Today we will talk about Venus Pipes Share Price Target, a company which gives consistent profits and good returns. The target price of the company has been forecast for 2023 to 2050. Along with this, we will also discuss in detail the company’s Fundamental, Shareholding Pattern, Strengths, risks and important news as well as Price History. It is very important to know all these figures of the company before investing.

What is Venus Pipes?

Venus Pipes & Tubes is an Indian company which has been working in this field for 15 years. It manufactures stainless steel pipes and tubes and exports them to more than 25 countries. Using its experience, the company has also ventured into manufacturing stainless steel tubular products.

Venus Pipes manufactures the finest quality products for its customers with fifteen production lines, which include Pilger, Tube-Mill with Plasma Welder, Draw Bench, Annealing Furnace and many other supporting machinery. The company uses the latest and most efficient methods in manufacturing these products to ensure that their products are of high quality.

The company has set a benchmark in manufacturing to meet the international standards and testing is done in its in-house quality control lab to ensure that the company’s products are safe and durable.

Venus Pipes Fundamentals

Since its inception in December 2015, Venus Pipes & Tubes has rapidly carved a niche for itself in the iron & steel sector. At present the market cap of the company is Rs 4,259 crore. At present the company has reserves of Rs 385.80 crore, apart from this the long term and short term borrowings of the company are Rs 33.96 crore and Rs 115.37 crore respectively, which is continuously increasing year after year.

The company’s return on equity (ROE) and return on capital (ROCE) are 21.17% and 30.70% respectively, indicating the company’s efficient use of capital and strong profitability. At the same time, the company’s revenue has also seen tremendous growth (45.16% last year) year after year.

The company’s stock has made a big jump in the last one year, with this it has reached the highest price of ₹ 2275 in 52 weeks. Talking about P/E ratio, the company is trading with P/E ratio of 48.47 which further indicates the extraordinary growth of the company.

| Company Name | Venus Pipes and Tubes Ltd. |

| Sector | Iron & Steel |

| Established | December 2015 |

| Website | venuspipes.com |

| Listing At | NSE, BSE |

| BSE Code | 543528 |

| NSE Code | VENUSPIPES |

| Mkt Cap | ₹4,167 Cr |

| Reserves and Surplus | 385.80Cr |

| ROE | 21.17% |

| ROCE | 30.70% |

| 52 Week High | ₹2,275 |

| 52 Week Low | ₹1,140.95 |

| P/E Ratio (TTM) | 48.47 |

| P/B Ratio | 10.26 |

| Face Value | 10 |

| Book Value Per Share | 200.09 |

| EPS (TTM) | 42.36 |

| Dividend Yield | 0.02% |

| Debt to Equity | 0.37 |

| Net Sales | 805.38 |

| Sales Growth | 45.16% |

| Net Profit (Anual) | 85.98Cr |

| Profit Growth | 94.48% |

Venus Pipes Listing Date

Venus Pipes was successfully listed on the Indian Stock Exchanges NSE and BSE on 24 May 2022. At the time of listing, the per share price of the company was Rs 341.

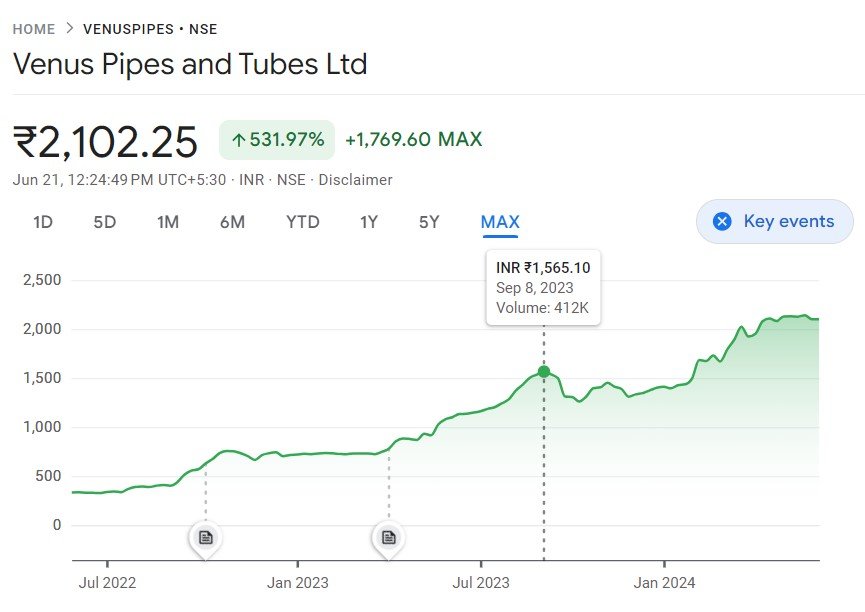

Venus Pipes Share Price History

Since its listing in the Indian market at Rs 341 in 2022, the company has been continuously growing. The company is currently trading at Rs 2230. In just two years, the company has registered a growth of about 553.95%.

Venus Pipes stock has grown 80.38% in last one year, 50.56% in last 6 months, 13.65% in last quarter, -2.26% in last one month and 1.90% in last week.

Venus Pipes Share Price Growth Chart

The life time share chart of the company shows that the company has been continuously growing by a huge margin since its listing.

Venus Pipes Profit/Loss – Last 3 Years Report

Venus Pipes Income Report

| INCOME (Cr.) | MAR 24 | MAR 23 | MAR 22 |

|---|---|---|---|

| 12 mths | 12 mths | 12 mths | |

| Revenue From Operations [Gross] | 802.20 | 552.40 | 386.95 |

| Less: Excise/Sevice Tax/Other Levies | 0.00 | 0.00 | 0.00 |

| Revenue From Operations [Net] | 802.20 | 552.40 | 386.95 |

| Total Operating Revenues | 802.20 | 552.40 | 386.95 |

| Other Income | 3.18 | 2.40 | 2.12 |

| Total Revenue | 805.38 | 554.79 | 389.08 |

Venus Pipes Expenses

| Expenses | MAR 24 | MAR 23 | MAR 22 |

|---|---|---|---|

| 12 mths | 12 mths | 12 mths | |

| Cost Of Materials Consumed | 632.19 | 466.20 | 356.26 |

| Purchase Of Stock-In Trade | 0.00 | 0.00 | 6.46 |

| Operating And Direct Expenses | 0.00 | 0.00 | 0.00 |

| Changes In Inventories Of FG,WIP And Stock-In Trade | -56.90 | -21.61 | -47.67 |

| Employee Benefit Expenses | 22.37 | 10.18 | 6.25 |

| Finance Costs | 22.08 | 9.84 | 7.06 |

| Depreciation And Amortisation Expenses | 11.77 | 1.97 | 1.43 |

| Other Expenses | 58.22 | 28.53 | 16.42 |

| Total Expenses | 689.73 | 495.11 | 346.20 |

Venus Pipes Profit/Loss

The total revenue of the company has been continuously increasing for the last 3 years. The total revenue of the company in March 2022, 2023 and 2024 was Rs 389.08, 554.79 and 805.38 crore respectively. At the same time, the expenses of the company have also increased which was Rs 689.73 crore last year. The company had earned a profit of Rs 31.67 crore in March 2022, Rs 44.21 crore in March 2023 and the highest profit of Rs 85.98 crore in March 2024.

| Profit/Loss | MAR 24 | MAR 23 | MAR 22 |

|---|---|---|---|

| 12 mths | 12 mths | 12 mths | |

| Profit/Loss Before Exceptional, ExtraOrdinary Items And Tax | 115.64 | 59.69 | 42.88 |

| Profit/Loss Before Tax | 115.64 | 59.69 | 42.88 |

| Profit/Loss After Tax And Before ExtraOrdinary Items | 85.98 | 44.21 | 31.67 |

| Profit/Loss From Continuing Operations | 85.98 | 44.21 | 31.67 |

| Profit/Loss For The Period | 85.98 | 44.21 | 31.67 |

Other Additional Information

| EARNINGS PER SHARE | MAR 24 | MAR 23 | MAR 22 |

|---|---|---|---|

| 12 mths | 12 mths | 12 mths | |

| Basic EPS (Rs.) | 42.36 | 22.60 | 22.55 |

| Diluted EPS (Rs.) | 42.36 | 22.60 | 22.55 |

| DIVIDEND AND DIVIDEND PERCENTAGE | |||

| Equity Share Dividend | 0.00 | 1.02 | 0.00 |

| Equity Dividend Rate (%) | 10.00 | 10.00 | 0.00 |

Venus Pipes Balance Sheet – Last 3 Years Report:

Equities And Liabilities

| Equities And Liabilities | MAR 24 | MAR 23 | MAR 22 |

|---|---|---|---|

| 12 mths | 12 mths | 12 mths | |

| SHAREHOLDER’S FUNDS | |||

| Equity Share Capital | 20.30 | 20.30 | 15.22 |

| Total Share Capital | 20.30 | 20.30 | 15.22 |

| Reserves and Surplus | 385.80 | 301.91 | 113.31 |

| Total Reserves and Surplus | 385.80 | 301.91 | 113.31 |

| Total Shareholders Funds | 406.09 | 322.20 | 128.53 |

| NON-CURRENT LIABILITIES | |||

| Long Term Borrowings | 33.96 | 24.69 | 14.26 |

| Deferred Tax Liabilities [Net] | 7.45 | 1.47 | 0.73 |

| Other Long Term Liabilities | 0.00 | 0.00 | 0.23 |

| Long Term Provisions | 1.07 | 0.58 | 0.34 |

| Total Non-Current Liabilities | 42.48 | 26.74 | 15.56 |

| CURRENT LIABILITIES | |||

| Short Term Borrowings | 115.37 | 65.77 | 54.39 |

| Trade Payables | 173.83 | 74.11 | 33.46 |

| Other Current Liabilities | 19.76 | 18.59 | 15.94 |

| Short Term Provisions | 0.06 | 0.03 | 0.01 |

| Total Current Liabilities | 309.02 | 158.50 | 103.79 |

| TOTAL CAPITAL AND LIABILITIES | 757.59 | 507.44 | 247.89 |

Assets

| ASSETS | MAR 24 | MAR 23 | MAR 22 |

|---|---|---|---|

| 12 mths | 12 mths | 12 mths | |

| NON-CURRENT ASSETS | |||

| Tangible Assets | 293.95 | 59.75 | 21.26 |

| Intangible Assets | 0.00 | 0.11 | 0.11 |

| Capital Work-In-Progress | 0.00 | 121.59 | 7.35 |

| Other Assets | 0.00 | 0.00 | 0.00 |

| FIXED ASSETS | 293.95 | 181.45 | 28.72 |

| Non-Current Investments | 0.00 | 0.00 | 0.00 |

| Deferred Tax Assets [Net] | 0.00 | 0.00 | 0.00 |

| Long Term Loans And Advances | 0.00 | 0.00 | 0.00 |

| Other Non-Current Assets | 8.27 | 2.07 | 1.68 |

| Total Non-Current Assets | 302.21 | 183.52 | 30.40 |

| CURRENT ASSETS | |||

| Current Investments | 3.12 | 2.89 | 1.39 |

| Inventories | 225.94 | 166.94 | 93.46 |

| Trade Receivables | 177.14 | 70.49 | 73.52 |

| Cash And Cash Equivalents | 7.64 | 25.98 | 7.35 |

| Short Term Loans And Advances | 0.00 | 0.00 | 0.00 |

| OtherCurrentAssets | 41.54 | 57.62 | 41.79 |

| Total Current Assets | 455.37 | 323.92 | 217.50 |

| TOTAL ASSETS | 757.59 | 507.44 | 247.89 |

Other Additional Information

| OTHER ADDITIONAL INFORMATION | MAR 24 | MAR 23 | MAR 22 |

|---|---|---|---|

| 12 mths | 12 mths | 12 mths | |

| CONTINGENT LIABILITIES, COMMITMENTS | |||

| Contingent Liabilities | 0.00 | 65.92 | 35.78 |

| BONUS DETAILS | |||

| Bonus Equity Share Capital | — | 4.37 | 4.37 |

| CURRENT INVESTMENTS | |||

| Current Investments Quoted Market Value | — | 2.89 | 1.39 |

| Current Investments Unquoted Book Value | — | — | — |

| NON CURRENT INVESTMENTS | |||

| Non-Current Investments Quoted Market Value | — | — | — |

| Non-Current Investments Unquoted Book Value | — | — | — |

Venus Pipes Quarterly Report

| Mar 24 | Dec 23 | Sep 23 | Jun 23 | |

|---|---|---|---|---|

| Sales + | 224.24 | 209.13 | 191.84 | 180.17 |

| Expenses + | 190.44 | 177.97 | 164.59 | 156.74 |

| EBITDA | 45.17 | 41.04 | 35.16 | 28.13 |

| EBIT | 41.34 | 37.36 | 32.30 | 26.74 |

| Net Profit | 25.04 | 23.28 | 27.25 | 23.43 |

| Profit Before Tax | 33.81 | 31.17 | 27.25 | 23.43 |

| Operating Profit Margin | 20.15% | 19.81% | 18.37% | 15.66% |

| Net Profit Margin | 11.17% | 11.24% | 10.59% | 9.69% |

| Earning Per Share | 12.34 | 11.47 | 9.98 | 8.58 |

| Depreciation | 4 | 4 | 3 | 1 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

Venus Pipes Share Price Target 2023, 2024, 2025, 2026, 2028, 2030, 2040 and 2050

Venus Pipes Share Price Target 2023

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 720 | 730 |

| February | 725 | 734 |

| March | 725 | 742 |

| April | 745 | 860 |

| May | 880 | 1000 |

| June | 1080 | 1130 |

| July | 1160 | 1230 |

| August | 1250 | 1500 |

| September | 1300 | 1510 |

| October | 1290 | 1380 |

| November | 1320 | 1370 |

| December | 1320 | 1390 |

Venus Pipes Share Price Target 2024

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 1420 | 1440 |

| February | 1470 | 1800 |

| March | 1840 | 1900 |

| April | 1890 | 2070 |

| May | 2090 | 2121 |

| June | 2160 | 2180 |

| July | 2165 | 2195 |

| August | 2190 | 2220 |

| September | 2200 | 2243 |

| October | 2210 | 2246 |

| November | 2225 | 2253 |

| December | 2233 | 2280 |

Venus Pipes Share Price Target 2025

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 2240 | 2256 |

| February | 2243 | 2265 |

| March | 2255 | 2280 |

| April | 2265 | 2290 |

| May | 2280 | 2298 |

| June | 2295 | 2340 |

| July | 2335 | 2420 |

| August | 2350 | 2390 |

| September | 2380 | 2415 |

| October | 2390 | 2428 |

| November | 2410 | 2435 |

| December | 2430 | 2490 |

Venus Pipes Share Price Target 2026

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 2435 | 2470 |

| February | 2455 | 2480 |

| March | 2464 | 2496 |

| April | 2482 | 2495 |

| May | 2490 | 2523 |

| June | 2520 | 2540 |

| July | 2538 | 2588 |

| August | 2550 | 2570 |

| September | 2558 | 2590 |

| October | 2580 | 2610 |

| November | 2600 | 2655 |

| December | 2640 | 2686 |

Also Read: Yatra Online shares will make you rich, 100% guarantee.

Venus Pipes Share Price Target 2028

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 2844 | 2870 |

| February | 2852 | 2875 |

| March | 2864 | 2890 |

| April | 2873 | 2898 |

| May | 2890 | 2915 |

| June | 2910 | 2955 |

| July | 2932 | 2960 |

| August | 2955 | 2972 |

| September | 2970 | 2992 |

| October | 2990 | 3020 |

| November | 3015 | 3067 |

| December | 3060 | 3092 |

Venus Pipes share prediction: expert opinion

Venus Pipes Share Price Target 2030

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 3320 | 3380 |

| February | 3335 | 3375 |

| March | 3342 | 3382 |

| April | 3373 | 3398 |

| May | 3395 | 3422 |

| June | 3400 | 3488 |

| July | 3454 | 3498 |

| August | 3465 | 3492 |

| September | 3490 | 3552 |

| October | 3502 | 3541 |

| November | 3519 | 3554 |

| December | 3532 | 3588 |

Venus Pipes Share Price Target 2040

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 4122 | 4166 |

| February | 4132 | 4168 |

| March | 4141 | 4182 |

| April | 4152 | 4194 |

| May | 4190 | 4240 |

| June | 4232 | 4290 |

| July | 4255 | 4282 |

| August | 4280 | 4344 |

| September | 4322 | 4349 |

| October | 4345 | 4388 |

| November | 4380 | 4420 |

| December | 4415 | 4482 |

Venus Pipes Share Price Target 2050

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 5520 | 5562 |

| February | 5560 | 5621 |

| March | 5610 | 5655 |

| April | 5650 | 5705 |

| May | 5668 | 5708 |

| June | 5680 | 5720 |

| July | 5703 | 5755 |

| August | 5720 | 5780 |

| September | 5725 | 5760 |

| October | 5755 | 5821 |

| November | 5780 | 5825 |

| December | 5803 | 5898 |

How to Buy Venus Pipes Share?

There are many brokers registered by SEBI to buy and sell shares of any company. You can open your demat account and start trading through any broker. The names of some popular brokers are mentioned below-

- Zerodha

- Groww

- Angel One

- Upstox

Venus Pipes Shareholding Pattern

| Promoter | 48.68% |

| Other Domestic Institutions | 9.47% |

| Retail and Others | 34.04% |

| Foreign Institutions | 4.27% |

| Mutual Funds | 3.55% |

| Total | 100.00% |

Latest News of Venus Pipes

1. Venus Pipes has launched a range of fitting products to manage liquids and gases in industrial applications and expand its piping system, positioning the company as a complete vendor of “Piping, Fittings and Flanges (PFF)” solutions.

2. The company is currently placing great emphasis on increasing its seamless and welded pipe and tube production capacity. To complete this plan, Venus Pipes has also approved capital expenditure of ₹175 crore. The company hopes to complete this work by 2025.

3. Venus Pipes and Tubes MD Arun Kothari said 40% of the capital expenditure of ₹175 crore will be issued through warrants, the remaining will be raised from debt and internal accruals.

Strengths

- Revenue Growth: The company’s revenue has seen significant growth between 2022 and 2024. The company’s revenue in March 2024 was ₹ 805.38.

- Profit growth: The company’s net profit has increased by 94.48% to ₹85.98 crore in March 2024. Which indicates strong financial position.

- High Return Ratio: High ROE (21.17%) and ROCE (30.70%) indicating efficient use of equity and capital.

- Debt-to-Equity Ratio: The company’s debt to equity ratio of 0.37 shows that the company is not heavily dependent on debt financing.

- Reserves and Surplus: Reserves and surplus of the company increased from ₹113.31 crore in March 2022 to ₹385.80 crore in March 2024 indicating strong financial stability of the company.

- Net Profit Margin: The net profit margin of the company has been continuously increasing for the last 4 quarters and it has increased to reach the quarterly net profit margin of 11.17% in March 2024.

- Moving Averages: The share price of the company is above the short, medium and long term moving averages which indicates bullishness in the share price. The longer the moving average of any company, the stronger the bullish signal in its market.

- Earnings Per Share: Earnings per share (EPS) indicates the profitability of any company. The company’s EPS is currently 42.36 which is positive for the company’s stock price.

- Profit Growth: The company has seen a huge improvement in its annual net profit and book value per share in the last 2 years which shows that the company is not only profitable but its net worth is also growing.

- Operating Margins Profit: Along with the increase in operating margins (YoY), the company has also increased the operating profit. It is similar to a profitability metric that reinforces investors’ positive view of the company.

Risks

- Shares Pledged by Promoters: There has been an increase in the shares pledged by the promoters of the company, leading to a decline in the net cash flow of the company, which can be risky from an investment point of view.

- Net Nash Flow: The net cash flow of the company is continuously decreasing due to which the company is not able to generate its net cash, this could be due to the increasing cost of material, labor or other expenses of the company which can affect the cash flow of the company.

- Competitive Field: There is a lot of competition in the stainless steel pipe and tube industry in the current Indian market. Due to which new entrants or established players may put pressure on the company’s margins.

- P/E Ratio: The P/E ratio of the company is 48.47, which indicates that the stock is overvalued.

- Dividend Yield: The company’s dividend (0.02%), is quite low.

- Sector Volatility: Doing business in the iron and steel sector often faces fluctuations in raw material prices and economic recession.

- P/B Ratio: A high P/B ratio indicates that the stock is trading well above its book value, which may be a concern for value investors.

Venus Pipes Points to Consider Before Investing

1. Recently anti-dumping duty has been imposed on Chinese imports due to which Venus Pipes may benefit as a domestic producer.

2. The success of the company’s expansion plans and integration will be helpful for the company’s growth in the future.

3. Investors should monitor how anti-dumping duties impact both import prices and domestic demand.

4. The company’s stock is trading well above its book value and is likely to be overvalued.

5. Investors should note its high valuation, low dividend yield and sector-specific risks.

Competitors of Venus Pipes

- Man Industries India

- Zenith Steel Pipes

- Hi-Tech Pipes

- Rama Steel Tubes

- Oil Country Tubular

- Hariom Pipe Industries

- Vibhor Steel Tubes

- Ratnamani Metals & Tubes

Similar Stocks

| Company Name | Mkt Cap (Rs. Cr.) | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Ratnamani Metals & Tubes | 25.25 kCr | 51.86% | ₹2,311.00 | ₹3,938.80 |

| Technocraft Industries (India) | 7.15 kCr | 88.47% | ₹1,532.50 | ₹3,190.00 |

| JSW Steel Ltd. | 2.32 LCr | 23.48% | ₹723.00 | ₹944.00 |

| Jindal Steel & Power Ltd. | 1.05 LCr | 84.62% | ₹557.45 | ₹1,097.00 |

| Man Industries India | 3 kcr | 231.1% | ₹129.35 | ₹459.00 |

Profitable Stocks

| Company Name | Mkt cap(Cr.) | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Havells India | 1.19 LCr | 42.38% | ₹1,232.85 | ₹1,985.40 |

| Indian Railway Finance Corp | 2.46 LCr | 421.33% | ₹31.95 | ₹200.00 |

| Bharti Airtel | 8.54 LCr | 64.68% | ₹834.70 | ₹1,455.95 |

| Interglobe Aviation | 1.67 LCr | 71.2% | ₹2,333.35 | ₹4,609.80 |

| Yatra Online Ltd. | 2.01 kCr | -6.55% | ₹120.00 | ₹194.00 |

Conclusion

The company has been performing strongly over the past several years, and maintains low debt levels. While the company has strong growth potential in the future, there are also some risks that will be important to consider. Carefully evaluate the company’s Strengths, Weaknesses, Opportunities, and Threats (SWOT analysis). Remember, it is important to do your own research and consult a financial advisor before making any investment decisions.

Disclaimer – Please note that we are not SEBI-registered advisors. Our post is for educational purposes only. Therefore, before investing in any share, take advice from a SEBI certified expert. If you invest, you yourself will be responsible for your profit and loss, not us.

Q1. What is the PE ratio of Venus pipes?

Ans: Venus Pipes has a P/E ratio of 48.47.

Q2. Is Venus Pipes a good investment?

Ans: Venus Pipes can be a good option from investment point of view at this time, because the company has been successful in giving huge returns for the last three years.

Q3. What is Venus Pipes Share Price Target 2024

Ans: The target price of Venus Pipes for 2024 is Rs 1420 to Rs 2253.

Q4. What is Venus Pipes Share Price Target 2025

Ans: The target price of Venus Pipes for 2025 is Rs 2240 to Rs 2490.

Q5. What is Venus Pipes Share Price Target 2026

Ans: The target price of Venus Pipes for 2026 is Rs 2435 to Rs 2686.

Q6. What is Venus Pipes Share Price Target 2030?

Ans: The target price of Venus Pipes for 2030 is Rs 3320 to Rs 3588.

Q7. What is Venus Pipes Share Price Target 2035?

Ans: The target price of Venus Pipes for 2035 is Rs 3745 to Rs 3863.

Q8.What is Venus Pipes Share Price Target 2040?

Ans: The target price of Venus Pipes for 2040 is Rs 4122 to Rs 4482.

Q9. What is Venus Pipes listing date?

Ans: Venus Pipes was listed on BSE and NSE on 24 May 2022.