industries Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 15.64% |

| Retail and Others | 84.28% |

| Foreign Institutions | 0.07% |

| Total | 100.00% |

How to Buy Zenith Steel Pipes & Industries Shares?

Buying and selling of Zenith Steel Pipes and Industries shares can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- grow

- Angel One

- Upstox

Similar Stocks

| Company Name | Mkt Cap (Rs. Cr.) | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Ratnamani Metals & Tubes | 25.25 kCr | 51.86% | ₹2,311.00 | ₹3,938.80 |

| Technocraft Industries (India) | 7.15 kCr | 88.47% | ₹1,532.50 | ₹3,190.00 |

| JSW Steel Ltd. | 2.32 LCr | 23.48% | ₹723.00 | ₹944.00 |

| Jindal Steel & Power Ltd. | 1.05 LCr | 84.62% | ₹557.45 | ₹1,097.00 |

| Man Industries India | 3 kcr | 231.1% | ₹129.35 | ₹459.00 |

Also Read: Den Networks Share Price Target 2024, to 2050

Zenith Steel Share Price Target: Export Opinion

Profitable Stocks

| Company Name | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| JSW Energy | ₹119748.34Cr. | 143.4% | ₹286 | ₹752 |

| IIFL Securities Ltd | ₹5,834Cr. | 194.30% | ₹63.0 | ₹240 |

| NTPC | ₹382000.21Cr. | 95.23% | ₹200 | ₹395 |

| Marksans Pharma Ltd | ₹9,224Cr. | 77.29% | ₹93.8 | ₹205 |

| Ashoka Buildcon Ltd | ₹7,310Cr. | 154.59% | ₹89.0 | ₹262 |

Conclusion

The fundamentals of Zenith Steel Pipes are very weak. The company has been generating revenue for the last several years but is unable to generate profit. If we leave the March quarter, the company has been continuously in loss for the last 3 quarters. Investing in the company is risky. This sector is also very competitive, so the company will have to work very hard to move forward.

Disclaimer– Please note that all the information given here is for general information purpose only and not for investment purposes. Therefore, before investing in any share, take advice from a certified market expert. If you invest, you will be responsible for your profits and losses.

Also Read:

Yatra Online shares will make you rich, 100% guarantee.

Tata Gold Price Target, money printing machine for small investors.

Adani Power price target, share will increase 10 times.

Tata Steel price target, trust of more than 100 years old company.

SW Solar price target, guarantee boom in solar sector.

Tata Power share price target, guaranteed returns.

Den Networks Share Price Target 2024, to 2050

Q1. What is the target price of Zenith Steel in 2024?

Ans: Zenith Steel target price for 2024 is Rs 4 to Rs 16.

Q2. What is the target price of Zenith Steel in 2025?

Ans: Zenith Steel target price for 2025 is Rs8 to Rs22.

Q3. What is the target price of Zenith Steel in 2030?

Ans: Zenith Steel target price for 2030 is Rs24 to Rs62.

Q4. What is the target price of Zenith Steel in 2040?

Ans: Zenith Steel target price for 2040 is Rs110 to Rs190.

Q5. What is the target price of Zenith Steel in 2050?

Ans: Zenith Steel target price for 2050 is Rs210 to Rs450.